Gen Z Versus Millennials – Who Fared Better at Saving Money and Budgeting?

by Fintech News Singapore September 22, 2020When it comes to saving habits, Singaporean Gen Zs (aged 18 – 23) are savvier than their millennial counterparts (aged 24 – 39), a survey by personal finance website SingSaver found.

Conducted across August and September, the survey analysed 1,000 responses from these two demographics across Singapore to better understand their saving habits, investing habits and financial knowledge.

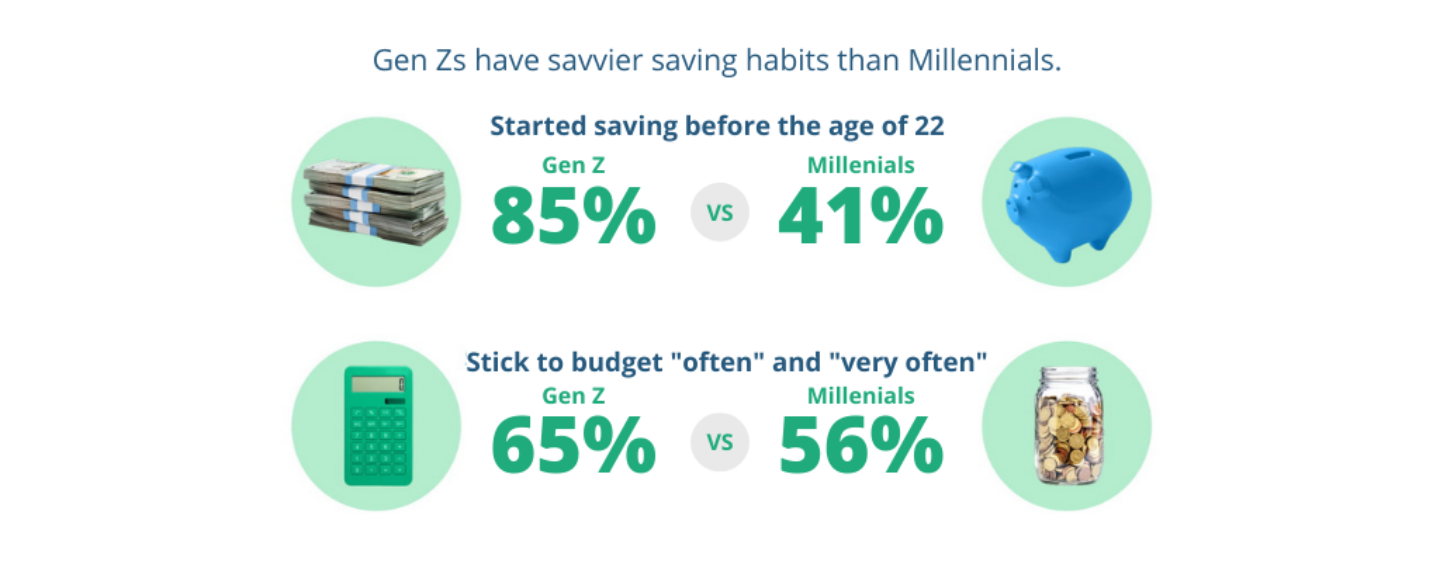

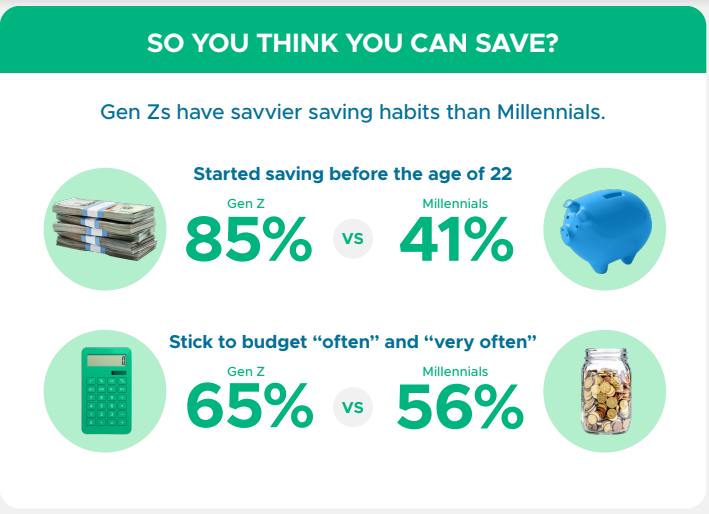

The survey found a whopping 85% of Gen Zs started saving before the age of 22, while just 41% of millennials did the same. It also appears that younger Singaporeans have more determination when it comes to budgeting, as 65% of Gen Zs say they stick to their budget “often” and “very often”, as compared to 56% of millennials.

However, millennials (47%) are more prudent than Gen Z (35%) when budgeting, saving and investing – perhaps due to their added responsibilities and the prevailing pandemic-induced economic uncertainty.

This uncertainty has also prompted 48% of Gen Z and millennials to research more about personal finance. This improved financial knowledge could be why 71% of Gen Zs and millennials “agree” or “strongly agree” that they are confident their emergency savings fund is able to cover 3 to 6 months of expenses.

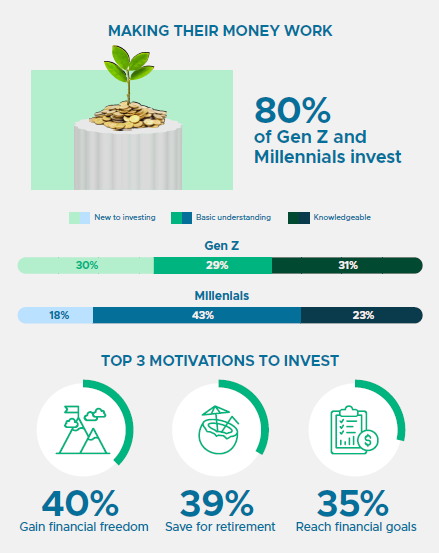

When asked about investing, a significant 80% of Gen Z and millennials said they invest, but 6 in 10 of these respondents said they are “very new to” or “have a basic understanding of” investing. Interestingly, SingSaver saw a 324% increase in interest for investment-related content since January 2020, based on page view growth across different demographics.

And although retirement might not be front of mind, more Gen Z cited saving for retirement (39%) as their biggest motivations for investing, while millennials are concerned with gaining financial freedom (45%).

The top three investment products Gen Z and millennials prefer to invest in are bonds/stocks (59%), real estate (41%) and mutual funds (35%). Despite a large proportion of Gen Z and millennials investing, nearly two thirds (57%) of the respondents still use a basic, low yield savings account. This indicates an opportunity for continued education within regards to personal finance.

When asked what some of their biggest challenges are when managing personal finance since the outbreak of Covid-19, millennials (38%) in particular feel that they do not have adequate knowledge and guidance when managing personal finance as compared to Gen Z (26%).