PayNow Increases Default Limit for Ad-Hoc Transactions up to S$200,000

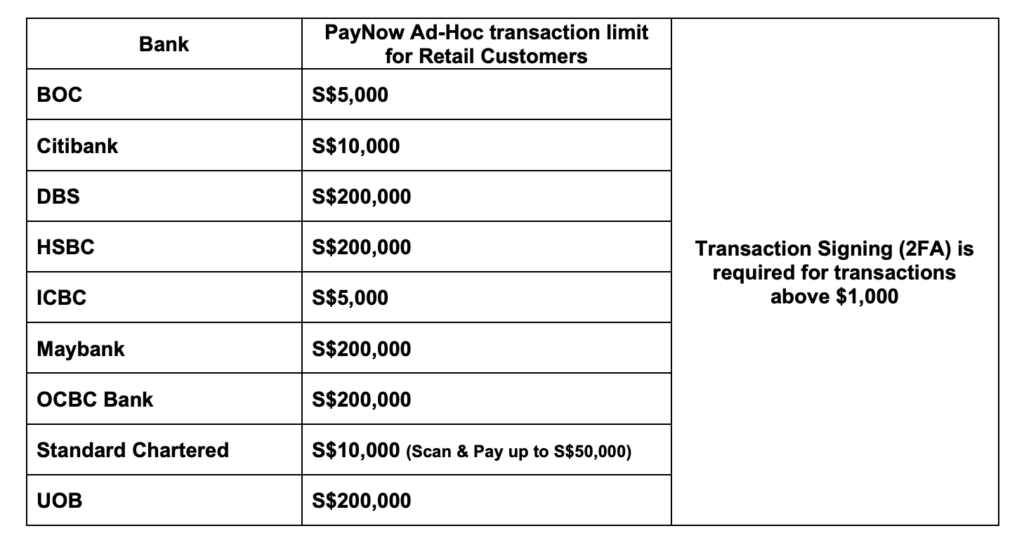

by Fintech News Singapore September 29, 2020The Association of Banks in Singapore (ABS) announced that all of the nine participating PayNow banks will allow ad-hoc transactions of at least S$5,000 or more.

This will enable customers to use PayNow, an electronic fund transfer service, for a wider scope of payments to merchants and friends.

The higher limit applies to PayNow on both internet banking and mobile application channels, and includes both scan-and-pay transactions and transfers initiated by entering the NRIC, mobile number, or Unique Entity Number (UEN) of the recipient, without first going through the process of adding the recipient as a payee.

Customers will be required to key in their Second Factor Authentication (2FA) for transactions exceeding S$1,000. They also have the option to set their PayNow limit to a level that they are comfortable with.

The nine participating PayNow banks are Bank of China, Citibank, DBS, HSBC, ICBC, Maybank, OCBC, Standard Chartered and UOB.

Summary of the transaction limits offered by each bank

As of end-August 2020, it is said that there are more than 4.46 million registered PayNow users, who have collectively transferred close to S$34 billion since the launch of PayNow in June 2017.

Featured image: screengrab from Youtube