New Research Highlights Untapped Opportunity for Fintech in Women’s Market

by Fintech News Singapore October 23, 2020Despite being strong savers and reliable customers, the women’s market remain largely underserved with only 65% of women benefiting from financial services, compared to 72% of men.

Though this gender gap represents a massive opportunity for fintech players, these are failing to tap into the market in a meaningful way, according to a new research by the Financial Alliance for Women.

This is primarily because fintechs tend to focus on growing their user base as quickly as possible to capture investor interest when starting out, the research said.

The reason for this is that men are perceived to be early technology adopters, these companies often begin to tailor their products to men. By the time fintechs are well-funded, they are already well on their way to being caught in a self-reinforcing spiral, the research found.

The report added that most fintechs lack women in key roles, leading to unconscious biases during the business modeling and product development processes. The Financial Alliance for Women, which polled 168 fintechs, 30 investors as well as other ecosystem actors from 43 countries, found that most fintechs’ product and tech teams are less than 25% female, and a majority have male-only founders.

While fintech remains a largely male-dominated sector, females-led fintechs are found to generate higher revenues than those without women in leadership positions.

Results of the Fintech Benchmarks Proof-of-Concept released in August 2020 reveal that among a sample of 45 fintechs, female-led ones had nearly three times the revenue per customer of non-female-led fintechs

The gender-gap is also visible in startup funding. According to a new study by Deloitte, startups founded by women still face more difficulties raising cash than do other firms.

Over the past five years, women-founded startups raised an average of 50% less capital than startups only by men, a disparity that could be in part driven by the gender bias of venture capitalists (VC) when making funding decisions, Deloitte says.

If provided with equal access to opportunity, women fintech entrepreneurs would likely unleash more successful new ideas by creating solutions based on their own disappointing or frustrating financial services experiences, the consulting firm says.

Developing holistic, gender-intelligent customer value propositions

In order to capitalize on the full business opportunity of the women’s market, fintech firms must prioritize the collection and analysis of sex-disaggregated data to design “gender-intelligent” solutions that truly meet women’s needs, says the Financial Alliance for Women.

This means understanding the differences in how females and males interest with financial services, then using this data and knowledge to build customer value propositions that help women overcome obstacles and solve their unique life moments.

For example, recent researches have shown that women are strong savers and better borrowers than men. Indian robo-advisory firm Scripbox, whose customer base is more than 28% women, has found that female customers are more disciplined savers (85% of women were invested in systemic investment plans compared to 80% of men), tend to save more (women saved 15% of their salary compared to 10% of men), and invest for the long-term and stay invested (only 10% of women withdrew from their mutual funds ahead of the term compared to 15% of men).

The Financial Alliance for Women further advises fintechs to integrate holistic, non-financial solutions into their customer value propositions, and move beyond building just gender-neutral products or changing the interface design and color.

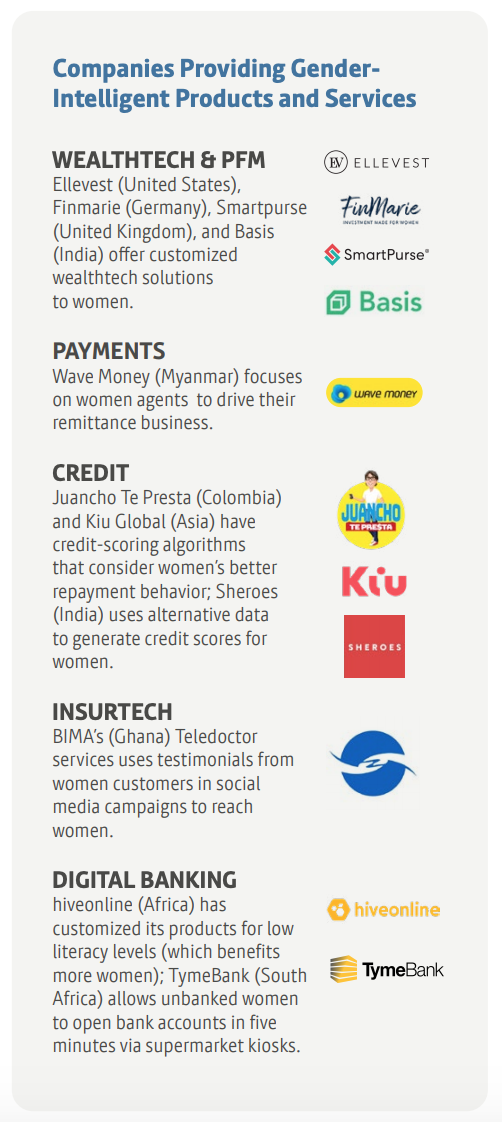

Several fintechs have championed this and are now leading the way, the organization says. In wealthtech and personal finance management, startups like Ellevest (USA), Finmarie (Germany), Smartpurse (UK) and Basis (India) offer customized solutions to women. In credit, Juancho Te Presta (Colombia) and Kiu Global (Hong Kong) have credit-scoring algorithms that consider women’s better repayment behavior, while Sheroes (India) uses alternative data to generate credit scores for women. And in digital banking, hiveonline (Denmark) has customized its products for low literacy levels, targeting women in Africa, it notes.

Companies Providing Gender-Intelligent Products and Services, How fintechs can profit from the multi-trillion-dollar female economy, Financial Alliance for Women, Oct 2020

Featured image credit: Unsplash