Rely Secures S$100 Million Capital From Goldbell to Expand its Pay Later Services

by Fintech News Singapore December 8, 2020Singapore-based fintech startup Rely announced it has secured a facility from Polaris, the strategic partnerships arm of Goldbell Financial Services, to process transactions of up to S$100 million. This will enable them to expand their Buy Now Pay Later (BNPL) service to new merchants in Singapore.

After raising an undisclosed seven figure sum in a pre-series A round with Goldbell Financial Services and the Octava Foundation last year, Rely’s new S$100 million capacity is an extension of its goal to scale operations and forge partnerships with major retailers in Singapore, Malaysia and South Korea.

Alex Chua

“By coupling Rely’s data acquisition capabilities with Polaris’s innovative and scalable funding structure, Rely can sustainably support larger digital transactions. This partnership creates an opportunity for brands to reinvigorate the shopping experience for consumers through an innovative alternative payment channel, stimulating spending after a very tough year for the retail scene.”

says Alex Chua, CEO of Goldbell Financial Services.

Hizam Ismail

“Our financing partnership with Polaris has supercharged Rely’s growth by enhancing the ability to process high-value, high-volume BNPL transactions. This financial boost provides large enterprise retailers with the confidence in partnering Rely to meet the needs of particularly younger, digitally savvy shoppers.”

says Hizam Ismail, Co-founder and Chief Executive Officer of Rely.

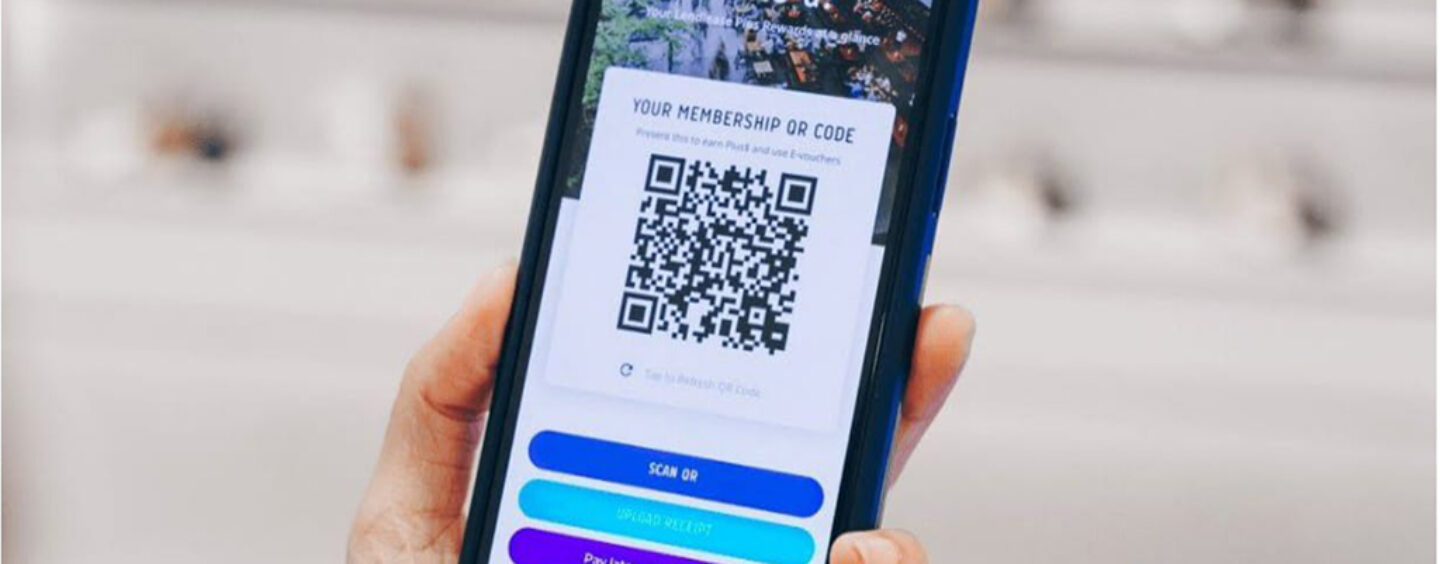

Additionally, Rely partnered real estate and investment firm, Lendlease, to launch a new service within Lendlease’s Plus App to provide BNPL services for consumers shopping at 313@somerset.

Featured image: Rely landing page on the Lendlease Plus Rewards App