Grab Financial’s Funding Represented 63% of Singapore’s Fintech Fundraising in Q1

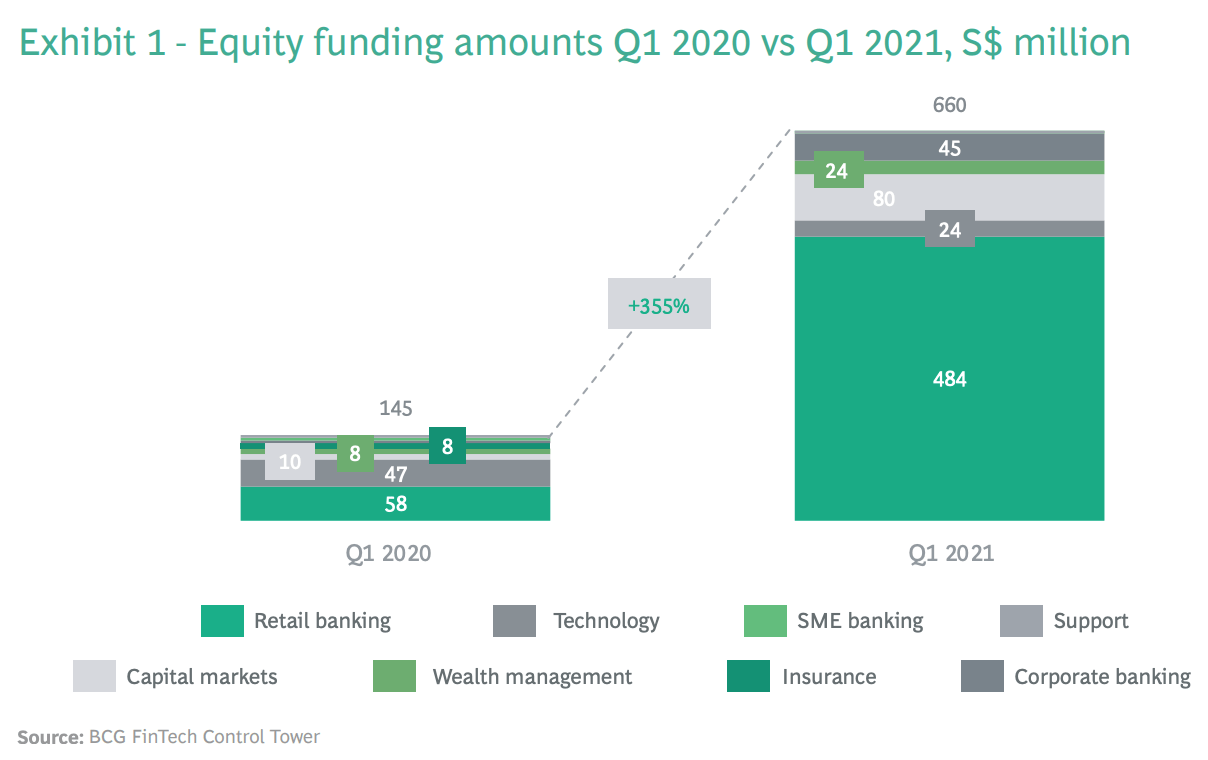

by Fintech News Singapore May 25, 2021In Q1 2021, Singaporean fintech companies raised a staggering S$656 million in equity funding, a 355% increase compared to the same period last year, data from the Boston Consulting Group (BCG) show.

The large figure, which represents about 46% of total funding raised in the whole year 2020, was driven by fintechs operating in the business lines of retail banking, with the Grab Financial Group (GFG) deal alone making up 63% of Q1’21 fintech funding.

GFG, the fintech arm of ride-hailing giant Grab, raised a massive S$417 million Series A funding round in January. The deal was announced just a month after the Grab-Singtel consortium was granted a full digital banking license by the Monetary Authority of Singapore (MAS).

Grab, which offers an array of digital services such as transportation, delivery, online banking, mobile payments, and insurance services, is set to go public through a merger with Altimeter Growth Corp., a special purpose acquisition company (SPAC). The SPAC merger would value the company at nearly US$40 billion, making it the largest blank-check merger to date.

After retail banking, fintech companies focusing on capital markets raised the second largest amount in Q1’21 at S$80 million. ISTOX, a digital securities platform, represented 86% of that amount, closing in January a S$69 million Series A funding round.

ISTOX, which is owned by blockchain infrastructure firm ICHX, aims to open private capital opportunities, including startups, hedge funds and private debt, by allowing users to make investments as small as S$100. It says it’s able to keep fees low by using blockchain technology for smart contracts and to hold digital securities, making thus the issuance process much more effective and less costly.

Equity funding amounts Q1 2020 vs Q1 2021, S$ million, Source: BCG Fintech Control Tower, via “Singapore fintechs off to a flying start in 2021” report, May 2021

Shadab Taiyabi, president of the Singapore Fintech Association, said in a statement that Q1’21 fintech funding trends in the city state showcase that the fertile ground created by progressive regulations has come to fruition.

These notable deals came on the back of regulatory developments announced throughout 2020 such as the unveiling of Singapore’s first four digital banks, as well as the introduction of a framework for digital payments and cryptocurrency, the report notes.

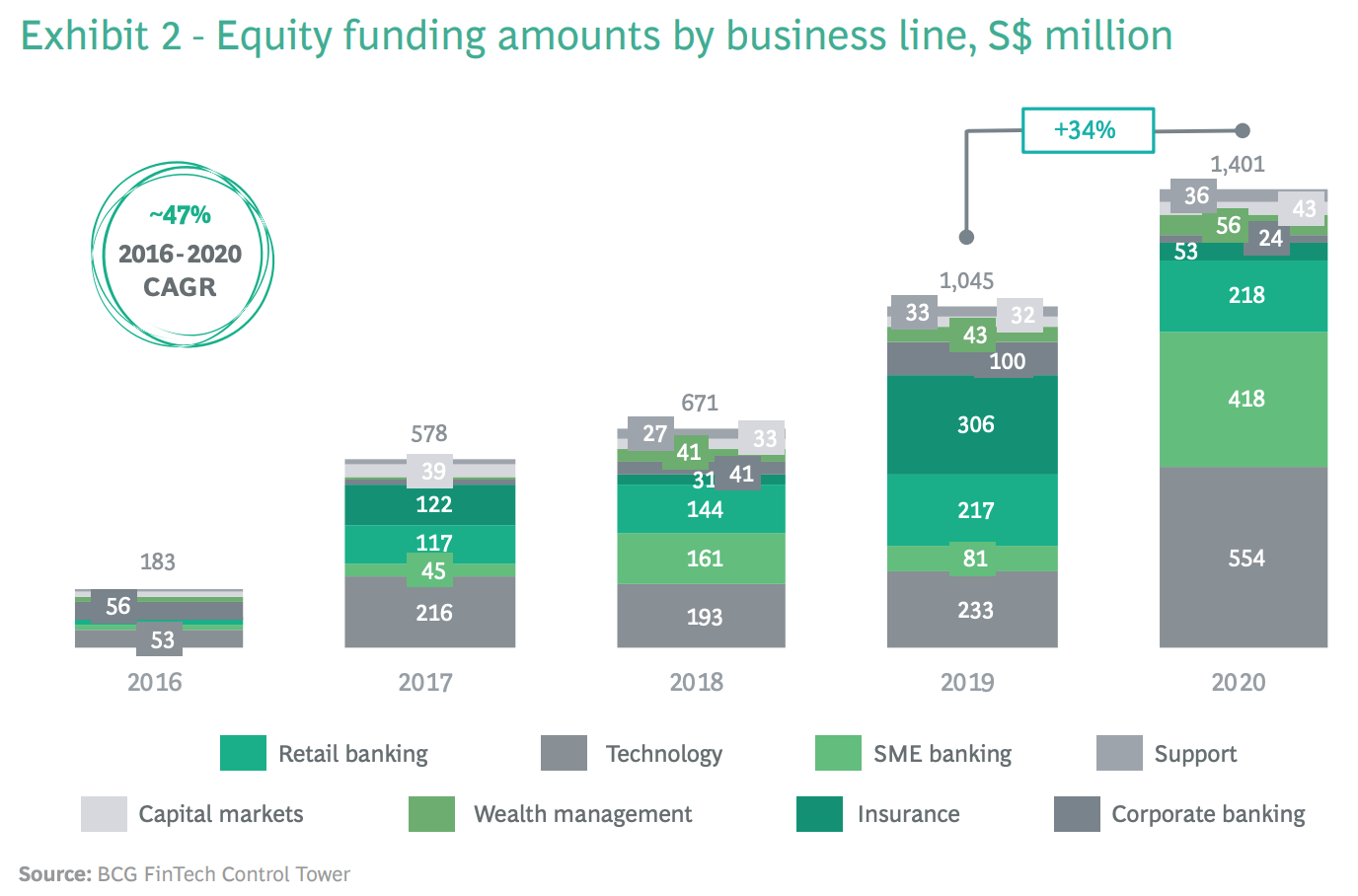

They also built on the momentum of 2020, which saw S$1.4 billion being raised by fintech companies, the highest annual amount ever despite the outbreak of COVID-19.

The year also registered a series of high-profile merger and acquisition (M&A) deals, including Singlife’s S$3.2 billion merger deal with Aviva Singapore, the largest transaction ever in the Singaporean insurance sector, and Grab’s acquisition of digital wealthtech provider Bento.

Equity funding amounts by business line, S$ million, Source: BCG Fintech Control Tower, via “Singapore fintechs off to a flying start in 2021” report, May 2021

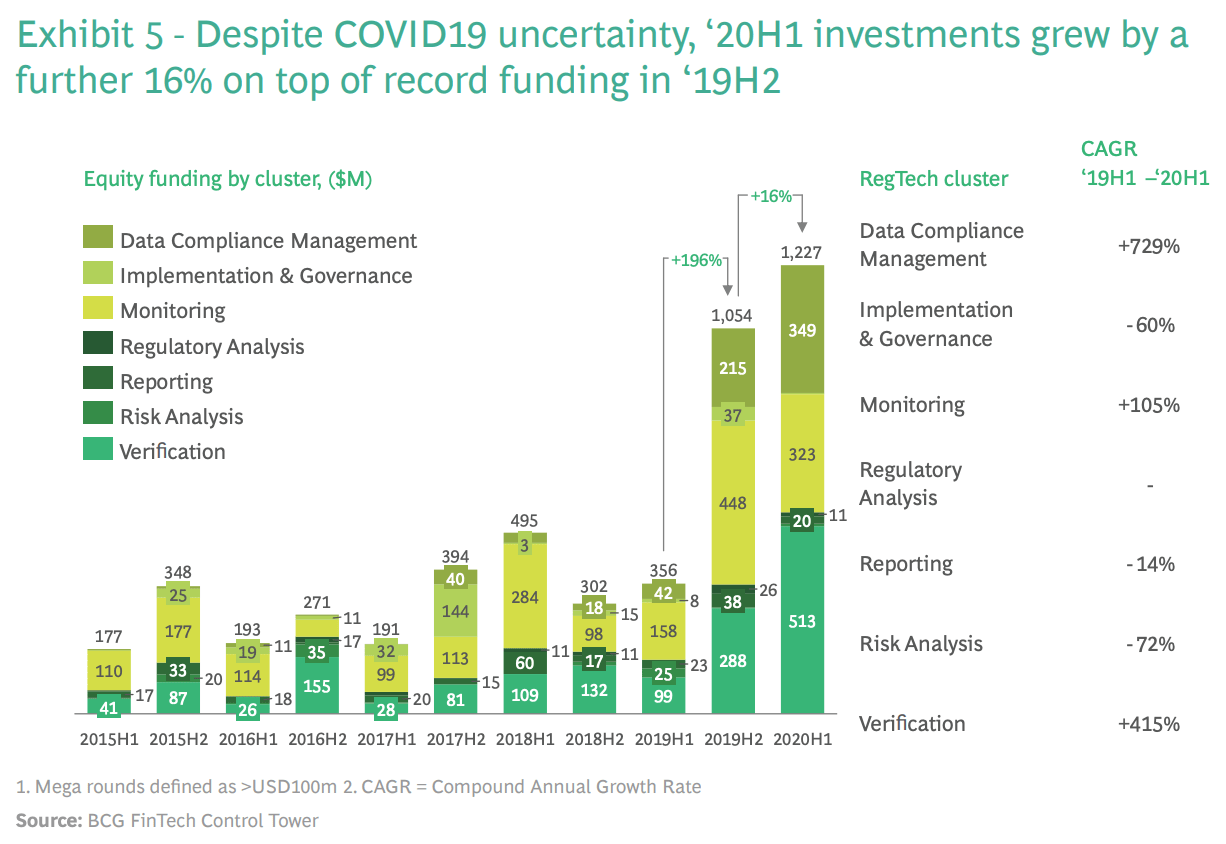

In 2021, a focus is being put on regtech, with MAS unveiling a number of initiatives intended to foster development in the space. In April, the central bank announced a S$42 million regtech grant scheme to encourage pilot projects and implementation. An additional funding of S$30 million was also injected into the Digital Acceleration Grant (DAG) scheme to accelerate tech adoption in the financial sector.

Singaporean regtech companies raised S$1.2 billion in funding in H1’20, up 16% from H2’19 despite the global pandemic. Companies providing verification products and services made up 41% of the sum, followed by data and compliance management (28%), and monitoring (26%).

Regtech funding in Singapore, Source: BCG Fintech Control Tower, via “Singapore fintechs off to a flying start in 2021” report, May 2021

Featured image credit: Photo by Kin Pastor from Pexels