What Does Singapore’s Open Banking Landscape Look Like in 2021?

by Fintech News Singapore June 30, 2021Amid a rapidly changing financial landscape, incumbent banks must be open to innovation and explore opportunities to partner with non-banking partners for the benefit of their customers. One such way this can be accomplished is through the open banking system.

A collaborative ecosystem between traditional banks and non-banking partners, open banking allows third-party providers to have access to consumers’ financial information held by their bank. Doing so enable banks to introduce services and products to their customers that they’ve never been able to before on their own.

This is done through an application programming interface (API). A 2018 global survey by Accenture revealed that among 18 to 24-year- olds, 85% of them would trust a third party to aggregate their bank data.

Open banking aims to benefit consumers through improved consumer experience, access to open banking-enabled products, and better financial decision-making by having their financial information consolidated in a single platform.

Both the United Kingdom and Europe have opted for a regulatory-driven approach when it comes to open banking. In Europe, a revised Payment Services Directive (PSD2) was adopted by the European Parliament in October 2015 which included regulations to promote online and mobile payments through open banking. In August 2016, the United Kingdom Competition and Markets Authority (CMA) issued a ruling which gave licensed start-ups access to financial data held by the nine biggest UK banks.

In the Asia Pacific, Singapore, an early adopter of open banking, has been touted as a leader of open banking and API within the region in the Open Banking APAC report by the Emerging Payments Association Asia (EPAA) which was released in February 2020.

APIX, laying a strong foundation for Singapore’s open banking

The Monetary Authority of Singapore (MAS) is a key driver of developments in Singapore’s open banking space. One of the key initiatives that MAS has taken to support open banking in Singapore is laying a strong foundation for the growth of Singapore’s open banking by introducing API Exchange (APIX), a collaboration platform. It is the world’s first cross-border, open-architecture platform and aims to support financial innovation and inclusion in ASEAN and around the world.

Launched in November 2018, the platform is where financial institutions and fintech firms can connect easily and collaborate on design experiences via APIs. According to Shailesh Naik, the founder and Chief Executive Officer of MatchMove, a fintech company registered in Singapore, he has seen progress in the collaboration between banks and fintech firms in this space over the past two years. Banks are now more willing to cooperate and began reaching out to stay competitive as processes in fintech firms became more attractive and cost-effective to the conventional finance sector.

API Playbook and Financial Industry API Register

Prior to that, MAS had published the ‘Financial World: Finance-As-A Service API Playbook’, in collaboration with the Association of Banks in Singapore (ABS). It serves as a comprehensive guideline for financial institutions and fintech companies to develop and adopt open API based system architecture in their organisations.

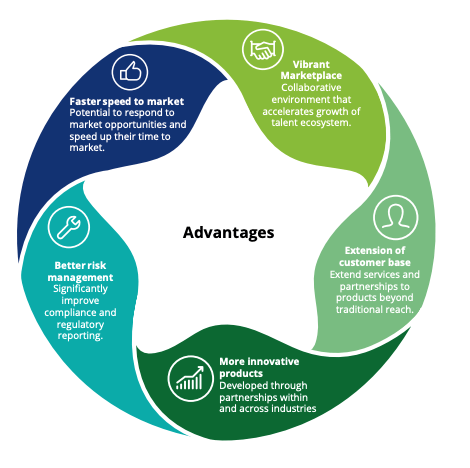

Advantages of an API Economy, Source: Financial World: Finance-As-A-Service API Playbook

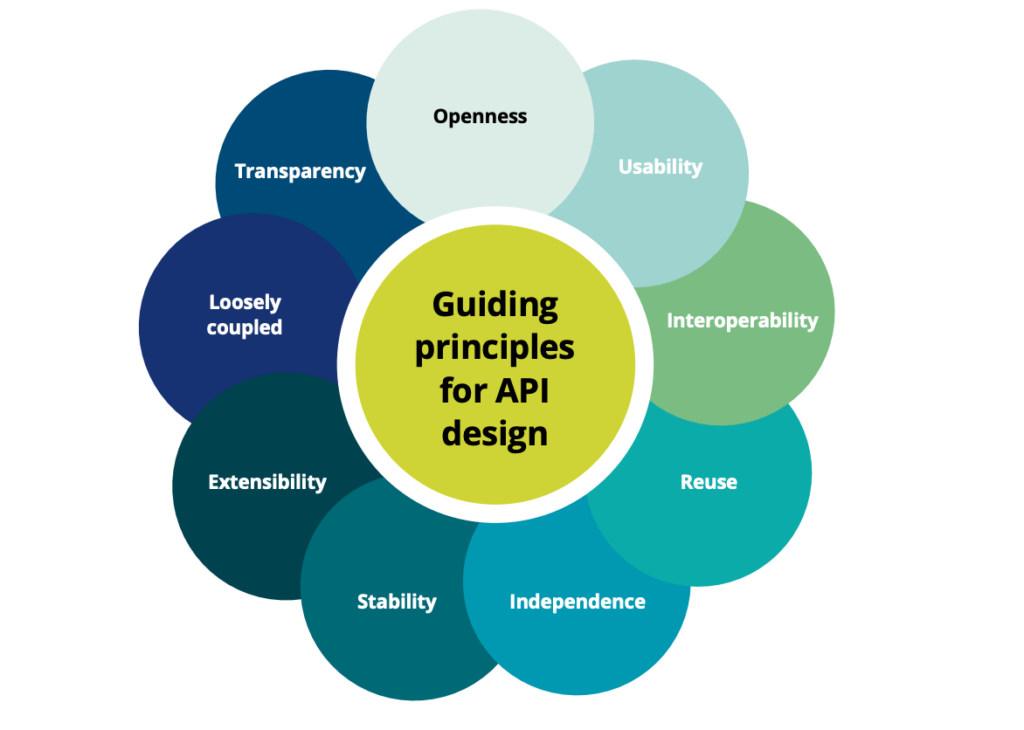

The guide includes a framework for governance, implementation, design principles for APIs and a list of over 400 recommended APIs and more than 5,6000 processes for their development. It has been described as the gold standard for regulatory advice on the topic in Asia.

Additionally, MAS also operates the Financial Industry API register which tracks open APIs in the Singapore financial industry by functional categories.

Guiding Principles for API Design, Source: Financial World: Finance-As-A-Service API Playbook

Singapore Financial Data Exchange: A leap forward in Singapore’s open banking space

Another key milestone for Singapore’s open banking space is the Financial Planning Digital Services initiative, which aims to facilitate data portability with a secure API framework. On 7 December 2020, MAS then launched the Singapore Financial Data Exchange (SGFinDex), which involves the consolidation of financial data from banks and government agencies in a single place, instead of multiple locations.

This is facilitated through Singapore’s national digital identity, the Singapore Personal Access (SingPass), which is a single sign-on service used by Singaporeans to transact with more than 60 government agencies online. Consumers have the option to grant access to financial institutions of their choosing to share their information.

Developed by the public sector in collaboration with ABS and seven participating banks, it is the world’s first public digital infrastructure to use a national digital identity and a centrally managed online consent system.

A voluntary adoption approach for Banks to embrace open banking in Singapore

MAS believes in making adoption voluntary for banks, instead of mandating it. Despite this voluntary approach, Singaporean banks are taking initiatives on their own. In 2017, DBS launched the world’s largest API developer platform in the industry, with 155 APIs in more than 20 categories. Through these APIs, other brands, fintechs, corporates, and software developers can communicate with the bank and access services such as funds transfers and peer-to-peer payment service PayLah!

Meanwhile, other banks are partnering with fintechs and developers to launch applications that utilise their publicly available APIs. One such example is Standard Chartered through their ‘The Good Life’ privileges programme, which gives their customers access to merchants that offer discounts and alternative payment methods. Another example is United Overseas Bank (UOB), which has selected specific fintechs and launched applications that leverage their APIs.

Trust, a key component for Singapore’s open banking to succeed

In 2019, Ravi Menon, the Managing Director of MAS, highlighted the importance of strengthened trust in the financial sector. The rewards of open banking must be balanced by the risks presented by the sharing of customers’ data between various parties.

In Accenture’s 2019 Global Financial Services Consumer Study, 75% of consumers state that they are very cautious about the privacy of their data, with data security breaches being the second-biggest concern for consumers. Therefore, for Singapore’s open banking to truly take off, customers must be fully confident that their data is safe.

Although banking data in Singapore is regulated by the Banking Act and the enhanced Personal Data Protection Act, banks, too, must play their part and continue to be vigilant in protecting their customers’ data to benefit both consumers and the industry, and ensure the success of Singapore’s open banking.

Featured image: Photo by Peter Nguyen on Unsplash