Regtech might not be a familiar name to most people but it is an important component in the fintech space. Regtech stands for regulatory technology which exists to help financial institutions and other organizations comply with increasingly stringent compliance rules.

No Place To Hide – Banks Are Punished Around The Globe

Ever since the global financial crisis in 2008, banks found themselves at the mercy of regulators. British regulator metered out a fine of $72 million pounds to Barclays for failure to do proper due diligence on their clients last year. Hong Kong regulator fined HSBC HK$605 million in May 2016 for mis-selling Lehman Brothers products. Singapore regulators fined BSI Bank S$13.3 million over money laundering charges and subsequently shut it down in May 2016.

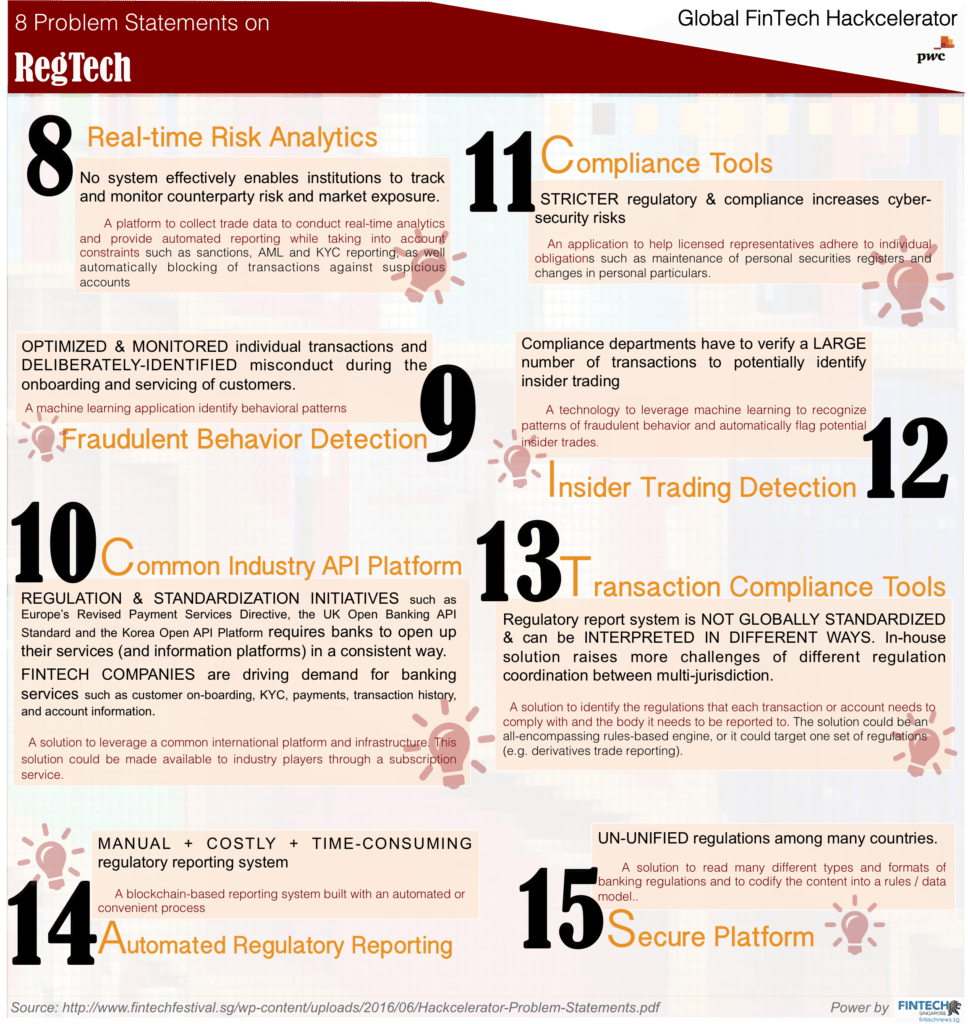

10 banks hit hardest by settlements. Source: CNBC

US regulator fined Goldman Sachs US$5.06 billion in April 2016 for its fraudulent practices of selling mortgage backed securities when it did not ‘ identify and eliminate any additional loans with credit exceptions’. In other words, it misrepresented bad mortgages as good mortgages to investors. As of October 2015, banks had paid $204 billion in regulatory fines according to CNBC.

Clearly, there is a global drive for regulators to tighten and enforce the rules for banks which demands a systematic way of identifying with possible compliance breaches and also comply with regulatory demand for timely, accurate and precise for capital and liquidity reports. Regulators don’t want just raw data and instead demand that financial institutions perform advanced analytics when they make key decisions according to the Deloitte’s 2016 regulatory overview.

$100 Billion To Be Won

As banks are fined left, right and centre, there is a $100 billion RegTech market for tech start-ups to prove themselves. In London, PassFort provides auditable risk based system for anti-money laundering and know your customers system that might have helped HSBC avoid the $72 million pounds of damage. In Vancouver, Trulioo based its existence on helping financial institutions such as Rabobank identify its customers with its existing legacy systems. In Dublin, Silverfinch helps assets managers to provide timely and accurate information to insurers to meet their regulatory requirements.

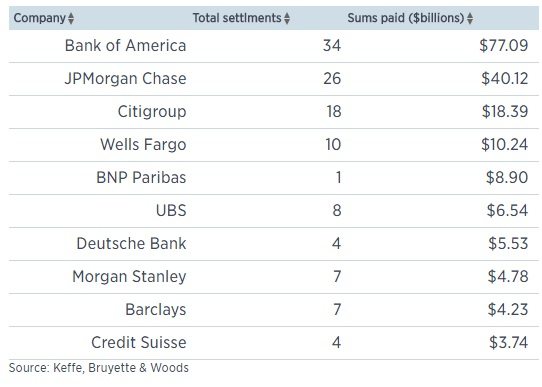

India’s V-Comply

Over in Asia, we have V-comply from India which provides compliance management software on the cloud. Their value proposition is simple. There are tons of work to be done to ensure compliance and managers need a system to identify and monitor the progress of the compliance work. They provide a simple system of red, amber and green chart for the tasks at hand.

Source: V-comply

They have a compliance library which tells you the compliance activities that your bank should do and also allows you to assign these responsibilities to your employees. This way, banks know exactly what they need to do and whether the work has been done. For instance, Goldman Sachs had to review thousands of mortgages for its mortgage back securities and their failure to do it completely cost them $5 billion.

With such a heavy duty work, it is possible that some work fall through the cracks when employees leave the organization if it is tracked by Excel alone. V-comply would provide a dashboard to track all work that is done and left undone.

Australia’s Intelligence Bank GRC

Over in Australia, IntelligenceBank is helping the likes of the Australian government, Deloitte and Suncorp Bank with their compliance activities. Specifically, their Governance Risk Compliance (GRC) product helps organizations in their internal investigations of fraud with the Incident Monitor.

Internal investigators can record the circumstances around the fraud and attach documents to support every individual case. On a higher level, management can run reports on the status and types of incidents.

Source: IntelligenceBank

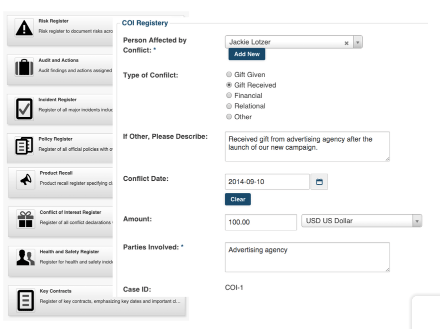

On a more mundane basis, employees are required to record to the gifts which they receive or give to others if they are working in the Australian government in accordance to the Public Governance, Performance and Accountability Act 2013 (PGPA Act) in a fight against conflict of interest. Australian regulator also obliged financial institutions to manage their conflict of interest to ensure that they act in the interest of their clients.

They need a system to record possible conflict of interests and how they resolve it for their retail and wholesale clients. Similar regulations exist around the world which allows IntelligenceBank to export its product overseas with some adaption to local laws.

Conclusion

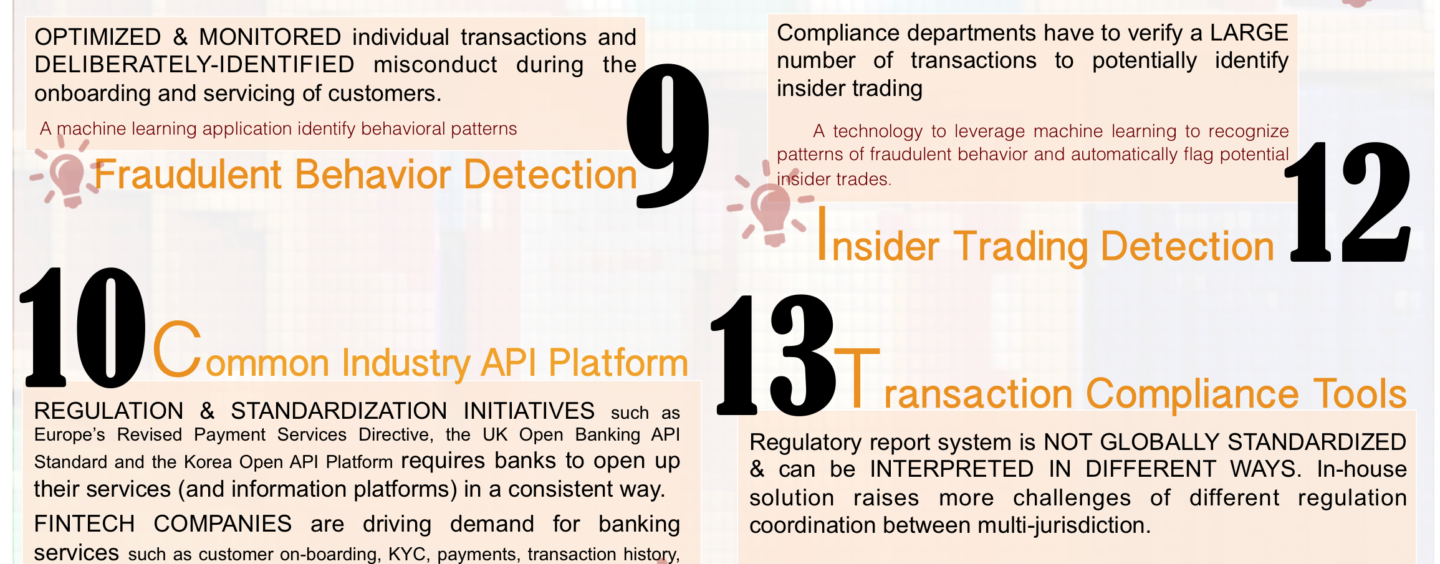

While there are RegTech startups in Europe, Australia and India, it is surprising to me that I can’t find RegTech startups in Singapore and Hong Kong which are the 2 major financial capital in Asia. Singapore’s financial regulator, the Monetary Authority of Singapore (MAS) even created an infographic to encourage the establishment of RegTech in Singapore.

As you can see, there are 7 areas in RegTech itself that needs to be solved. In the inaugural Singapore Fintech Festival to be held in November 2016, there will be ABS-MAS Regulation Technology (RegTech) Forum and the festival itself would be attended by the Deputy Prime Minister. Clearly, Singapore is placing taking RegTech seriously.