A world without banks is coming closer. A new report by the Massachusetts Institute of Technology (MIT) investigates how legacy banks will unquestionably come to an end and the possibility of the future ‘invisible banking’.

Existing banks seem fail to keep up with digital transformation

“Banks are trying to be cool and hip and build super cool digital front ends… But it’s like putting lipstick on a pig – ultimately it’s still a pig and the new front end is still running into an awful digital back end.” – Mark Mullen, Chief Executive Atom, Durham, UK

The report, ‘Digital Banking Manifesto: The End of Banks?’ by Alex Lipton, David Shrier, Alex Pentland, published in August, points out that banking activity is mostly technological and mathematical in nature which make it is well suited to digitalization. However, as we are entering a new era of innovation, major industries including retail, travel, communications, and mass media have undergone revolutionary changes to meet new demands from the digital-savvy market, while banking remains chained down to its old-fashion legacy systems.

The report, ‘Digital Banking Manifesto: The End of Banks?’ by Alex Lipton, David Shrier, Alex Pentland, published in August, points out that banking activity is mostly technological and mathematical in nature which make it is well suited to digitalization. However, as we are entering a new era of innovation, major industries including retail, travel, communications, and mass media have undergone revolutionary changes to meet new demands from the digital-savvy market, while banking remains chained down to its old-fashion legacy systems.

Two key reasons behind this situation, according to the report, are the ‘weak competition’ between banks and the heavy legacy back office infrastructures which inhibits banks from embracing innovation to survive and thrive in the digital economy.

Customers are generally not happy with the current banking services and keeping money in the bank is both risky and unprofitable. There is also a large group of people in developing countries who are unbanked or underbanked since traditional banking systems are not flexible enough to address their needs or assess credit worthiness.

This huge market need seems to be left untouched as the customers do not really have viable alternatives.

Banking will evolve to The Third Wave of Digital Innovation

By observing developments in mobile telecommunication adoption and data technology, the report foresees a potential rise of the third wave of banking innovation – Digital Bank of the Future (DBF).

The world saw the first wave – the “incrementalists” – with the invention of ATMs in mid 1970s and the launch of online banking services in the 1980s. In 1996, internet banks such as NetBank came along thanks to the popularity of the internet.

Digital hybrids like NetBank brought the second wave of digital innovation. These hybrids took advantage of front-end systems to connect with consumers, but still use centralized databases, cloud based storage and primitive user data protocols. They represent a bridge solution between the legacy bank of yesterday and the fully digital bank of the future.

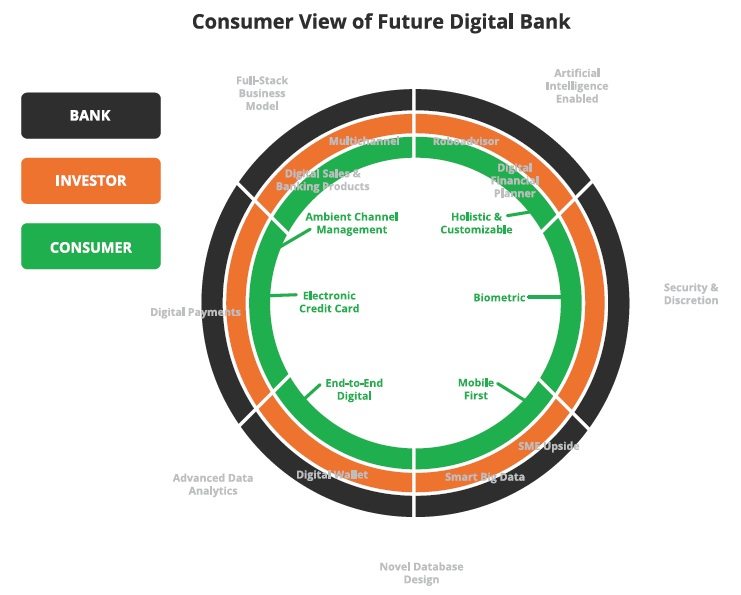

From MIT Digital Bank Manifesto Report

Emerging from the digital economy of the 21 century, the third wave DBF will take advantage of technologies and be designed around the needs of digital natives. A mobile-first strategy will deliver ease of access and fast adoption for millennials. It will use a new set of technologies to smoothly integrate with consumers’ lives, promisingly gain access to the 2.5 billion unbanked or underbanked consumers globally, and offer greater financial flexibility to 45+ million small & medium-sized enterprises (SMEs).

DBF will replace the easily-attacked central data depository with a secure, encrypted, distributed data system. Personal data stores offer greater security which also means better digital wallet.

We are entering a new financial ecosystem

A new financial ecosystem will grow on the ruin of fractional banking. The report maps out a possible internal network of this ecosystem where digital bank and virtual currencies will be in the center of the internet of things (IoT) or be the bank of things (BoT). The researchers call it “invisible banking” – a banking model that integrates smoothly into consumers’ life and connect them with other parts of the system such as insurers, wealth managers, brokers, credit card issuers as well as various non-financial actors. Digital cash will play a role as a lubricant allowing the wheels of commerce to spin faster and more efficiently. In this system, banks have to evolve faster because the competition for their customers’ digital wallet from current digital champions, such as Google, Amazon, Facebook and Alibaba will be fierce.

All such developments will enhance the social utility of the bank and its appreciation by the public while improving its profitability.

Is there a model that we could call “invisible banking” that integrates into our daily lives without friction? The answer is yes and no – the legacy banking model will unquestionably disappear over time, but in the transition period, digital banks will have a role in daily life for the foreseeable future as transaction lubricants and enablers.