The China Banking Regulatory Commission (CBRC) on 24th August officially released “Interim Measures for Administration of Peer-to-Peer Lending Information Intermediaries” (hereafter referred to as “Measures”). An information intermediary rather than a financial institution defines a P2P lending institution or platform. Measures also published a negative list of P2P’s business scope, except for the item that the clients’ money must fall under the third-party depository. After a 12-month transitional period, all P2P platforms in China are not allowed to take deposits, make loans, advertise offline and manage financial products, no mention to finance their own.

The extraordinary growth of P2P Lending

Chinese witnessed a surge of expansion in the P2P industry. The total volume of P2P reached 252.8 billion at the end of 2014. The figure sharply increased to ¥982.3bn a year later, almost quadruple the figure in 2014. This trend continues and the volume hit ¥842.3bn in the first half of this year.

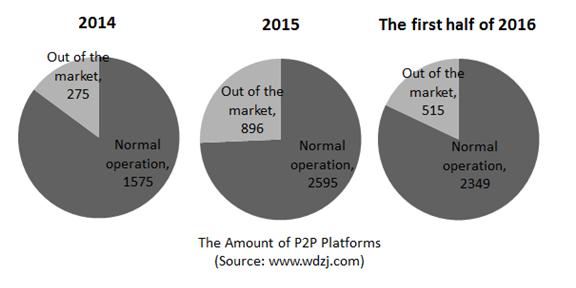

The number of platforms and closed platforms increased at the same pace. Now more P2P institutions will exit the market because of the install of Measures, it was previously thought that this issue seemed to improve in the first six months this year.

The reasons for a platform to exit the market could be healthy or vicious. According to statistics, among the 515 closed platforms in these six months, 247 were healthy exits. They closed P2P businesses and transformed into other businesses. People have experienced legal problems or even running off with clients’ money. Compared with last year, the rate of healthy exit has increased.

Diversification and micro-lending

The upper limit of loan size is clear in Measures. ¥0.2m in one institution and ¥1m from several institutions in total is the amount a person can borrow. For a company, the numbers are ¥1m and ¥5m.

In “2016 Semi-annual Report on P2P Lending”, the credit limit per head in one single P2P is ¥552,700. Although platforms have a year to fix themselves into the regulation, everyone has different understandings on Measures. Hongling Capital is a P2P platform famous for large loans financed ¥0.1bn for some steel company with the term of 15 months on 31st August. After the 12-month transitional period That is to say, this loan will not close. An executive in Hongling Capital believed there is no problem.

Seeking alternatives

Since P2P platforms are now online information intermediaries they are to supposedly acquire the license of Internet Content Provider (ICP). While currently, less than 50 P2Ps have this qualification. Under the clause of the third-party depository, platforms have to cooperate with banks, which is not common at present. Most of them also have to decrease the amount of loan and cut some services. The prospect is not cheerful for this industry, especially small companies.

Some P2P companies are thinking about transformation such as equity, financial institution, or even finance technology (Fintech). Owing to the inadequate law in Chinese financial market, it is probable that they can easily escape from the regulations with a name without P2P. Chinese introduces the word “fintech” from abroad as a substitute “internet finance”, a word full of negative news. A company that is able to finish a credit check cover over-200,000 in several minutes indicated that they are a genetic company and not P2P, so they do not respond to the Measures. To make themselves look more like fintech, some platforms launched Robot-Advisor. Technology companies in China regard Fintech and the way it steps into the field of finance is cooperating with relevant licensed institutions.

This article first appeared on Asean Today