In Singapore, consumer preferences are rapidly evolving, with banking customers increasingly preferring online interaction over in-person interaction. A new consumer survey by digital business transformation company Publicis Sapient found that Singaporeans are prolific users of mobile banking, with one in two (50%) consumers indicating turning to mobile apps to communicate with their bank.

The figure was shared in the third edition of the Digital Life Index which looks at the state of digital adoption across various sectors, including retail, telehealth and financial services.

Results from the survey show that in Singapore, banking customer prefer engaging with their bank through digital channels. Besides a clear preference for mobile apps, 33% of Singaporeans indicated relying on bank websites. In comparison, only 12% of respondents named bank branches as their primary mode of communication with their bank, and 4% said they concentrate their banking activities at ATMs.

Singaporeans indicated preferring using digital channels to open a bank account (52%), manage their investments (57%), and apply for loans (52%) and credit cards (64%). However, many still prefer meeting a financial advisor face-to-face for their advisory needs.

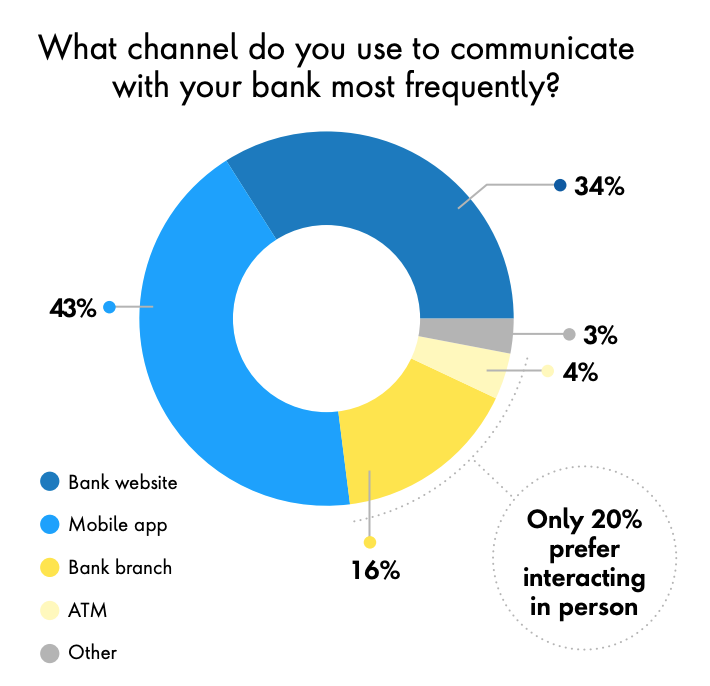

Trends observed in Singapore are consistent with those witnessed globally where people are now interacting with banks online at far higher rates than they do in person. 43% of respondents globally said they communicate with their bank most frequently through a mobile app, while 34% cited the bank’s website. Only 20% of consumers indicating preferring interacting in person either by visiting a branch (16%) or via an ATM (4%).

What channel do you use to communicate with your bank most frequently? Source: The Digital Life Index, Publicis Sapient

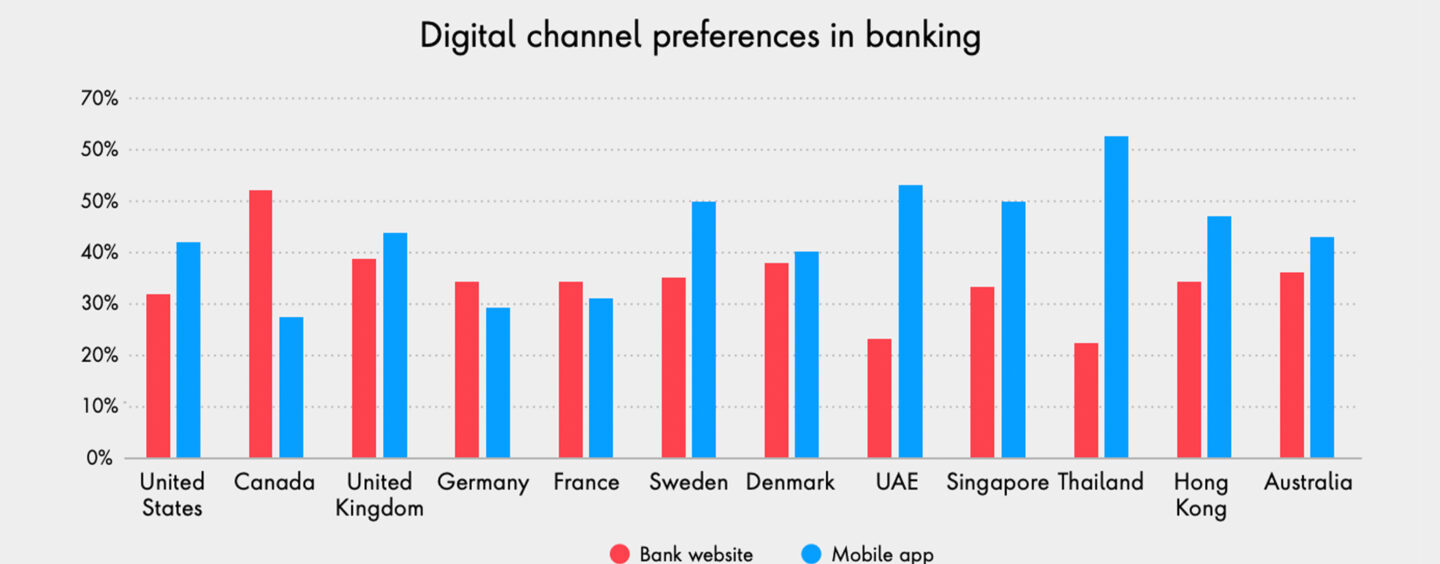

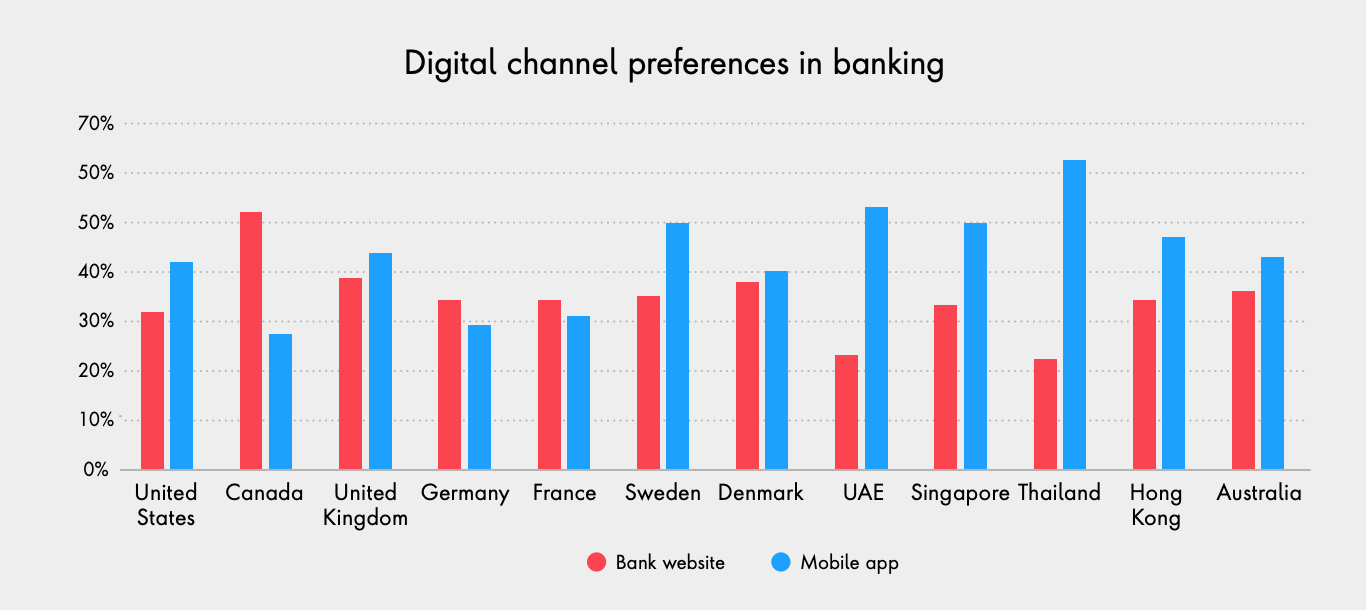

Singapore is one of the fastest adopters of digital channels alongside Thailand, the United Arab Emirates (UAE), Canada and Sweden where at least half of respondents in each country indicated preferring using either the bank’s website or mobile app to engage with their financial institution, the survey found.

Digital channel preferences in banking, Source: The Digital Life Index, Publicis Sapient

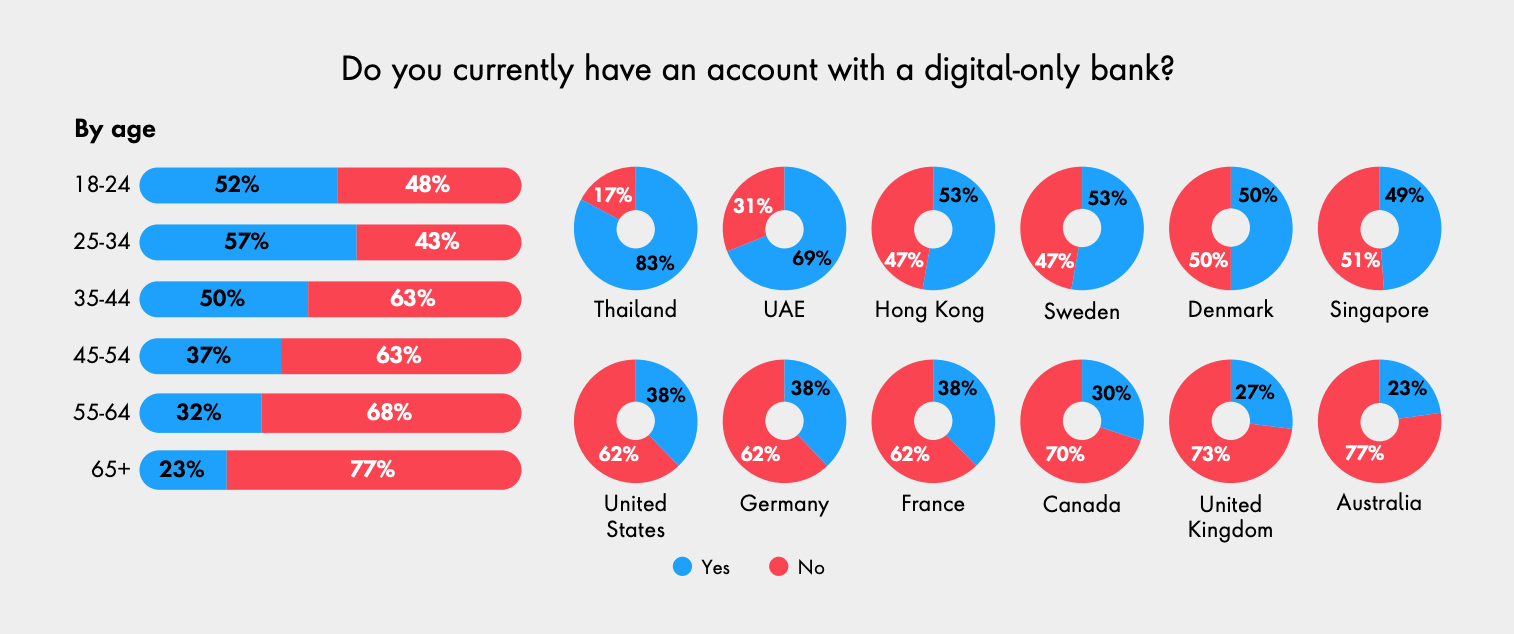

These countries are also seeing booming adoption of neobanking/digital banking, recording the highest penetration rates. 83% of respondents in Thailand, 69% of respondents in the UAE, and 53% of respondents in both Hong Kong and Sweden said that they have an account with a digital-only bank.

In comparison, only 23% of respondents in Australia, 27% in the UK and 30% in Canada said that they have an account with a digital-only bank.

Do you currently have an account with a digital-only bank? Source: The Digital Life Index, Publicis Sapient

Gearing up for its first virtual-only banks

Singapore is due to see the launch of its first virtual-only banks next year. Singapore-based Internet company Sea, and ride-hailing firm Grab’s venture with Singtel are both set to start operations on a restricted basis from 2022. Both hold a digital full banking license.

Sea operates three main businesses: e-commerce marketplace Shopee, gaming developer Garena, and digital financial services network SeaMoney. Grab is a leading super-app, boasting over 166 million users across Southeast Asia, and Singtel is Singapore’s largest telco.

Meanwhile, the consortium led Chinese real estate developer and state-owned enterprise Greenland Group, which holds a digital wholesale banking license, intends to build a digital bank that will tap China’s fintech to serve small and medium-sized enterprises (SMEs) in Singapore.

Finally, the last licensee, Ant Group, is the fintech affiliate of e-commerce giant Alibaba and the world’s most valuable fintech company worth US$150 billion. It’s already a digital banking leader in its home country where it offers micro-lending, insurance, credit scoring and money market funds. With its Singapore license, Ant Group wants to become not only the go-to fintech partner for SMEs in the city-state but also for the broader Southeast Asian region.