E-Wallet Adoption in E-Commerce Still Low Despite Growth in Mobile Users

by Fintech News Singapore December 16, 2021Across Southeast Asia, mobile phone usage is booming, driving with it the rise of mobile commerce. In Singapore and Malaysia, more than 50% of e-commerce traffic comes from smartphones, a new survey by Stripe found.

The study, which polled consumers in the region on their online shopping habits and preferences, found that 52% of respondents in Singapore and 47% of respondents in Malaysia do more than half of their shopping from a mobile device.

Shifting customer preferences is forcing merchants to not only make their website mobile-friendly to provide a pleasant customer experience, it also puts greater importance on third-party mobile wallet services.

Supporting global digital wallets such as Apple Pay and Google Pay, as well as regional digital wallets like GrabPay can help improve the shopping experience on mobile, the report says. Mobile wallets also give businesses the opportunity to offer a one-click payment experience that, on average, is three times faster than having to manually enter payment details.

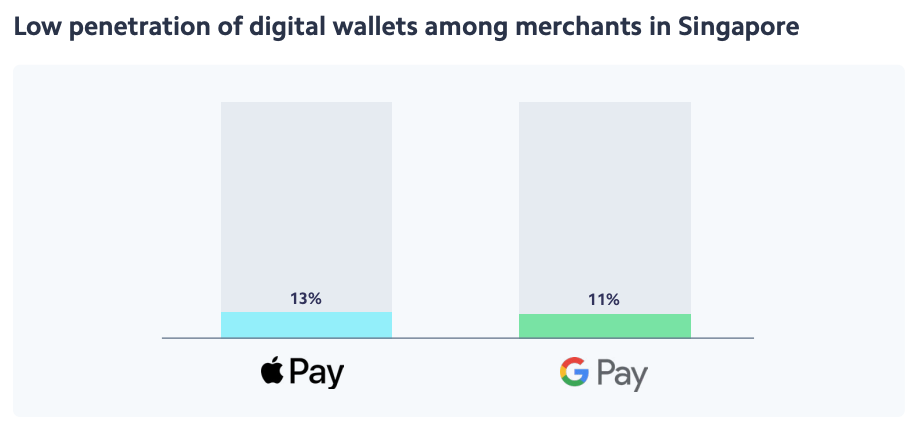

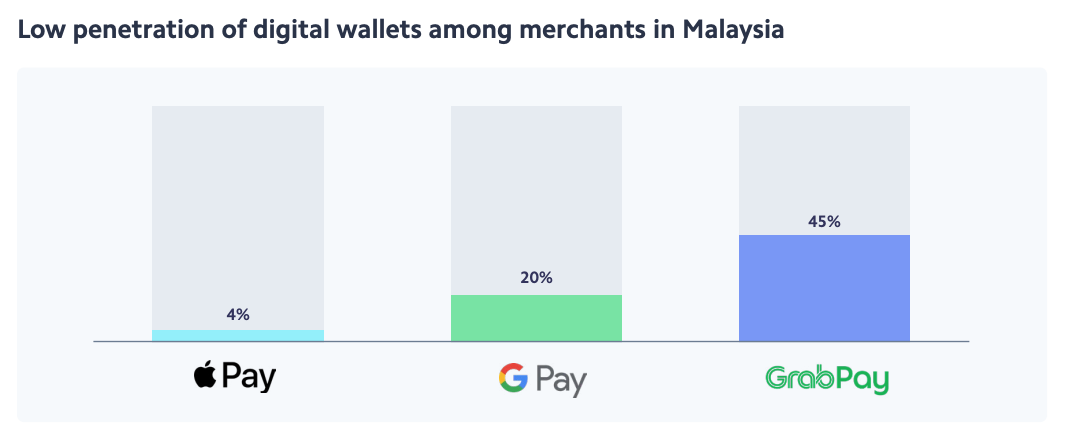

Despite these benefits, penetration of digital wallets among merchants in both countries remains very low. In Malaysia, only 4% of merchants support Apple Pay, and 20% support Google Pay. In Singapore, these figures stand at 13% for Apple Pay and 11% for Google Pay.

Penetration of digital wallets among merchants in Singapore, Source: The state of checkouts in Singapore — 2021, Stripe

Penetration of digital wallets among merchants in Malaysia, Source: The state of checkouts in Malaysia — 2021, Stripe

Low penetration of digital wallets is just one of the big errors online merchants make, the report notes. For instance, many merchants in Southeast Asia (41% in Malaysia and 28% in Singapore) still force customers to create an account before making a purchase, introducing friction and increasing chances of cart abandonment.

In fact, 21% of consumers in Malaysia and 19% of consumers in Singapore indicated that they would abandon their cart if forced to create an account at checkout.

Other major errors identified by Stripe include poorly designed checkout experiences with, for example, the lack of address autocomplete and real-time error messaging. Many merchants also fail to provide a localized checkout experience, lacking, for instance, popular local payments services and methods such as buy now, pay later (BNPL).

The mobile revolution

In Southeast Asia, mobile devices have been at the heart of the digital revolution. Being late adopters to the Internet, most consumers in the region have never owned a desktop computer and have instead gone straight to mobile.

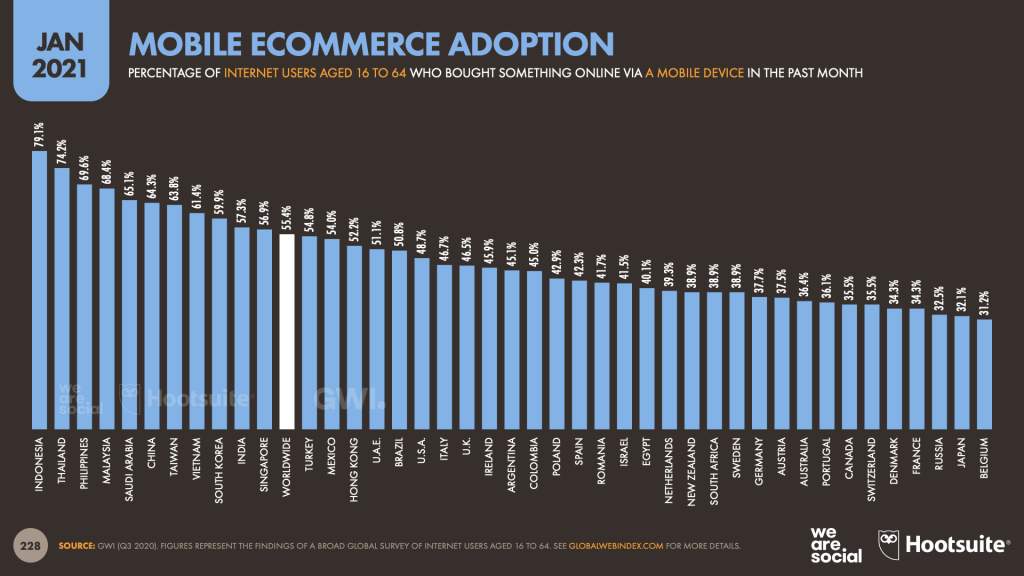

Today, Southeast Asians are the most enthusiastic adopters of mobile commerce. A 2020 global survey of Internet users aged 16 to 64 found that Indonesia swept the top spot for mobile commerce adoption, with 79% of Internet users purchasing something online via a mobile device. Indonesia is followed by Thailand (74%) and the Philippines (70%).

Mobile e-commerce adoption, Source: Digital 2021 Report by We Are Social

The uptake of mobile channels in Southeast Asia is driving the use of digital wallets. While debit and credit cards and bank transfers remain the dominant online payment methods among Singaporean and Malaysian consumers, digital wallets are fast rising in popularity, says Stripe.

A recent study by fintech company Boku conducted in partnership with Juniper Research estimates that the number of mobile wallets across Indonesia, Malaysia, the Philippines, Singapore, Thailand and Vietnam will grow 311% from 2020 to almost 440 million by 2025, reflecting the online commerce boom.

At the end of 2020, 1.2 billion people across Asia-Pacific were connected to the mobile Internet, equivalent to a 42% penetration rate, estimates industry trade group the GSM Association (GSMA). By 2025, over 333 million people across the region will start using mobile Internet for the first time, pushing the penetration rate to 52% of the population.

Mobile technologies and services generated over US$750 billion of economic value added (5.1% of GDP) in Asia-Pacific (APAC) in 2020, a figure that’s expected to increase to US$860 billion by 2025 as countries increasingly benefit from the improvements in productivity and efficiency brought about by the increased take-up of mobile services.

Featured image credit: Cards photo created by freepik – www.freepik.com