China, India and Indonesia Record Highest Digital Wallet Adoption Rates Across APAC

by Fintech News Singapore January 24, 2022Across Asia Pacific (APAC), China, India and Indonesia are leading the region in digital wallet adoption. A new report by business payment company PPRO found that in these three markets, online shoppers prefer using e-wallets such as Alipay, Paytm and GoPay for their online purchases over bank transfers, cash and payment cards.

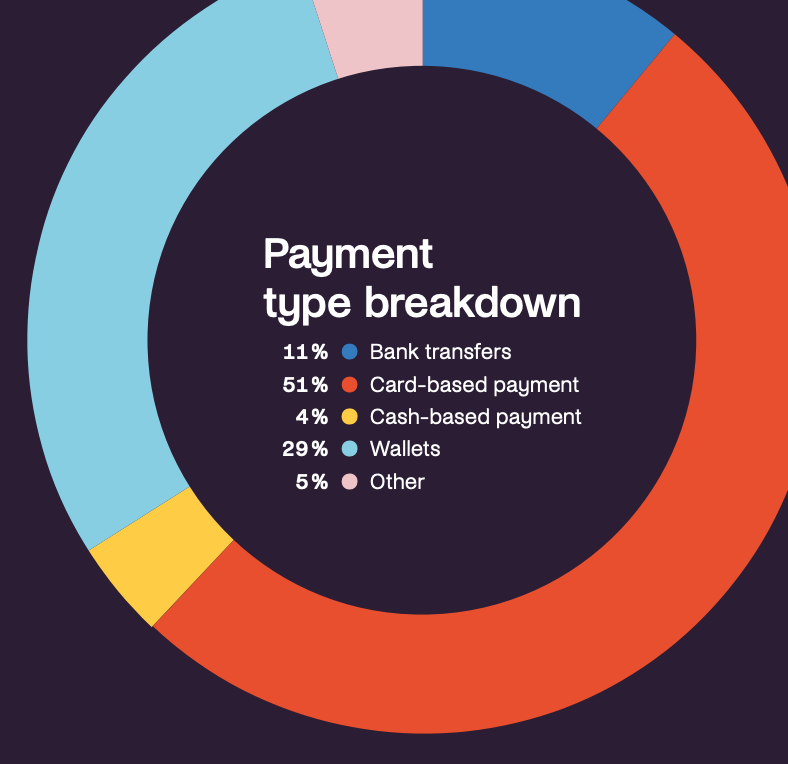

Unsurprising, China leads APAC in digital wallet usage. A nation of smartphone lovers, the country has been quick to adopt digital wallets, which are now used to pay for the majority of e-commerce payments. Services like Alipay and WeChat Pay take a 72% market share, far ahead of card-based payments (12%) and bank transfers (5%), according to PPRO.

Payment type breakdown for online purchases in China, Source: 2021 Payment Almanac, PPRO

China’s high level of digital wallet adoption is evidenced by the volume of transactions that goes through Alipay, China’s leading online payment service. In 2020, the company disclosed that monthly payment volume averaged CNY 10 trillion (US$1.5 trillion). It said it had about 711 million monthly active users as of June 2020.

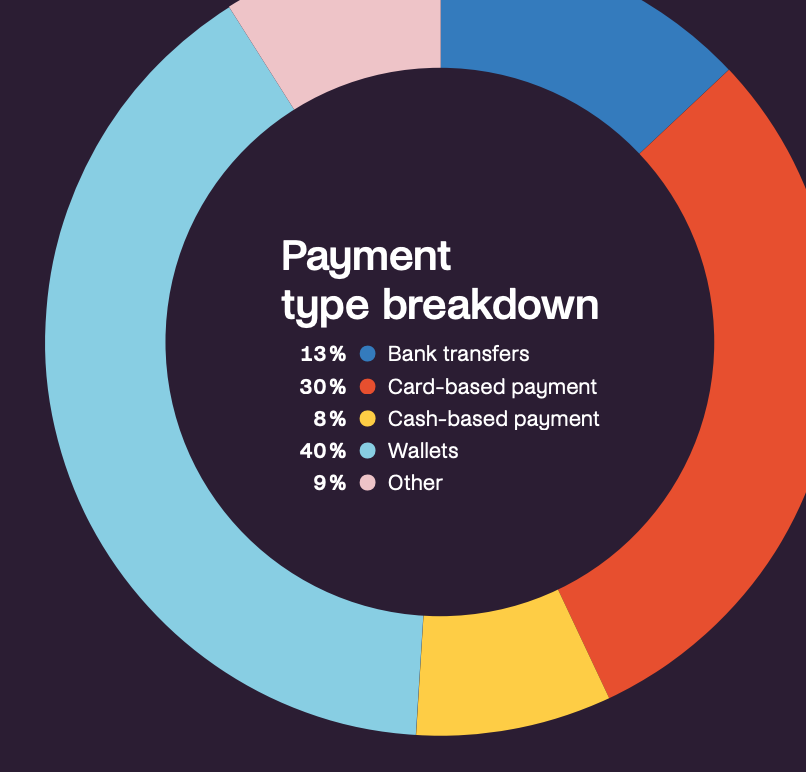

In India, 40% of online purchases were found to be paid using digital wallets, like Paytm and PhonePe, The country, one of the most dynamic emerging e-commerce markets, has seen the growth of a thriving digital wallet scene that now counts brands including Amazon Pay, and domestic QR code-based Paytm, which JP Morgan estimates hold a 11% to 13% market share. Google Pay and PayPala also exist, taking a 2% to 4% market share each.

After digital wallets, top e-commerce payment methods in India are card-based payments (30%) and bank transfers (13%), according to PPRO.

Payment type breakdown for online purchases in India, Source: 2021 Payment Almanac, PPRO

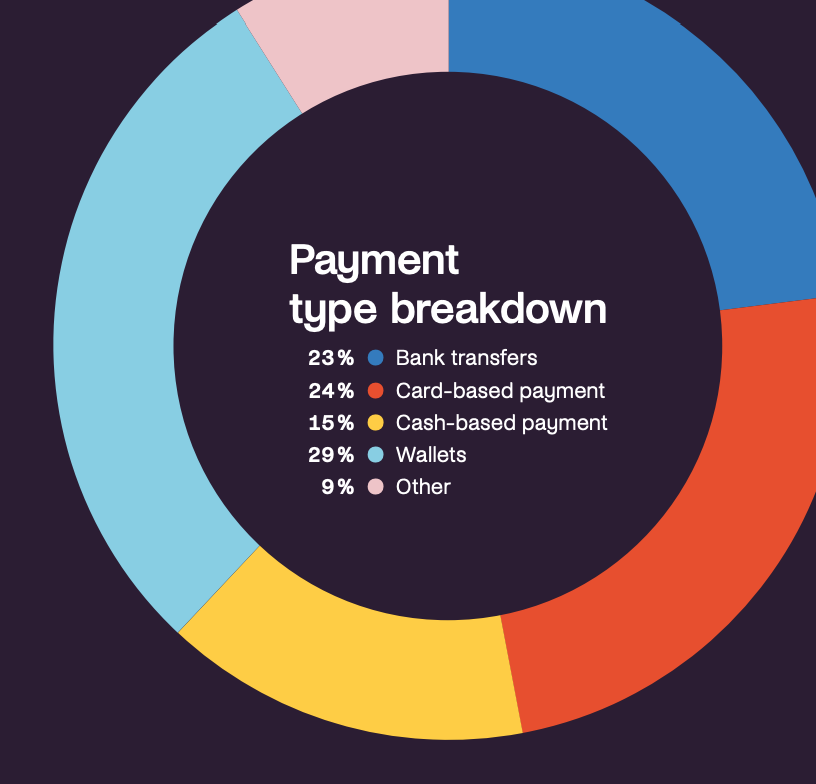

Next, Indonesia, Southeast Asia’s largest country and economy, is seeing rapid adoption of digital wallets supported by rising smartphone penetration. These services are now used in 29% of online purchases, with popular brands that include OVO, DANA and GoPay, the digital wallet arm of the GoTo Group.

Booming adoption of digital wallets is shown by the surge in digital payments, notably over the past year. Bank Indonesia reported an increase of 61.82% in the value of e-money transactions between November 2020 and November 2021

After digital wallets, card-bard payments (24%) and bank transfers (23%) are other popular payment methods for e-commerce transactions in Indonesia, according to PPRO.

Payment type breakdown for online purchases in Indonesia, Source: 2021 Payment Almanac, PPRO

Japan, Malaysia and Taiwan as top laggards

At the other end of the spectrum, Japan, Malaysia and Taiwan were found to be top laggards in digital wallet adoption. The three countries recorded the lowest market shares of digital wallet in e-commerce payments across APAC, with 11% for Japan, 14% for Malaysia, and 16% for Taiwan.

In Japan, where credit card penetration was the highest across APAC in 2020 at 68%, card-based payments are unsurprisingly the primary way to pay for online shopping, taking a 62% market share.

Similarly, Malaysian and Taiwanese online shoppers also favor card payments, which make up 31% and 46% of e-commerce transactions, respectively.

Meanwhile, the Philippines, Vietnam and Thailand appear to be at a tipping point, with digital wallets, cash, cards and bank transfers standing neck-to-neck.

With a 33% market share, cards are Filipino online shoppers’ preferred payment method, but cash payments and digital wallets aren’t far behind with a market share of 24% and 20% respectively.

According to the Bangko Sentral ng Pilipinas, the country’s central bank, 20.1% of monthly payments were done digitally by the end of 2020, providing good prospects for future growth in digital wallet usage.

In Vietnam, cash remains king, making up 28% of e-commerce transactions. However, bank transfers, cards and digital wallets follow closely with a market share of 26%, 21% and 21%, respectively.

And in Thailand, online shoppers were found to be preferring bank transfers for their purchases (31%), followed by cash (22%), digital wallets (19%) and cards (17%).