Over a Quarter of Banks Report Improved Revenue After Implementing AI

by Fintech News Singapore March 18, 2022Adoption of artificial intelligence (AI) is growing rapidly in the financial services sector, as organizations all seek to benefit from the advantages brought about by the technology, including streamlined processes, task automation and improved customer experience.

A new survey conducted by tech firm Nvidia, which polled over 500 financial services professionals, including executives, data scientists, developers, engineers, and IT specialists, from around the world, found that a vast majority of financial services companies are already using AI in some type of way.

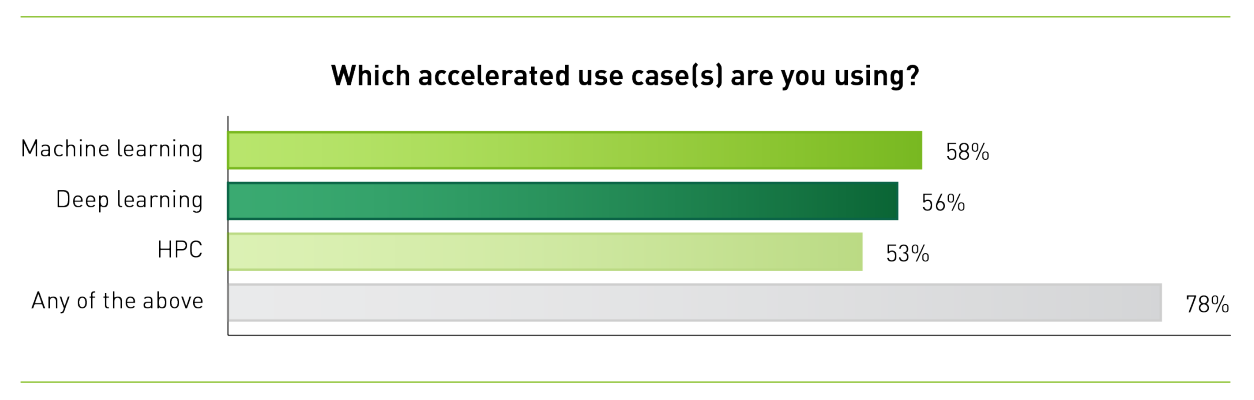

Across all sectors of financial services, over 75% of companies utilize at least one of the core accelerated computing use cases of high-performance computing (HPC), machine learning (ML), and deep learning.

Which accelerated use case(s) are you using?, Source: The State of AI in Financial Services in 2022, NVIDIA

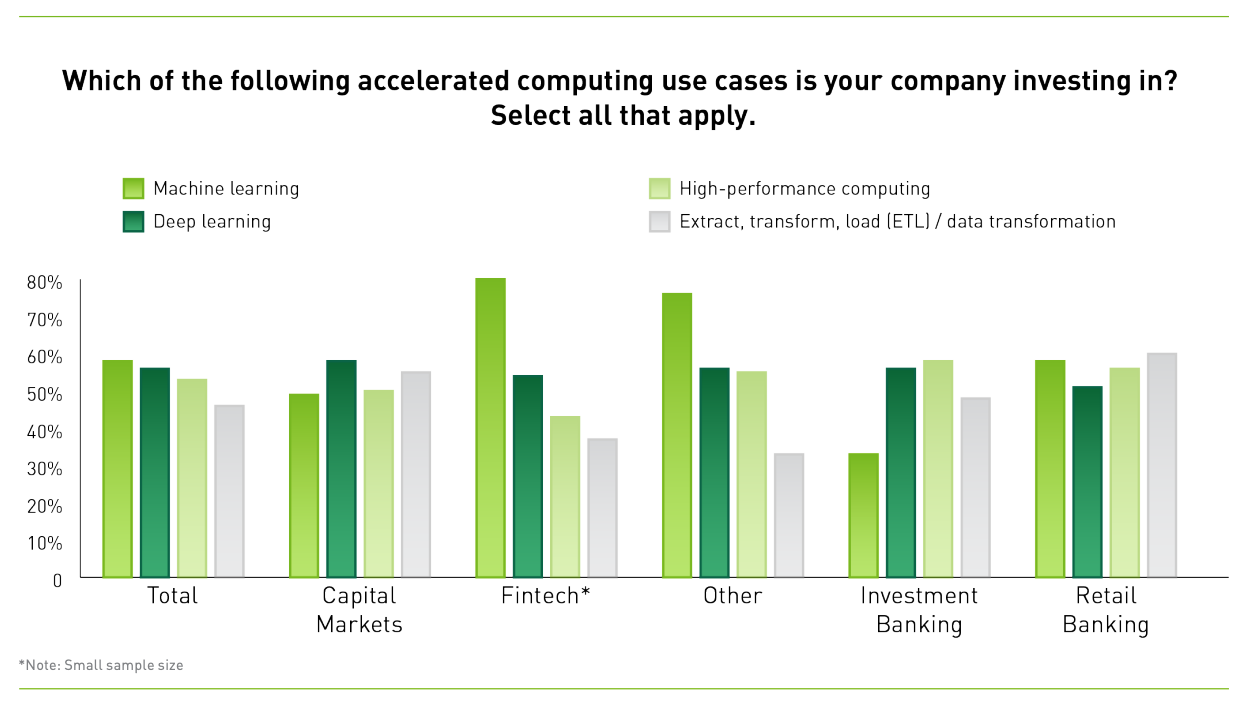

Breakdown adoption across the different sectors that make up the financial ecosystem, the survey found that capital market firms such as hedge funds, asset managers and exchanges, are the most prevalent users of deep learning at 58%. In contrast, 80% of fintech companies are leveraging ML.

Which of the following accelerated computing use cases is your company investing in?, Source: The State of AI in Financial Services in 2022, NVIDIA

Fraud detection as the top AI application in finance

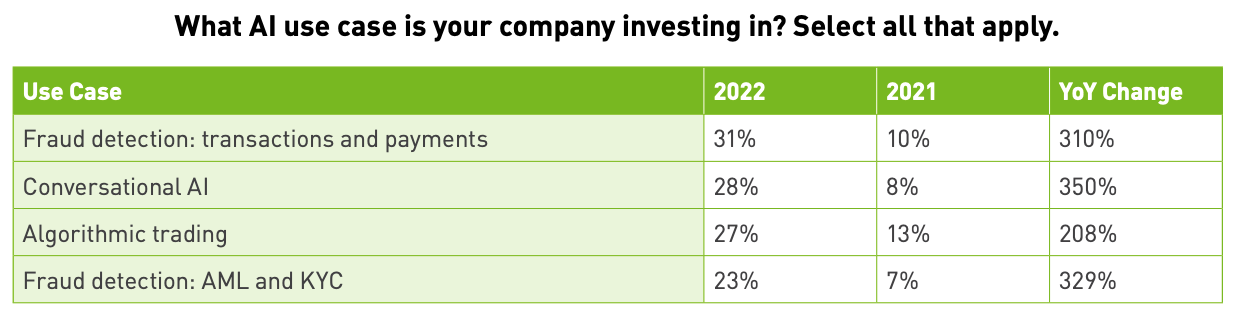

When asked about AI use cases financial services companies are investing in, respondents cited fraud detection for transactions and payments (31%) and algorithmic trading (27%) as the top two of the top three AI applications. Conversational AI, such as chatbots and virtual agents, is a new entrant into the top three ranking, taking the second place this year at 28%.

What AI use case is your company investing in?, Source: The State of AI in Financial Services in 2022, NVIDIA

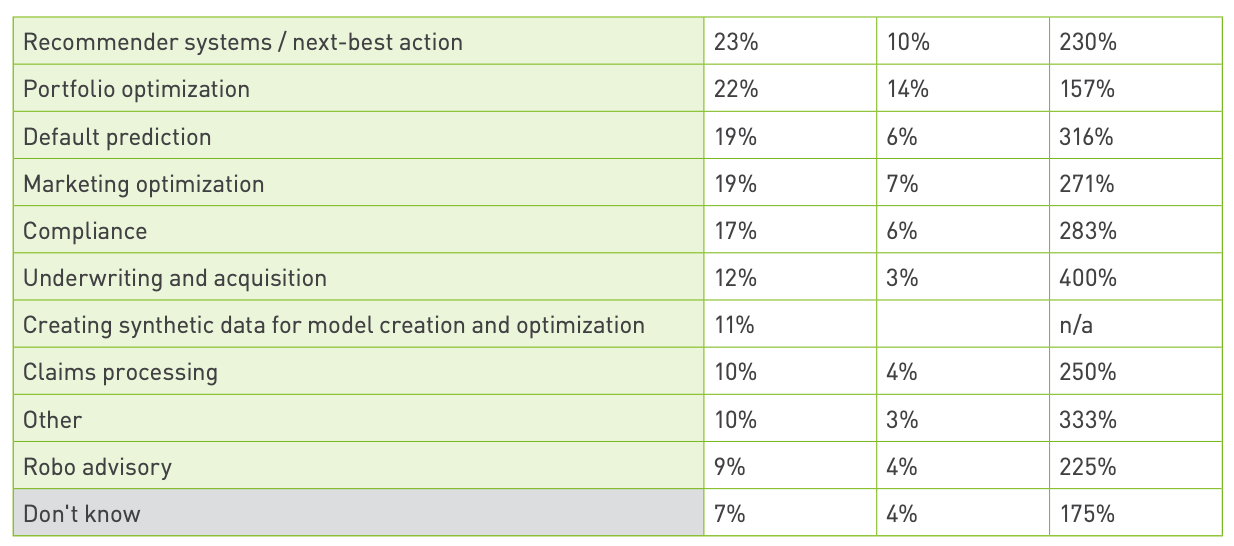

When comparing the penetration of these AI use cases in 2022 versus 2021, it is apparent that financial services companies are shifting their focus away from portfolio optimization and recommender systems/next-best action, which ranked among the top four AI use cases in 2021.

These are now taking a backseat on financial firms’ priority list, and are being replaced by underwriting and acquisition (400%), conversational AI (350%) and anti-money-laundering (AML) and know-your-customer (KYC) fraud detection (329%), the three AI use cases that showed the largest percentage gains this year.

Which of the following accelerated computing use cases is your company investing in? (2:2), Source: The State of AI in Financial Services in 2022, NVIDIA

Results from the Nvidia study echo those of a recent survey of IT executives conducted by the Economist Intelligence Unit (EIU) which revealed that banks are heavily investing in the use of AI for fraud detection as they seek to reduce losses, increase efficiency and improve customer experience.

A relevant example is Mastercard, which has been using data on transactions and authentications to predict and detect fraud more precisely and quickly, reducing false positives and thus providing a superior customer experience. The firm has been investing in AI for fraud protection for years, having acquired both tech vendors Brighterion and NuData Security back in 2017.

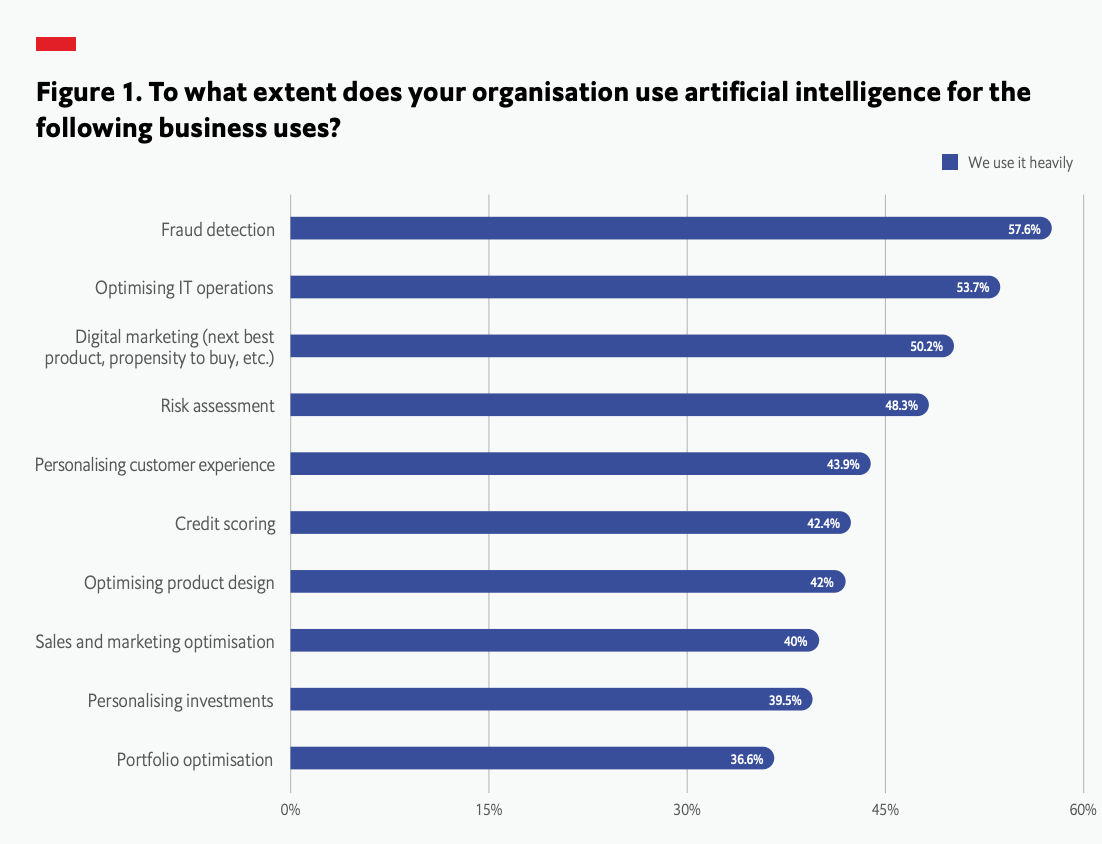

57.6% of IT executives polled by the EIU said they use AI “heavily” for fraud detection, making it the most popular AI use case in the financial sector. Fraud detection is followed by IT operations optimization (53.7%), digital markets (50.2%) and risk assessment (48.3%).

To what extent does your organisation use artificial intelligence for the following business uses?, Source: Banking on a Game-Changer: AI in Financial Services, The Economist Intelligence Unit

Impact of AI in financial services

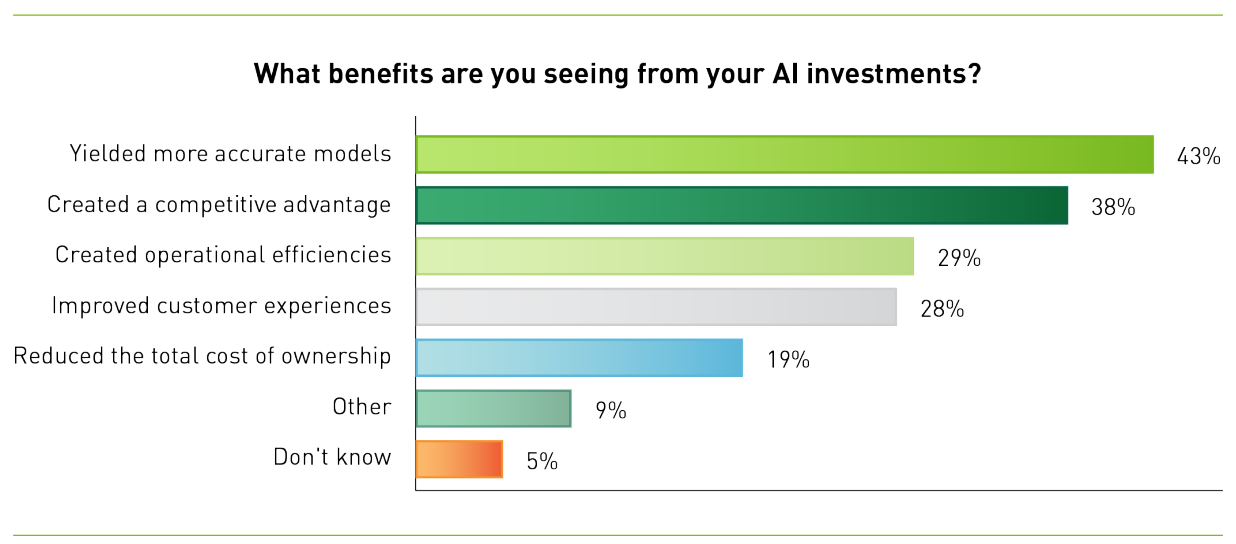

As part of the Nvidia survey, financial institutions that use AI were asked to identify the biggest benefits they’ve seeing in adopting the technology. 91% of respondents stated that they are driving critical business outcomes with investments in AI.

Among the top benefits respondents observed, 43% of respondents indicated that AI is yielding more accurate models, while 38% said they’ve gained a competitive advantage over rivals. 29% reported improved operational efficiencies, and 28% said AI has allowed them to improve customer experience.

What benefits are you seeing from your AI investments?, Source: The State of AI in Financial Services in 2022, NVIDIA

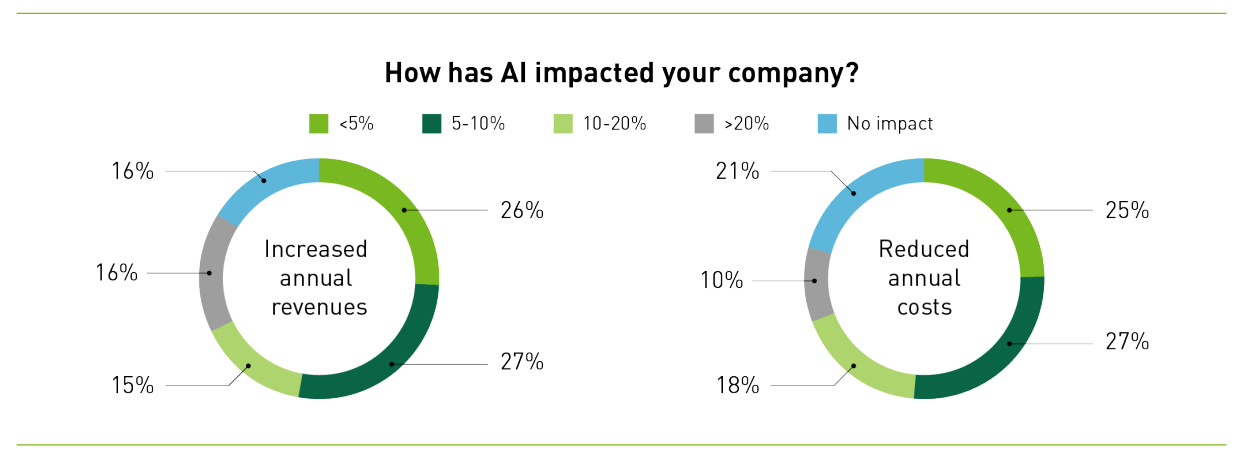

These improvements have resulted in a 10% and up increase in revenues for more than 30% of respondents. Over a quarter indicated that AI is reducing annual costs by more than 10%.

How has AI impacted your company?, Source: The State of AI in Financial Services in 2022, NVIDIA

Showcasing that AI is no longer just an option in finance, 81% of banking executives polled by the EIU reported that unlocking value from AI would be the key differentiator between winning and losing banks.