Is India Set to Become the Largest BNPL Market in the World Within 5 Years?

by Fintech News Singapore April 7, 2022Rising demand for access to credit, a progressive regulatory landscape, and a massive addressable population are setting the foundation for India to become the largest market for buy now, pay later (BNPL). This will further be propelled by the meteoric rise of e-commerce and digital payments, aided by the thriving domestic fintech ecosystem and the success of the India Stack.

This is according to Lizzie Chapman, the CEO and co-founder of Indian BNPL firm ZestMoney. In a new guest post on Fintech Futures, the BNPL executive looks at the Indian BNPL market, delving into why she believes India will become the world leader in BNPL innovation and adoption.

Indian consulting firm RedSeer estimates that the number of BNPL users in India could rise to 80-100 million customers by 2026, from 10-15 million currently. The firm also estimates that the country’s BNPL market will rocket to US$45-50 billion by 2026, from US$3-3.5 billion now.

These bullish estimates come on the back of encouraging metrics relating to digital payment growth and e-commerce.

Citing third party research, Chapman says digital merchant payments are projected to shoot up by over eight times and cross US$1 trillion by 2026 from the current US$285 billion. In tandem, digital lending is also set to soar, forecasted to touch US$100 billion in the next four-five years from the existing US$20 billion.

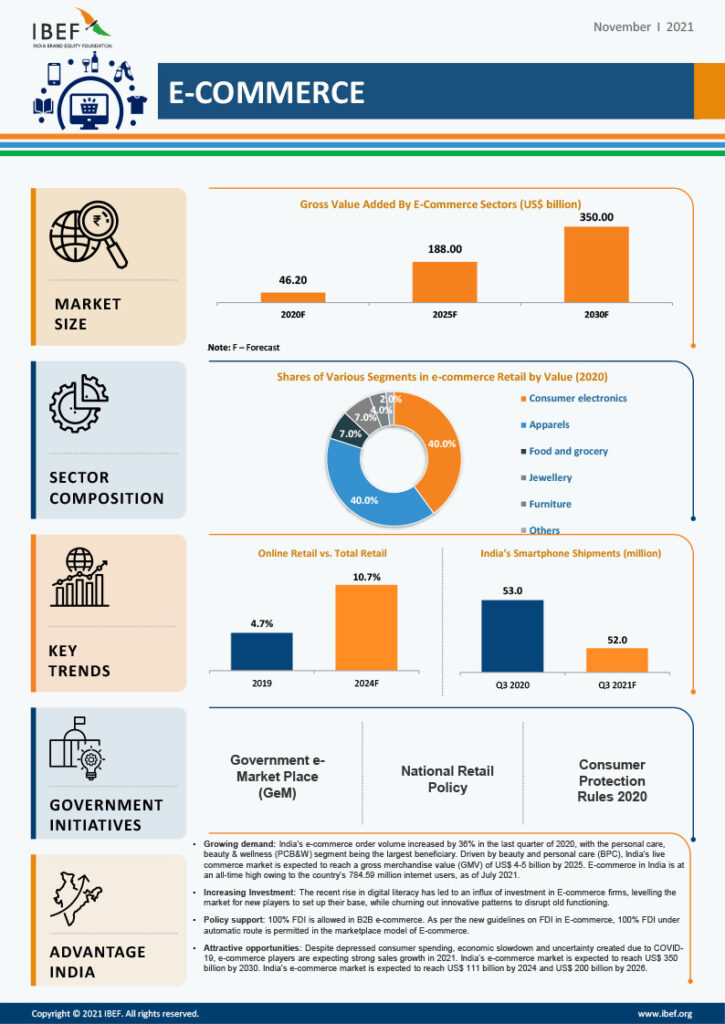

The meteoric rise of digital payments, coupled with a booming e-commerce industry which some project will become the third-largest market in the world by 2030, is setting the foundation for India to become “the largest BNPL market in the world in the next five years” and creating “a massive opportunity for scaling financial products,” Chapman says.

Growth of E-commerce Industry in India – Infographic,IBEF

This environment has enticed investors into backing India’s fintech industry, with funding soaring over the past years. In 2021, domestic fintech companies raised a staggering US$7.97 billion across 280 deals, according to data from India media platform Inc42. The amount represents a 2 times year-on-year (YoY) increase.

Delving into the reasons why she believes India is such a fertile ground for BNPL, Chapman points out two main drivers: for one, consumers are embracing BNPL arrangements because they love the flexibility and convenience these solutions provide; and second, India has a low credit penetration, providing high growth prospect for the space.

She cites several industry research which claims that India has a credit card penetration rate of just 3%, compared to about 58-66% for developed markets like the US, the UK and Australia.

This means that in addition to the obvious benefits of BNPL, including the ease of use, the absence of fees or interest (in most cases) and the ability to manage finances and make important purchases even when cash is tight, BNPL providers in India face far less competition from classic credit cards than Western markets.

A new study conducted by Indian research and analytics firm Benori Knowledge polled over 1,000 consumers and found a clear preference for BNPL arrangements. An overwhelming 90% indicated that they were more likely to shop from stores, both offline and online that offered a BNPL option at check-out. Likewise, a majority, 75%, confirmed using BNPL when shopping on e-commerce websites and apps.

These optimistic metrics and forecasts align with data reported by some of the country’s BNPL providers. Payment gateway Razorpay, for example, said it recorded a surge in its BNPL, which grew by 611% during the 2021 calendar year and by 569% in 2020.

At MobiKwik, another Indian payment services provider, BNPL nearly double in two years, the company said in late 2021. For the financial year ending March 31, 2021, MobiKwik said income from the BNPL segment accounted for nearly a fifth of its 3.01 billion rupees (US$40 million) revenues.

India’s red-hot BNPL sector is now seeing multiple products and business models emerge. In December 2021, consumer credit fintech startup SaveIN launched a BNPL platform for healthcare services, providing financing options at physical points of care. The company, which is backed by Y Combinator, has already partnered with hundreds of healthcare providers as well as clinics and hospitals across the nation.