The Fintech 100 – Announcing The World’s Leading Fintech Innovators For 2016

by Fintech News Singapore October 28, 2016Fintech Innovators, a collaboration between fintech investment firm, H2 Ventures and KPMG Fintech, announced its list of the world’s leading fintech innovators, the 2016 Fintech 100.

The annual list includes the leading 50 Established fintech companies across the globe, as well as the most intriguing 50 ‘Emerging Stars’ – exciting new fintechs with bold, disruptive and potentially game-changing ideas.

Highlights from the Fintech 100 report

– China fintech continues to dominate – within 3 years, China’s fintech ventures have gone from only one company included in the top Established 50 rankings in 2014, to this year China featuring four of the top five companies and eight of the top 50

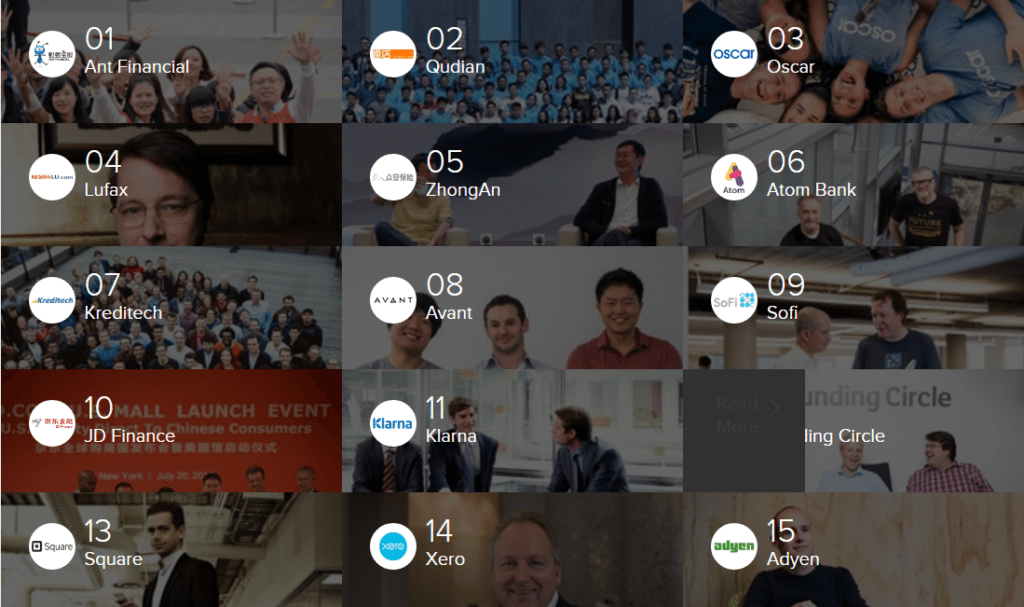

Leading 15: Ant Financial – Qidian – Oscar – Lufax – ZhongAn – Atom Bank – Kreditech – Avant – Sofi – JD Finance – Klarna – Funding Circle – Square – Xero – Adyen

– Global competition is expanding, with 17 countries represented in the top 50 Established companies, up from 13 last year, and 22 countries in the full Fintech 100.

– New fintech subsectors have emerged, including regtech (regulatory technology), with 9 companies on the list

– Insurtech continues its ascent, with 12 companies, almost double last year’s total.

From a geographic standpoint, the continued rise of Chinese fintech is indisputable, with Hangzhou-based Ant Financial taking the top spot in the 50 Established Innovators list, and Qudian, Lufax and Zhong An also in the top five. Oscar, at number three, is both the highest ranked insurtech and the highest ranked US-based company.

In total, the Fintech 100 includes 35 companies from the Americas, 28 companies from EMEA, plus13 from the UK, and 24 companies from the Asia-Pacific region, including 10 from Australia and New Zealand.

Chia Tek Yew, Head of Financial Services Advisory, KPMG in Singapore, on the evolution of fintechs in Asia Pacific: “It’s interesting to see how fintechs are transitioning from being a single ‘product’ disruptor to a fully-fledged financial player. One example is Ant Financial, which started as Alipay to help with payments within the Alibaba marketplace, and is now a player that provides multiple products such as deposits, loans, and assets under management.”

“These disruptors will start small and then expand its product range or geographic reach. They will typically seek out similar markets with the same unmet needs to scale their business. In the near future, I anticipate a growing number of such companies entering markets such as Indonesia,” he said. The level of funding has continued to rise for the Fintech 100, with the 50 Established companies attracting an additional US$14.6 billion of capital since last year’s report just 12 months ago, an increase of more than 40 percent from 2015.

Toby Heap, H2 Ventures, commented: “The 2016 Fintech 100 demonstrates the acceleration of the disruption taking place in the global financial services industry, with more capital than ever being invested around the world in startups and established ventures that are creating new financial products and solutions.”

“The continued dominance of China, which rapidly rose last year to take the top spot, tells only part of the story. We are seeing the emergence of exciting fintech players in countries across the world, from India to Israel, from Portugal to the Philippines.”

Ian Pollari, Global co-lead of KPMG’s Fintech practice added: “One of the striking features of the year’s list is the growing success of fintech disruptors, with more than 90 percent of the top 50 ventures challenging incumbents or traditional business models.”

“The Fintech 100 companies are increasingly attracting a greater share of capital as well, raising more than 65 percent of total global fintech investment over the past year.”

“The report also highlights a growing and increasingly diverse fintech sector, with the creation of value in new sub-sectors such as regtech and data & analytics, and the continued growth in insurtech and blockchain,” he said.

Top 10 World’s Leading Fintech Innovators For 2016

Emerging stars list

The Top 50 Emerging Stars list for 2016 includes companies from 19 countries, with fintechs from

countries such as Chile and the Philippines for the first time.

Bluzelle, one of KPMG Digital Village’s portfolio startups based in Singapore, was recognised as

one of the top 50 emerging stars in fintech globally.

“This recognition is an honour and a testament to the hard work our team has put in over the past 2

years. Over the next 12 months, we’re releasing new innovations in payments and smart contracts

that will bring enormous value to the end consumer,” said Pavel Bains, CEO of Bluzelle.

Selecting the Fintech 100

The Fintech 100 were selected following extensive global research and analysis based on data

relating to five factors:

1. Total capital raised

2. Rate of capital raising

3. Geographic and sector diversity

4. Consumer and marketplace traction

5. X-factor: degree of product, service and business model innovation (a subjective measure

that is applied only with respect to companies appearing on the 50 Emerging Stars list)

Top 20 World’s Leading Fintech Innovators For 2016

1. Ant Financial (China)

Ant Financial, formally known as Alipay, which is the world’s leading third-party payment platform. Ant Financial is dedicated to creating an open ecosystem, providing inclusive nancial services to small and micro enterprises and individual consumers. Businesses operated by Ant Financial include Alipay, Ant Fortune, Zhima Credit, MYbank and Ant Financial Cloud, covering payment, wealth management, independent credit scoring and reporting, private bank and cloud computing services. Ant Financial’s invested/controlled companies and a liates also work closely with Ant Financial to support its ecosystem.

2. Qidian (China)

Qidian is a student Micro-loan Site, an installment payment and investment management platform. Qudian Group operates two main business platforms: a consumer finance platform and a micro credit lending platform. Its aim has been to broaden the scope of financing available to the many consumers in China that do not currently use credit cards. The company has a substantial number of registered users and offers credit to young and middle aged consumers. The group has established several formal partnerships with companies engaged in financial services, e-commence, digital services, FMGG and other sectors.

3. Oscar (USA)

New York-based Oscar is a health insurance company that employs technology, design, and data to humanise health care. With a team of technology and healthcare experts, Oscar looked at the current state of the US healthcare system, and were frustrated by the consumer experience. In response, they decided to revive how healthcare is delivered. They are reinventing how to manage care, process medical claims, control healthcare costs, and provide transparency. With all the complexity hidden behind an easy experience for members. Oscar is making the healthcare system simple, smart and friendly.

4. Lufax (Shanghai)

Lufax is an Internet based lending and wealth management platform, which is owned by Ping An Group. Lufax aims to provide one of the most comprehensive wealth management platforms globally. In addition to online lending, its services include providing risk management expertise, financial assets trading information and related consulting services for enterprises, financial services institutions and other qualified investors. Lufax takes advantage of the latest big data and IT technologies, and leverages the most advanced risk assessment models and risk control systems.

5. ZhongAn (China)

ZhongAn is an Internet insurance company, head-quartered in Shanghai. ZhongAn applies mobile Internet, cloud computing, big data and other new technologies for a variety of different purposes including product design, automatic claims settlement, market positioning analysis, risk control and back-end claims services. Its services help users search for insurance products for a variety of purposes including travel, shopping, medical treatment and investment. ZhongAn offers a wide range of online insurance services to the Chinese market, catering to all socio-economic groups, with a major focus on travel, accident and health.

6.Atom Bank (UK)

Atom Bank is breathing new life into banking by building everything digitally. Atom is an App based bank that doesn’t have any branches. The App uses biometric security: face and voice recognition. Everyone who joins Atom is given their own unique personalised brand. Put simply, they get to name their own bank, have their own logo, finished off with their own colour palette for the App. Their low cost model gives customers better rates and overall value.

7.Kreditech (Germany)

Kreditech Group‘s mission is to improve financial freedom for the under banked by the use of technology. Combining non-traditional data sources and machine learning, the Company is aiming to provide access to better credit and a higher convenience for digital banking services. The product offerings include consumer loans, a digital wallet and a personal finance manager designed to help customers manage their credit score and plan their spending. Kreditech also offers a “credit as a service” model, allowing partners to integrate its credit products as payment method or funding source. Kreditech has processed almost three million loan applications through its subsidiaries.

8.Avant (US)

Avant is a online lending platform lowering the costs and barriers of borrowing for consumers. Avant launched in 2012 offering consumer personal loans. Over $1 billion dollars in loans has been originated through its platform. At its core, Avant is a tech company that is dedicated to creating innovative and practical financial products for all consumers. Through the use of big data and machine-learning algorithms, the company is able to efficiently mitigate default risk and fraud.

9.Sofi (US)

(Sofi) is a new kind of finance company taking a radical approach to lending and wealth management. SoFi helps early stage professionals accelerate their success with student loan refinancing, mortgages, mortgage refinancing, and personal loans.

Their non-traditional underwriting approach takes into account merit and employment history among other factors, therefore offering products that can’t be found elsewhere. They offer individual and institutional investors the ability to create positive social impact on the communities they care about while earning compelling rates of return.

10.JD Finance (China)

JD Finance Group is engaged in seven lines of business: supply chain finance, consumer finance, crowd-funding, wealth management, payment services, insurance and securities services. JD finance closely manages potential risks in order to improve the efficiency of the financial services sector and lower the costs of financial services generally. JD Finance’s services include JingBaobei, its microloan platform, Baitiao, its crowd funding platform, Jintiao and Xiaobai, which provides wealth management services. By utilising transaction records and credit management systems developed by JD Finance, it provides a variety of financial services for both enterprises and consumers.

11.Klarna (Sweden)

Klarna provides e-commerce payment solutions for merchants and shoppers. Klarna offers safe and easy-to-use payment solutions to e-stores. At the core of Klarna’s services is the concept of after delivery payment, which lets buyers receive ordered goods before any payment is due. At the same time, Klarna assumes the credit and fraud risk so that retailers can rest assured they will receive their money. Klarna Group has more than 1,400 employees and is active on 18 markets. They serve 45 million consumers and work with 65,000 merchants, attracting major international clients such as Spotify, Disney, Samsung, Wish and ASOS. Their goal is to become the world’s favourite way to buy.

12.Funding Circle (UK)

Funding Circle is one of the world’s leading marketplaces, exclusively focused on small businesses more than £1.3bn ($2bn) has been lent to 20,000 businesses in the UK, USA, Germany, Spain and the Netherlands. Businesses can borrow directly from a wide range of investors, including more than 40,000 people, the UK Government, local councils, a university and a number of financial organisations. Funding Circle have raised around $300 million of equity capital since 2010 from some of the largest investors in the world including Accel Partners, Baillie Gifford, BlackRock, DST Global, Index Ventures, Ribbit Capital, Sands Capital, Temasek and Union Square Ventures.

13.Square (USA)

Square is a merchant services aggregator and mobile payment company that aims to simplify commerce through technology. For sellers, they have created one cohesive service to run an entire business, from a register in your pocket and analytics on your laptop, to small business financing and marketing tools that drive new sales. For buyers, they make it faster to order from restaurants and easier to pay someone back.

14.Xero (New Zealand)

Xero develops easy-to-use online accounting software for small businesses. Their cloud-based software connects people with the right numbers anytime, anywhere, on any device. For accountants and bookkeepers, Xero helps build a trusted relationship with small business clients through online collaboration. Their product includes a full accrual accounting system with a cashbook, automated daily bank feeds, invoicing, debtors, creditors, sales tax and reporting. Xero is designed to be the accounting engine for small business, giving real time access to financial data and access for accountants or bookkeepers for quicker, easier collaboration at any point.

15.Adyen (Netherlands)

Adyen is a multichannel payment company outsourcing payment services to international merchants. Adyen is a technology company that provides businesses with a single solution to accept payments anywhere in the world. The only provider of a modern end-to-end infrastructure connecting directly to Visa, MasterCard, and 250 other payment methods, Adyen delivers frictionless payments across online, mobile, and in-store. Customers include Facebook, Uber, Airbnb, Netflix, Spotify, Dropbox, Evernote, Booking.com, Vodafone, Mango, Crocs, O’Neill, SoundCloud, KLM and JustFab.

16.Nubank (Brazil)

Nubank has developed a MasterCard platinum credit card that can be controlled with mobile applications. The Nubank card is designed for all who want a simple and transparent experience to manage their spending. The Nubank Card does not charge annual fees. They use 100% digital channels and reduce bureaucracy and paperwork to the fullest. The Nubank MasterCard is accepted at over 30 million establishments worldwide.

17.Kabbage (USA)

Kabbage is an online platform delivering working capital to small and medium-sized businesses. The company offers an automated funding platform which leverages real-time marketplace analytic through business activity such as accounting data, online sales, shipping to determine and provide cash advances to businesses. Kabbage leverages data generated by dozens of business operations to understand performance and deliver fast, flexible funding in real-time. Kabbage can support any small business by analysing various data sources that are used in everyday business.

18.OurCrowd (Israel)

OurCrowd is an equity-based crowdfunding platform, built for accredited investors to provide venture capital funding for Israeli (and later global) venture capital start-ups. Accredited investors who are accepted into the community can make minimum investments of $10,000 per deal. The focus of OurCrowd is the early stage funding market in Israel and only companies that have passed a due diligence process will be added to the OurCrowd platform. OurCrowd has become the first Israel focused, equity-based investment platform to launch and one of the world’s leading accredited investor only platforms.

19.Affirm (USA)

Affirm uses modern technology to re-imagine and re-build core components of financial infrastructure from the ground up. Their focus is to improve the lives of everyday consumers with less expensive, more transparent financial products. They offer installment loans to consumers at the point of sale, enabling people to take out simple loans and turn any purchase into a few monthly payments. All the pricing through Affirm is adaptive based on data that prices marginal risk in real time and generates a risk score for every transaction, so every aspect of taking out the loan is completely transparent.

20.Circle (UK)

Circle is a provider of payment tools for Bitcoin and other digital currency services. The company provides an application for end-users, businesses and charities aimed at enabling ease-of-use in online and in-person payments. Circle is working to revolutionise consumer finance with simple, free technology for storing and using money. Their product enables people worldwide to transfer money, easily and securely, free of charge. Circle has built mobile apps aimed at enabling greater ease-of-use in online and in-person payments, with enhanced security and privacy, and the convenience of free, instant, global digital money transfers.

Other names in the lost of 50 World’s Leading Fintech Innovators For 2016 are:

Stripe, Collective Health, Lendingkart, Weaalthfront, Credit Karma, Lending Club, Prosper, Xapo, SpotCab, OnDeck, Prospa, Lendix, WeLab, Rong360, iZettle, League, LendUp, Kueski, PINTEC, Motif Investing, Wealth Migrate, SecureKey Technologies, Tyro, Policybazaar, itBit, VivaReal, CoinBase, Knip, Payoneer, SocietyOne

>> See the full list here

Featured Image: from H2 Ventures