Despite Soaring Funding and Valuations, Indian Fintechs Struggle to Turn a Profit

by Fintech News Singapore September 19, 2022India’s fintech industry has grown as a rapid pace over the past years, and stands today as the world’s third largest fintech startup hub.

Locally, fintech companies raised a staggering US$29 billion in funding in the first seven months of 2022, the fourth largest sum by any country in the world. The country now clocks 37 fintech unicorns, ranking fourth in term of global fintech unicorn strength.

Yet, despite these achievements and a strong position in the global fintech market, industry leaders are skeptical about the profitability of the sector over the coming years, a new study by Boston Consulting Group (BCG) and venture capital (VC) firm Matrix Partners, shows.

A survey of over 125 founders and senior management at leading Indian fintech companies found that more than 70% of top executives believe most fintech companies may not be able to turn a profit in the next two to three years.

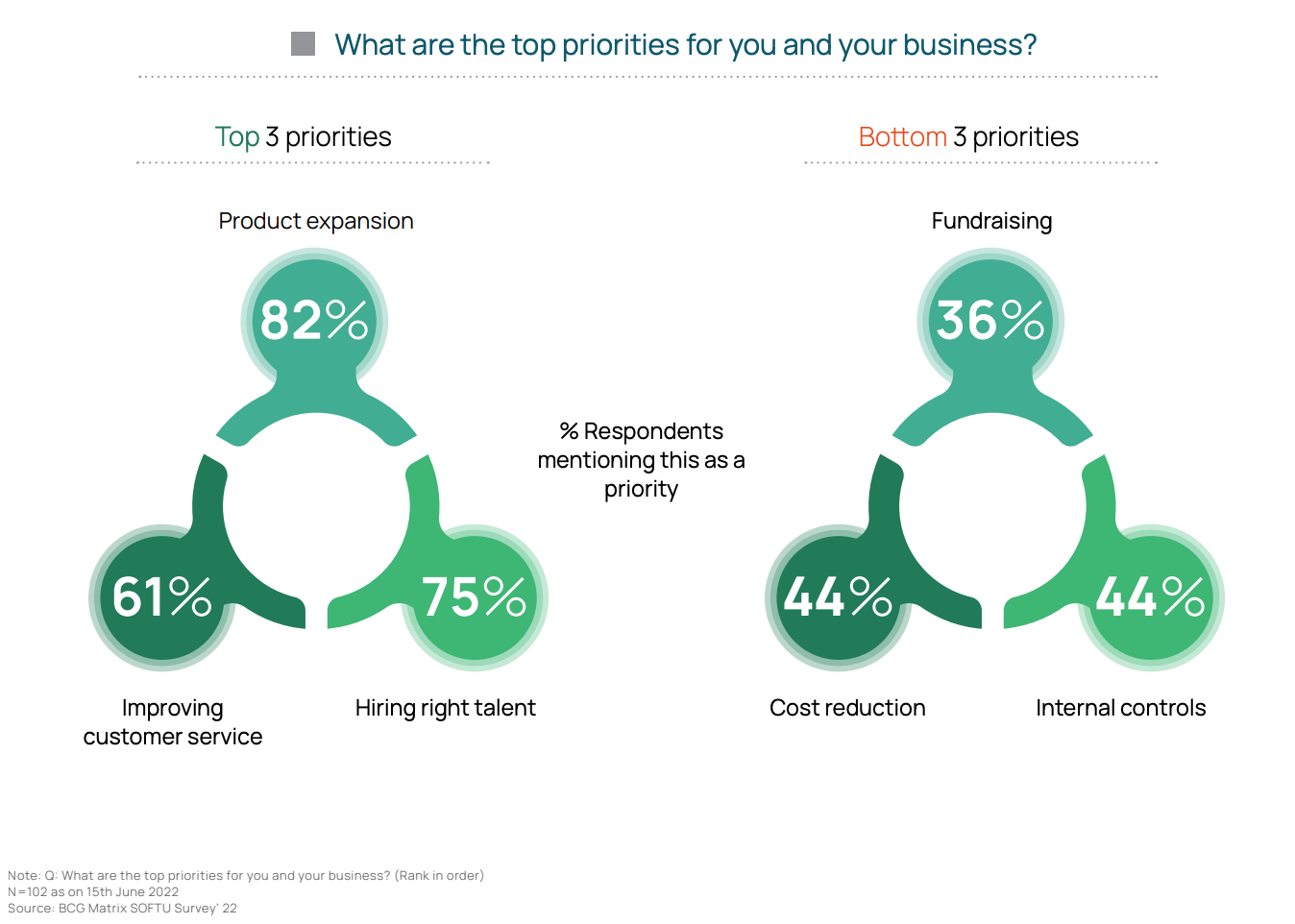

This is owed to a strong focus on scale and growth, where product expansion (82%), hiring (75%) and improving customer service (61%) were identified as the top three priorities by respondents.

What are the top priorities for you and your business?, Source: State of the India Fintech Union in 2022, BCG; Matrix Partners, 2022

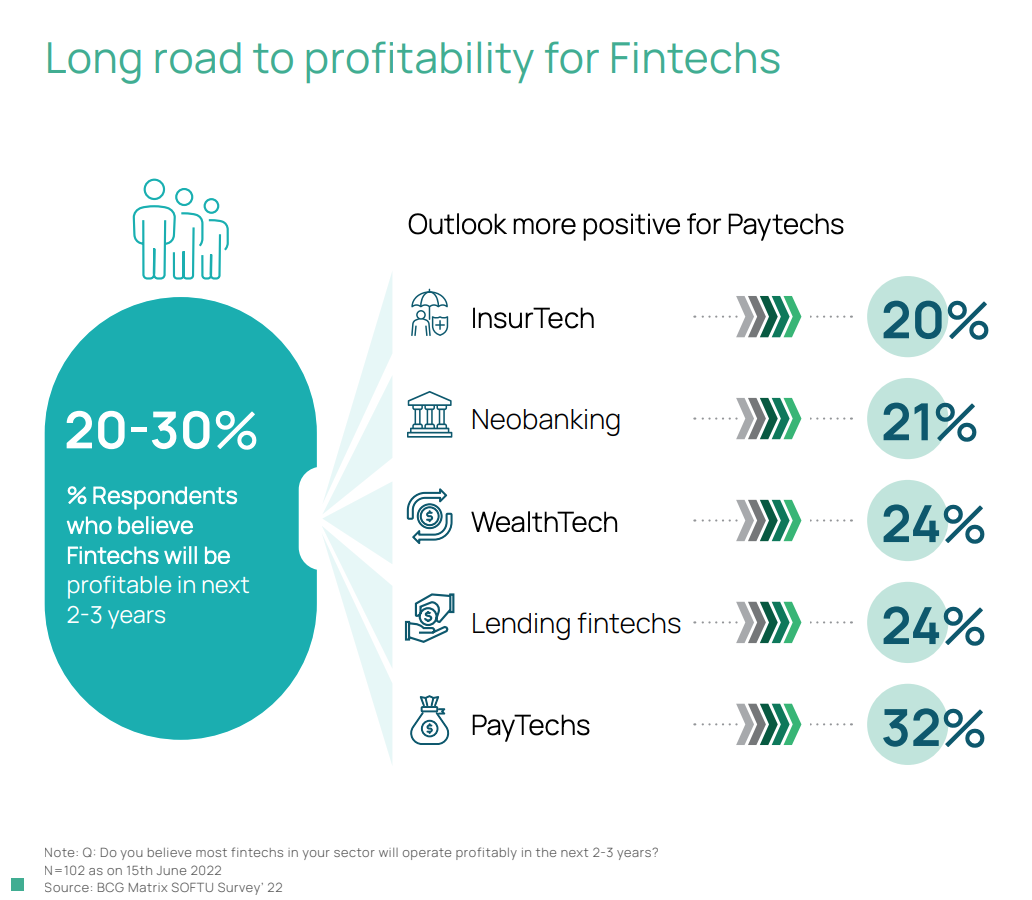

Across fintech subsegments, respondents were the most pessimistic on insurtech and neobanking, where only 20% and 21% of respondents believed most companies in these respective industries will reach profitability within the next few years.

Profitability is a key challenge for neobanks, the research found, as evidenced by the industry’s high customer acquisition costs (CAC) and low average revenue per user (ARPU), the top two challenges identified by neobanking companies.

In insurtech, industry players cited regulations, CAC, and scalability of business models as their top challenges.

Fintech profitability within the next two to three years, Source: State of the India Fintech Union in 2022, BCG; Matrix Partners, 2022

At the other end of the spectrum, respondents had the most positive outlook on paytech (32%), a sector that’s seen booming adoption facilitated by public initiatives like the Unified Payments Interface (UPI), India’s real-time payment system.

Since its launch in 2016, UPI has acted as a catalyst for digital payments, fintech adoption and financial inclusion.

Data released by the National Payments Corporation of India (NPCI) show that UPI recorded over 6.28 billion transactions in July 2022, a new record since the service was launched six years ago. Transactions nearly doubled year-on-year (YoY), soaring from 3.24 billion in July 2021 to 6.28 billion in July 2022.

Today, India is leading the world in real-time digital payments by representing almost 40% of all such transactions, Prime Minister Narendra Modi said in August, and the country has been improving financial inclusion at a compound annual growth rate (CAGR) of over 5%, according to the Hindu Business Line.

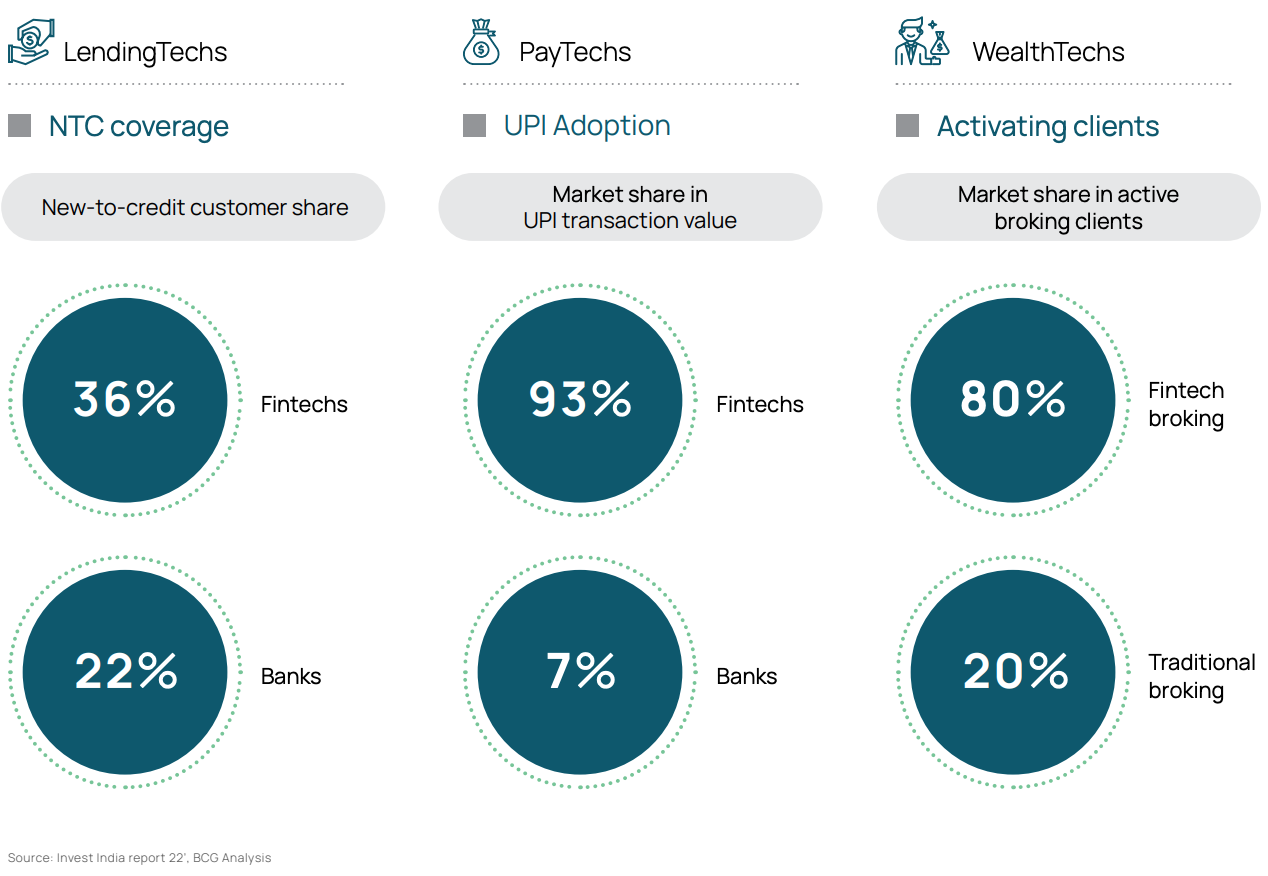

Evidence of the role of fintech in helping bring financial services to the masses is further showed in the BCG/Matrix Partners report.

According to the paper, fintech companies have been much more successful in reaching the unbanked and underbanked than traditional financial services companies, holding today a 93% market share in UPI transaction value against 7% for banks.

In wealth management and trading, digital brokers and wealthtech startups are said to have a 80% market share in active broking clients. And in lending, 36% of fintech customers are new to credit, a proportion that falls to 22% for banks.

Fintech companies are helping improve financial inclusion, Source: State of the India Fintech Union in 2022, BCG; Matrix Partners, 2022

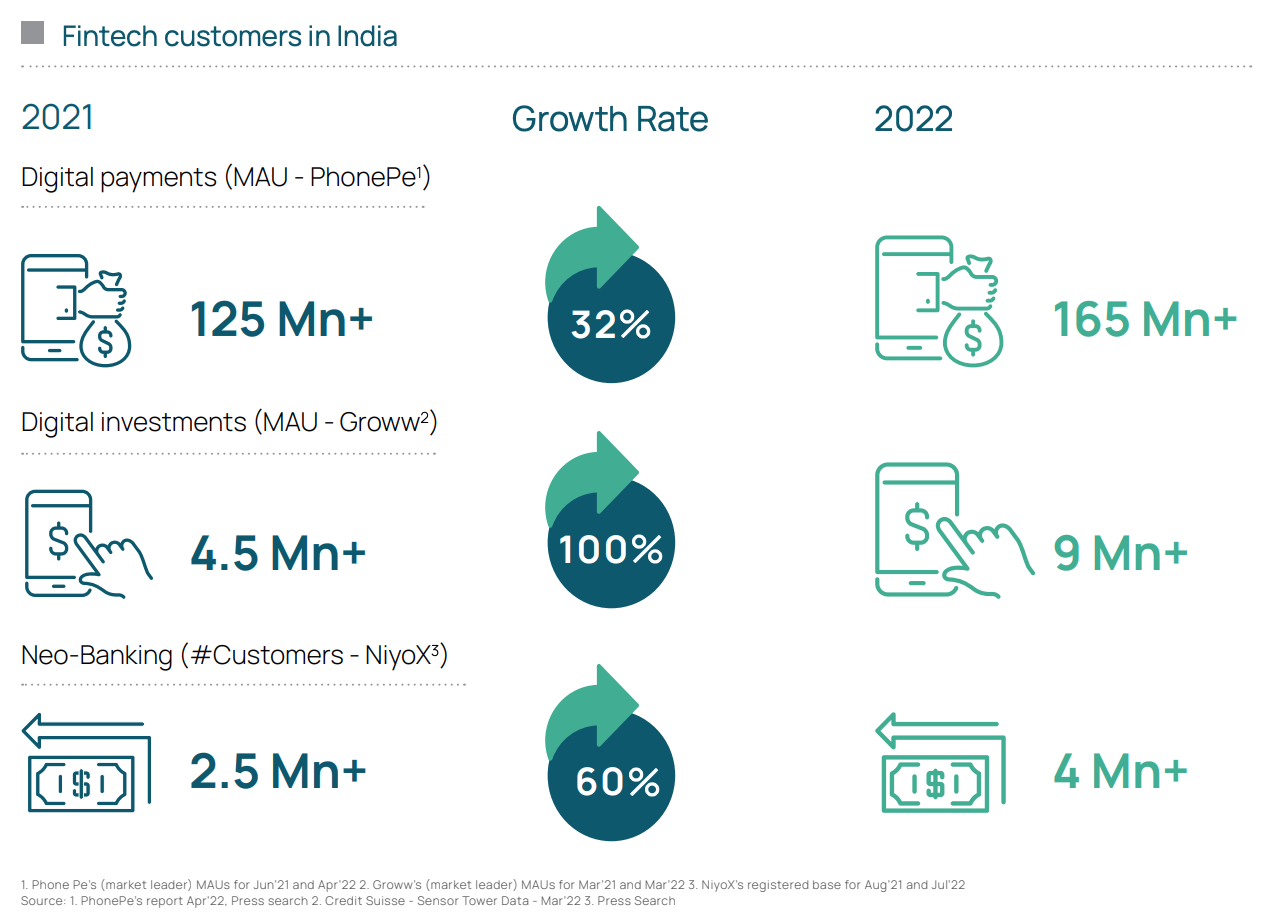

In 2021, fintech adoption continued to grow rapidly in India. PhonePe, the country’s largest digital payment company, saw its number of monthly active users jump 32% from 125 million in 2021 to 165 million in April 2022.

In digital investments, market leader Groww recorded its number of monthly active users soar 100% YoY in March 2022 to 9 million.

Meanwhile, in neobanking, NiyoX, an online consumer banking platform, saw its total number of customers rise from 2.5 million in August 2021 to 4 million in July 2022.

Consultancy EY expects India’s fintech market to reach US$1 trillion in throughput and US$200 billion in revenue by 2030.

Fintech customers in India, Source: State of the India Fintech Union in 2022, BCG; Matrix Partners, 2022