E-Commerce Boom Propelling Digital Payments Adoption in Southeast Asia

by Rebecca Oi October 24, 2022Southeast Asia (SEA) is experiencing exponential growth in digital payments encouraged by a booming e-commerce scene. The region is now home to some of the world’s largest online marketplaces in some of the fastest-growing economies like Indonesia, Malaysia, Singapore, and Thailand.

The increasing availability of digital financial services is a significant factor driving this growth. In the past, many SEA consumers were lukewarm to the idea of shopping online due to reservations and limited understanding of the security of making payments on e-commerce platforms, linking their online banking accounts, and the potential for fraud.

Digital finance services expanding the e-commerce footprint in SEA

However, the rise of trustworthy digital banking offered by recognisable financial institutions and the ease and reliability of leveraging third-party digital payment processors like Adyen in Singapore or iPay88 in Malaysia, has made it much more palatable and seemingly safer for consumers to make online purchases.

Digital financial alternatives have also helped to push the e-commerce footprint across SEA by making it easier for small businesses to accept online payments. Small businesses in the region were often limited to cash-only transactions due to the high fees charged by traditional banks for credit card payments.

In comparison, digital banking platforms typically charge much lower prices, making it more viable for small businesses to start accepting online payments.

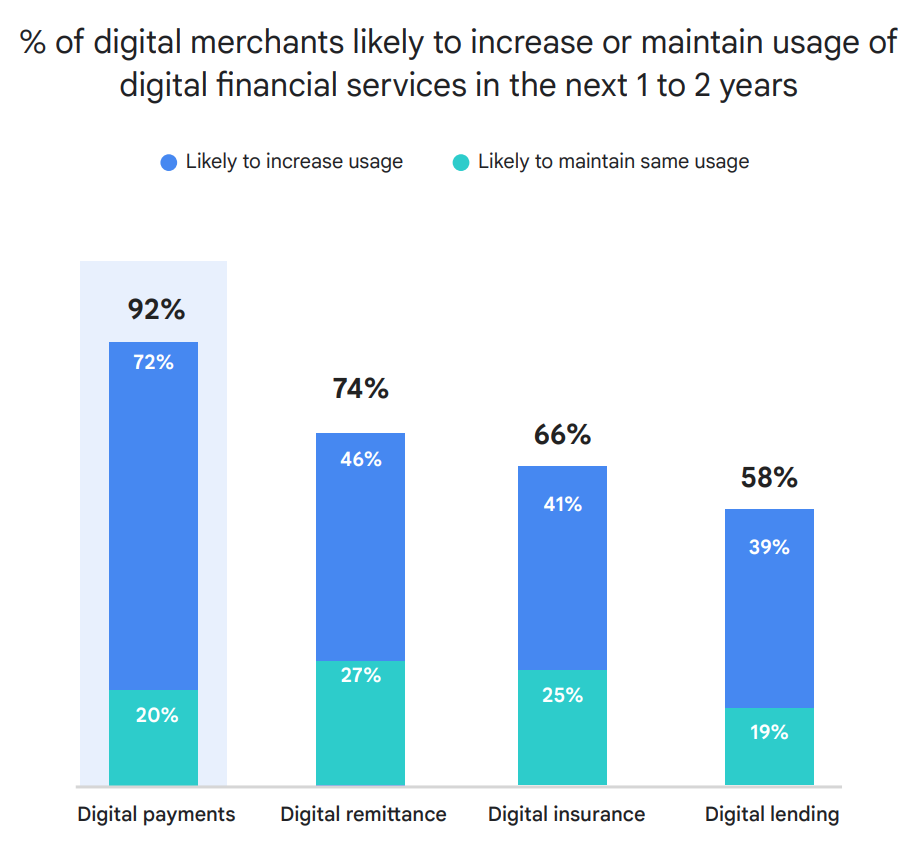

% of digital merchants likely to increase or maintain usage of digital financial services in the next 1 to 2 years, Source: eConomy SEA 2021, Google, Temasek, Bain & Company

The meteoric rise of e-commerce in Southeast Asia

With digital financing options easing consumers into accepting e-payments more readily, the pandemic was the catalyst for a further dramatic uptick in online shopping — perhaps the single biggest driver pushing digital payments’ growth in the region. This shift to e-commerce is expected to persist even after the pandemic ends, as Southeast Asians become more comfortable buying things online.

Buoyed by this trend, the Ascential Digital Commerce Whitepaper projects that e-commerce sales in the region will grow nearly 18 percent to reach US$38.2 billion by the end of 2022, and surpass US$57.8 billion by 2026.

Indonesia alone, one of the region’s biggest online commerce markets by volume, is expected to add US$9 billion in e-commerce sales this year.

The growth is expected to be so strong that Facebook and Bain & Company’s annual SYNC Southeast Asia report projects the growth in SEA to outpace the likes of China (5 percent), India (10 percent) and Brazil (14 percent).

“Southeast Asia would undoubtedly leapfrog China to become the fastest-growing digital economy in the Asia Pacific,” confirmed a partner in Bain & Company’s consumer products practise, Praneeth Yendamuri.

It is unsurprising why e-commerce adoption in Southeast Asia is catching fire. The region has a large population of young people who are comfortable using technology, and there is a growing middle class with disposable income.

In addition, many Southeast Asian countries have been investing in infrastructure to improve internet connectivity, and the explosion in smartphone adoption has greatly increased the accessibility to shop online.

The growing convergence of digital payments and e-commerce

There’s been closer alignment between e-commerce platforms and digital payment services in recent years. Particularly the major digital marketplaces are merging with embedded finance services to present a shared offering, leveraging their existing customer and merchant bases to acquire users for these new services.

According to a report from S&P Global Market Intelligence, the growth of these alternative digital payments like e-wallets has been so phenomenal in the region that even banks and regional tech giants are either operating digital payments themselves or offering them as a payment option, leveraging embedded finance solutions that appear to be presented by the bank itself, but is actually being enabled by a third-party digital finance provider.

This has led to major online players such as Shopee, Boost, and Lazada offering their own payment solutions. Each has a different strategy when it comes to implementing digital payments.

Lazada has strengthened its digital finance infrastructure through partnerships, such as Finaxar in Singapore, Asia Kredit in the Philippines, and AmBank in Malaysia.

The regional e-tailer also recently bought a US$304.5 million stake in the Indonesian e-wallet platform DANA to complement its purchasing options.

Similarly, Malaysian mobile carrier Axiata’s fintech arm Boost Holdings enables payments processing via its Boost eWallet. But this year, it partnered with the country’s fourth-largest lender, RHB, to launch its digital bank in the short term.

Meanwhile, Shopee has its e-wallet offering ShopeePay and digital banks Maribank and SeaBank in Singapore and Indonesia respectively. The healthy convergence between online commerce and e-payments has seen it expand its financial services footprint with ambitious plans for its digital banks around SEA.

Shopee parent Singapore’s Sea Group even doubled its revenues in 2021, led by e-commerce ventures, and is scaling up its fintech offerings in the region on the back of this growth. Sea generated US$3.4 billion in mobile wallet payments for the first quarter of 2021 alone, shortly after it won a digital banking licence in Singapore.

The company also purchased Indonesian lender Bank BKE (Bank Kesejahteraan Ekonomi) last year with the intention of turning it into a digital bank. In April 2022, Sea partnered with Malaysian conglomerate YTL Group to win one out of the five digital banking licences being offered by the country’s central bank, Bank Negara Malaysia (BNM).

However, reports have emerged that the company is struggling towards profitability and has laid off staff from its Singapore office. This is at least the third round of layoffs Shopee this year, after the recent job cuts the company made in Singapore, Indonesia and China.

What this means for businesses in SEA?

As e-commerce continues to grow in SEA, so is the adoption of digital payments. This is because businesses and consumers alike are recognising the many benefits that digital payments offer, including convenience, security, and speed.

Digital payments are also becoming increasingly popular due to the rise of mobile payments, which allow users to make payments via their mobile phones. This is particularly beneficial in SEA, where mobile penetration rates are high, and many people do not have access to traditional banking services.

This is good news for businesses in the region, as it will provide them with a more efficient and convenient way to receive payments from their customers.