While Retail Crypto Is Bearish, Institutional DeFi Picks Up Steam

by Fintech News Singapore November 28, 2022Institutional decentralized finance (DeFi), a trend that refers to the combination of DeFi software protocols with appropriate safeguards to ensure financial integrity, regulatory compliance and customer protection, is a fast-growing sector that’s emerging on the back of accelerated product innovation, booming adoption of digital assets, and the growth of the overall DeFi industry.

In a new report, Oliver Wyman Forum, Singaporean bank DBS, Onyx by JP Morgan, and Japan’s SBI Digital Asset Holding, looks at the nascent institutional DeFi space, providing an in-depth presentation of what the sector is all about while presenting the opportunities it brings.

The report defines institutional DeFi as the application of DeFi protocol to tokenize real-world assets, combined with the level of protections and controls that regulators demand and customers expect, including identity solutions to enable financial institutions to comply with anti-money laundering (AML) and know your customer (KYC) regulations, strong cybersecurity, and recourse mechanisms.

The report says that tokenization, the process of issuing digital tokens representing real-world asset, is a trend that has attracted the interest of many financial firms for its many potential benefits. These include efficiency gains driven by automation and disintermediation, transparency, improved liquidity potential and tradability of assets, as well as faster and potentially more efficient clearing and settlement.

Tokenization also allows for fractional ownership of assets. This, in turn, could lower barriers to investment and promote more inclusive access of retail investors to previously unaffordable or insufficiently divisive asset classes such as real estate, placements of equity or debt, thus providing greater access to markets that would otherwise be reserved to large investors.

Today, efforts to pursue tokenization is are well under way, the report says, and cover both payment instruments and assets.

On the payment side, it notes that central banks from around the world are ramping up efforts to issue digital representations of cash and develop central bank digital currencies (CBDCs). It cites a 2021 survey by the Bank for International Settlements (BIS) which found that 90% of central banks were investigating the potential of CBDCs, including 26% that were actively developing CBDCs or conducting pilot projects.

In the private sector, the growth of the stablecoin market, which reached a market capitalization of US$150 billion earlier this year, is a sign that interest in there and attests that investors are becoming more comfortable with digital representations of cash.

On the asset side, the report notes that tokenization is rapidly picking up around the world with trade volumes continuing to grow steadily. For example, Broadridge’s Distributed Ledger Repo platform, which uses tokenized government bonds, reached US$35 billion in the first weeks after launch.

JP Morgan’s intra-day repo application on Onyx Digital Assets, which the bank launched in November 2020, has already processed more than US$430 billion of repo transactions.

In tandem with industry efforts to develop real-world asset tokenization, the report says that DeFi has rapidly emerged in the past three years with innovations flourishing across various financial ecosystems and attracting billions of dollars of liquidity across decentralized exchanges, lending protocols and other solutions.

Though DeFi has so far been prevalent in the public blockchain space, these protocols, which are programmable and self-executing business processes, can be applied to interact with any tokenized asset.

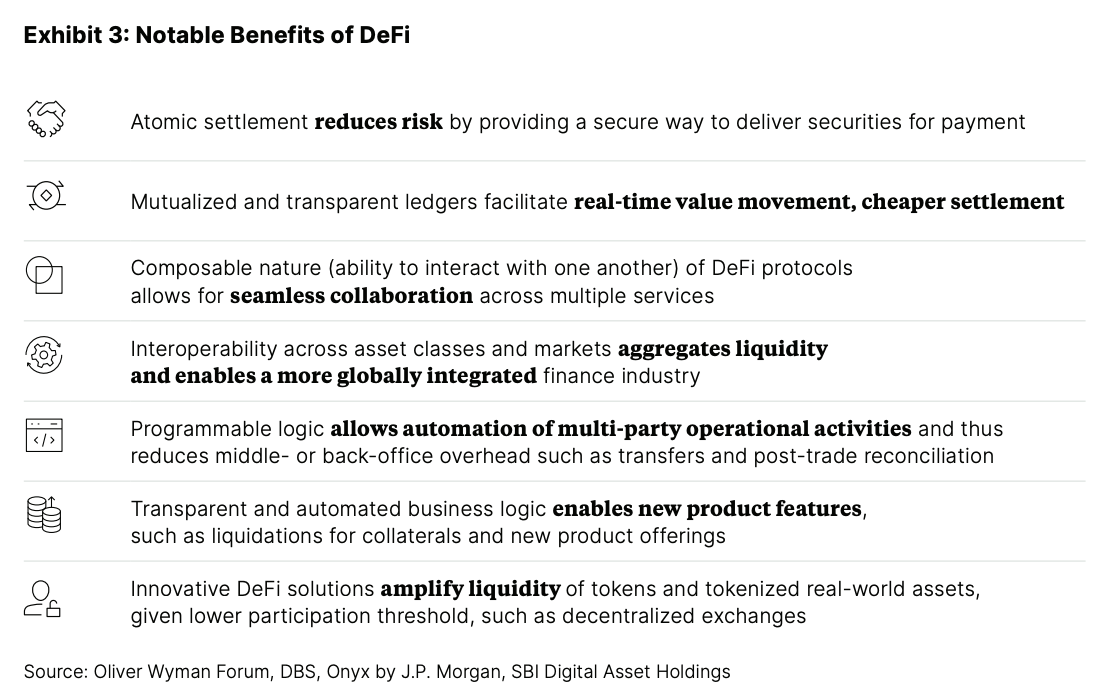

In the traditional finance world, tokenization coupled with programmability could have far-reaching implications for the broader industry, the report says. In particular, it could generate substantial cost savings because of reduced middle and back-office operations, and automation. It could also reduce risk by enabling atomic settlement, and introduce new business opportunities relating to the composability nature of DeFi protocols.

Notable benefits of DeFi, Source: Oliver Wyman Forum, DBS, Onyx by JP Morgan, SBI Digital Asset Holdings, 2022

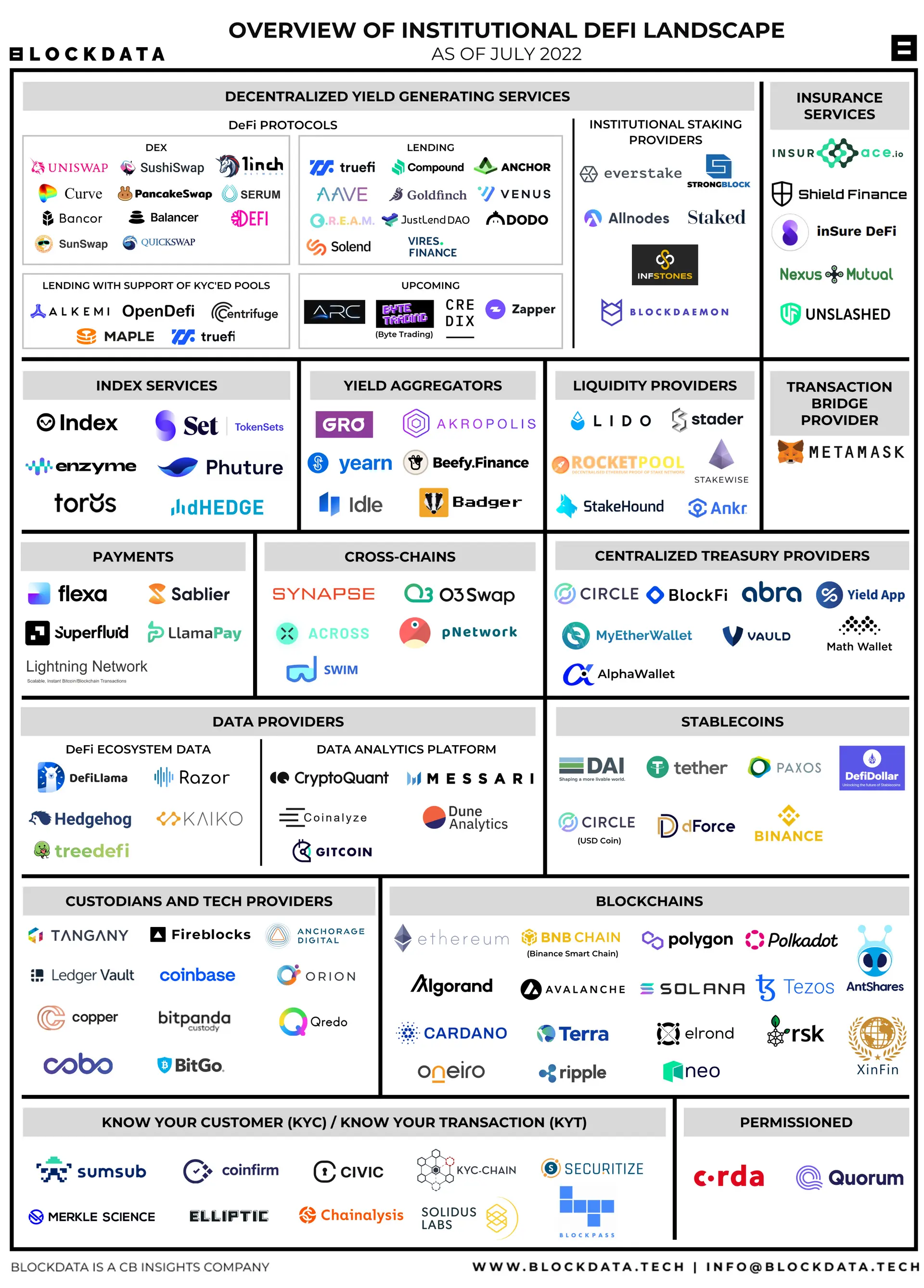

Institutional DeFi has grown strongly over the past year with new solutions being launched and partnerships being formed to tackle challenges such as gaps in digital asset trading, KYC and AML-related issues, and regulatory compliance.

For example, Blockpass, a digital identity verification provider, teamed up with EMURGO earlier this year to offer on-chain KYC services for Cardano ecosystem projects. EMURGO is a founding entity of the Cardano blockchain and its official commercial arm.

In January 2022, Liquid Meta, a DeFi infrastructure and technology company, and Civic, a blockchain-powered digital identity solution provider, formed a strategic partnership to bring secure permissioned identity services to DeFi. The partnership also focused on enabling Liquid Meta to provide capital liquidity to permissioned decentralized applications (dApps).

Overview of the institutional DeFi landscape, Source: Blockdata, 2022

Featured image credit: edited from Image by rawpixel.com on Freepik