Investors Concerned About Over-Digitisation as Human Touch Remains Indispensable

by Fintech News Singapore December 12, 2022Most investors prefer having a personal advisor over robo or digital solutions according to a survey conducted by Navigator Investment Services, an integrated investment platform under Singlife with Aviva, in collaboration with EY.

The “Advancing the Art of Advisory: Is Advisory Still Relevant?” report examines key wealth trends that are redefining how financial advisors engage and serve their clients as well as how they can be of relevance in a digital-first era.

Zennial investors as the new generation of wealth

In Asia, it is projected that younger generations will inherit US$2.5 trillion (approximately S$3.36 trillion) of family wealth by 2030.

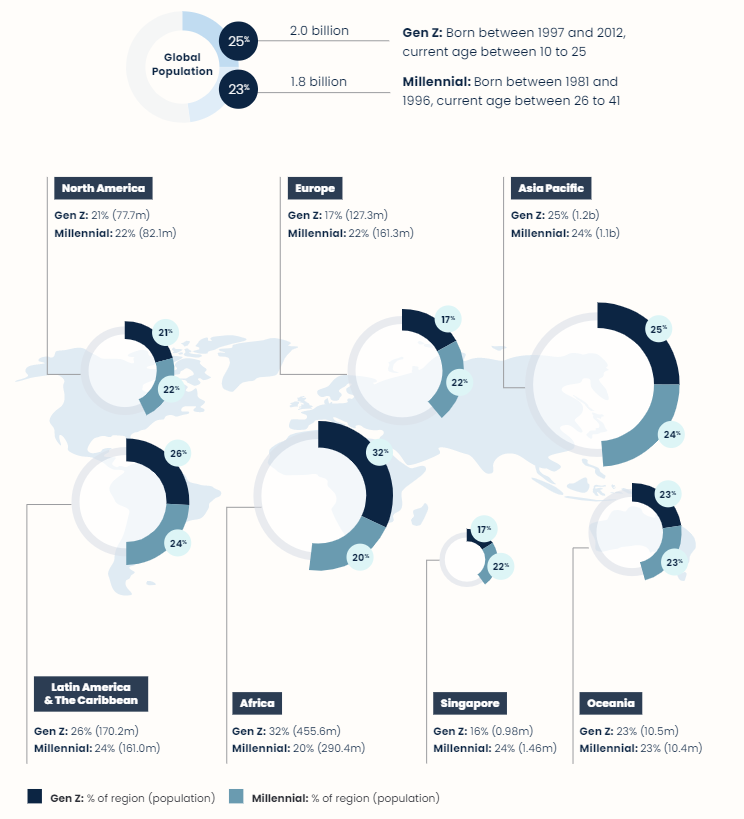

The new generation of wealth comprising both Millennials and Gen Z (Zennial investors) are the top two largest generations, together spanning 3.8 billion and constituting 48% of the global population.

Having grown up with the internet and social media, they are able to arm themselves with knowledge to learn and execute self-directed investment strategies.

As a result of this, these investors also demand more holistic offerings and customisation in their investments.

The human touch remains indispensable

As wealth management becomes increasingly digital, investors have expressed concerns over the lack of a personal touch with their financial advisors.

While digital adoption is reducing cost-to-serve, it has also led to less effective customisation that comes with reduced human interaction.

Surprisingly, a larger proportion of Millennials (67%) prefer to maintain the human touch when it comes to advisory services despite being digital natives with a penchant for experimenting with new wealth platforms.

The report finds that 72% of investors prefer to retain the human touch when it comes to advisory services, consisting of advisor-led relationships (35%) and hybrid (a combination of both digital and physical) relationships (37%).

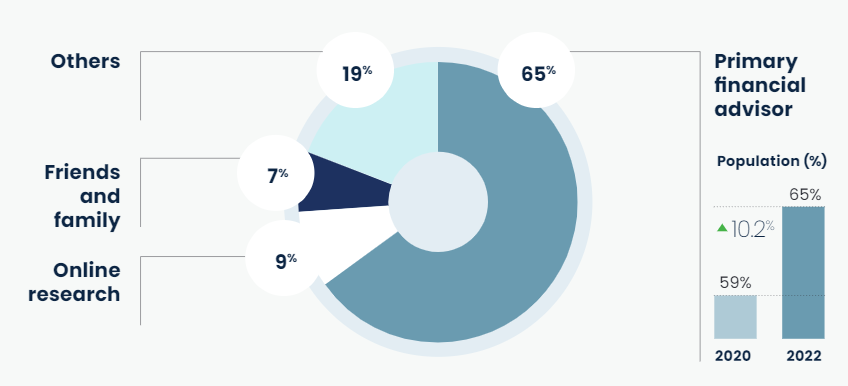

Most trusted sources of investment advice in 2022

Honing the craft of advisory

According to the report, retail investors already in an advisor relationship showed strong confidence in the value they are receiving from their advisors.

Investors say that “trust that their advisors will act in their best interests”, is the top attribute for selecting a wealth management provider (34%).

This is followed by the ability to achieve high returns (21%), their commitment to ethical conduct (15%) and whether they were a trusted recommendation (15%).

Fees were the least important consideration (7%) suggesting that investors are willing to engage advisors.

The report also revealed that investors are more likely to engage advisors during major life events, such as starting a new business (61%), buying a home (60%), or inheriting money (59%).

Most trusted sources of investment advice in 2022

Akhil Doegar

Akhil Doegar, Chief Executive Officer, Navigator said,

“While the rate of digital adoption has been increasing, the desire for a greater human touch continues to grow in tandem. Our report validates the value of advisory services as a highly trusted source of advice that will not be easily replaced by self-directed, digital investment options.

These observations bode well for financial advisors, but in order to sustain that competitive edge, they will need to address the critical blind spots to truly enhance client value propositions.”

Han Wee Tan

Han Wee Tan, Partner, Ernst & Young Advisory said,

“Financial advisors play important and diverse roles in their investors’ life: as a consultant across life milestones; a confidant during good and bad times; and a sentinel safeguarding them against emotional investment decisions.

Advisory requires dedication, hard work and communication to earn not just superior returns but, importantly, the trust of investors.”