This year has been a tough one for the crypto industry. From Bitcoin’s wild price swings to the implosion of major exchanges, it’s been a rollercoaster ride for investors and enthusiasts alike.

And while there have been some bright spots, such as the launch of Ethereum 2.0 and the rise of DeFi, there have also been plenty of failures.

In the world of cryptocurrencies, there are always winners and losers, with several high-profile failures making headlines. Here, we look at ten of the biggest crypto failures of 2022.

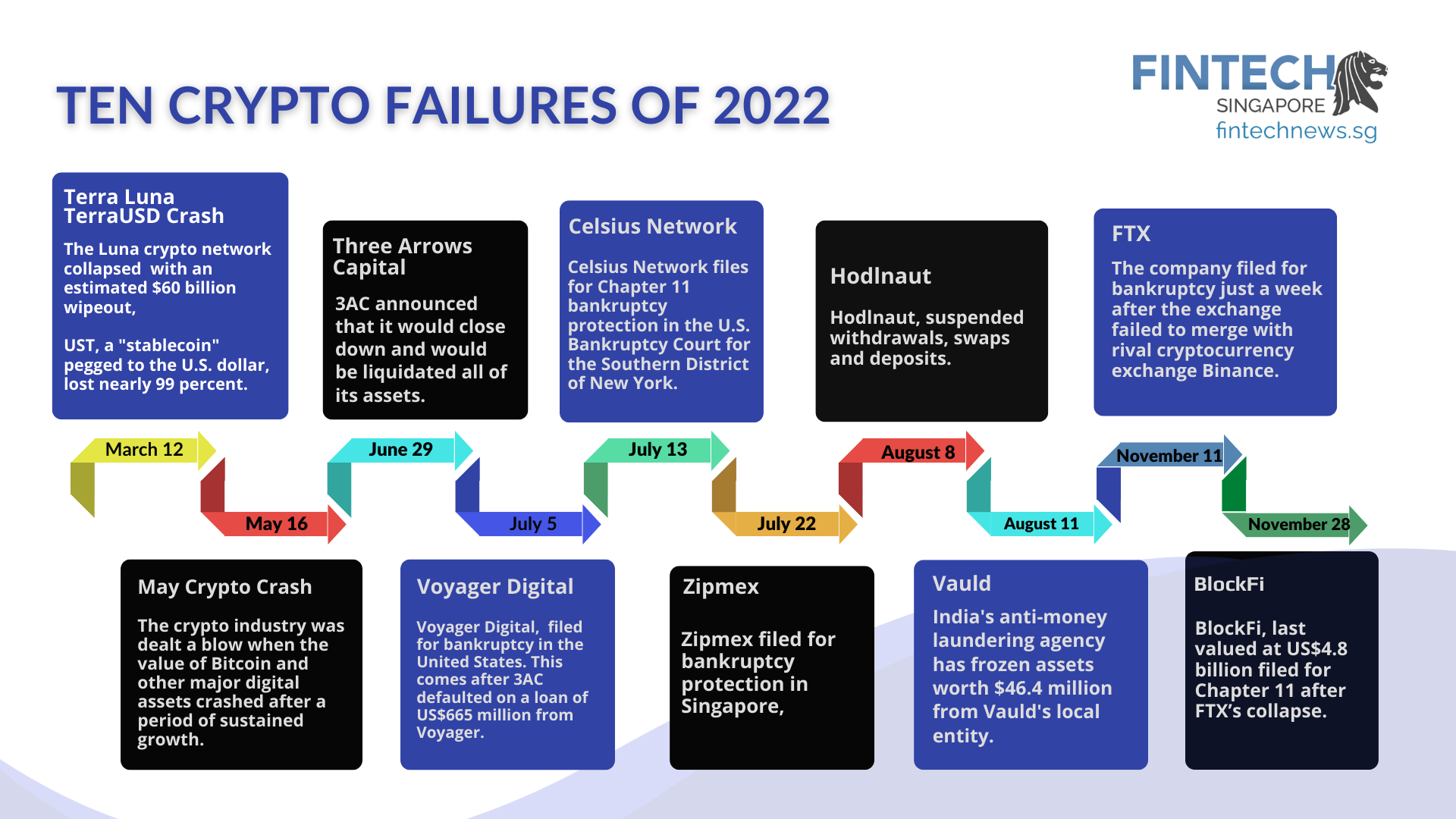

The Terra Luna/TerraUSD Crash

On March 12, 2022, the crypto industry was dealt a major blow when the prices of both Terra Luna (LUNA) and TerraUSD (UST) crashed. LUNA lost over 90 percent of its value in hours, while UST, a “stablecoin” pegged to the U.S. dollar, lost nearly 99 percent.

This event sent shockwaves through the entire cryptocurrency industry, showing that even the most well-funded and popular projects are not immune to major crashes. It also cast doubt on the stability of stablecoins, which are supposed to be the backbone of the crypto industry.

The May 2022 Crash

It is now widely accepted that the May 2022 Crypto crash was inevitable. For years, the crypto industry had been living on borrowed time, propped up by abundant liquidity that was bound to burst eventually. When it did, the consequences were dire.

The crypto industry was dealt a blow when the value of Bitcoin and other major digital assets crashed after a period of sustained growth. The leading cause of the crash was the U.S. Federal Reserve’s decision to increase interest rates. This caused a mass sell-off of crypto assets due to nervous traditional and crypto markets investors.

The sell-off was swift and brutal, with billions of dollars’ worth of value wiped out in hours.

Three Arrows Capital (3AC) founders on the run

Three Arrows Capital (3AC), one of the largest and most established cryptocurrency hedge funds, abruptly announced that it was closing down and would be liquidating all of its assets.

Three Arrows Capital (3AC), one of the largest and most established cryptocurrency hedge funds, abruptly announced that it was closing down and would be liquidating all of its assets.

It owed a whopping US$3.5 billion to 27 companies, including digital broker Voyager. The collapse of cryptocurrencies LUNA and UST in May was the cause of 3AC’s downfall.

The Singapore-based crypto hedge fund was founded in 2012 by Kyle Davies and Su Zhu, and the company was one of the first major institutional investors in the cryptocurrency market. It quickly became one of the most significant players in the space.

However, the company’s founders have been accused of fraud and mismanagement, with the company filing for Chapter 15 bankruptcy on July 1.

Liquidation of Voyager Digital

In July Voyager Digital, a crypto lender, has filed for bankruptcy in the United States. This comes after 3AC defaulted on a loan of US$665 million from Voyager.

Although the company reached an agreement in September to sell its assets for US$1.4 billion in crypto to FTX; it fell through following FTX’s implosion

However, Binance.US one of the world’s biggest crypto exchanges has entered an agreement to acquire the assets of Voyager and will make a US$10 million deposit as well as reimburse bankrupt Voyager “for certain expenses up to a maximum of US$15 million.”

Celsius Network closing its doors

Once one of the most popular cryptocurrency lending platforms, Celsius filed for bankruptcy after a series of unfortunate events forced it to close its doors.

Celsius faced significant financial issues and could not meet customer withdrawal requests, and was placing customer deposits into high-risk investments. In addition, the company has been accused of mistreating customers, violating customer privacy, and spending lavishly on a new bitcoin mining operation.

The company started having problems when it suddenly paused all withdrawals in June 2022, meaning users couldn’t move their funds elsewhere. Then, the platform filed for bankruptcy in mid-2022 after letting go of over 20 percent of its workforce.

Meanwhile, it is seeking to seeking to claw back US$7.7 million from the estate of rival Voyager Digital.

FTX Crashed and Burned

When crypto implodes, it does so with style. And in late 2022, no implosion was more spectacular than the one that took down FTX. The company was founded by Sam Bankman-Fried, also the exchange’s CEO. FTX was one of the most popular exchanges, with more than a million users, and started the year with a US$32 billion valuation.

There were allegations that Bankman-Fried funneled customer deposits to FTX’s affiliated trading firm Alameda Research, causing the exchange to see withdrawals from investors of about US$6 billion in just 72 hours.

However, in November, the company filed for bankruptcy just a week after the exchange failed to merge with rival cryptocurrency exchange Binance.

Bankman-Fried and a list of celebrities who endorsed FTX are also facing a class-action lawsuit in Florida.

BlockFi bankruptcy

According to PitchBook, BlockFi, last valued at US$4.8 billion, was the latest casualty to file for Chapter 11 after FTX’s collapse.

According to PitchBook, BlockFi, last valued at US$4.8 billion, was the latest casualty to file for Chapter 11 after FTX’s collapse.

The Crypto lender depended on FTX for a US$400 million credit facility to stay afloat. The company also indicated more than 100,000 creditors, with liabilities and assets ranging from US$1 billion to US$10 billion.

Hodlnaut probed for cheating and fraud

Hodlnaut has been badly affected by the contagion of the Terra crisis. The Singaporean cryptocurrency lending and borrowing platform became the latest casualty in the cryptocurrency industry, as it suspended withdrawals, swaps, and deposits. The company also withdrew its application for a licence from the Monetary Authority of Singapore (MAS) to provide digital token payment services.

The Commercial Affairs Department (CAD) has also launched a probe into the crypto lender for possible cheating and fraud. This is a blow to the cryptocurrency industry, which is already under stress.

Vauld mired in controversy

Vauld has been mired in controversy. The India registered Singapore-based company has been accused of facilitating “crime-derived” proceeds from predatory lending firms. As a result, India’s anti-money laundering agency has frozen assets worth US$46.4 million from Vauld’s local entity in August.

Vauld also suspended its customers from withdrawing, trading, and depositing on its eponymous platform last month, recently filed for bankruptcy, and reportedly owed creditors US$363 million.

Zipmex filed for bankruptcy protection

Zipmex, is expected to be acquired by a venture capital firm for about US$100 million. The move comes as the company filed for bankruptcy protection in Singapore, becoming the latest victim of the global downturn in digital currencies.

The Jump Capital-backed firm had to halt withdrawals in July under the strain of a liquidity crunch that has gripped the industry as it was working to address its exposure of US$53 million to crypto lenders Babel Finance and Celsius. It resumed withdrawals a day after.

In August, the crypto exchange tapped restructuring and financial consulting firm KordaMentha to oversee its payback scheme.

What’s next in the Crypto World?

The cryptocurrency industry has been through a lot in the past few years. From the massive bull run of 2017 to the bear market of 2018, crypto has seen it all.

And while the industry has made a lot of progress in the past few years, 2022 has been a particularly tumultuous year.

From regulatory issues to hacking scandals, the cryptocurrency industry has had to face a lot of challenges in the past 12 months.

What’s next for crypto? Only time will tell. But one thing is for sure: the world of crypto is never dull.