The Fintech Club of Thailand is an organisation that was founded in March 2016. It draws together companies for the development of fintech in the Kingdom of Thailand, and beyond. It is the main agency for the establishment of the National Sandbox, a test centre for the nationwide development of fintech. This in turn acts as a catalyst for fintech’s further development in industry and as an incubator for today’s entrepreneurs.

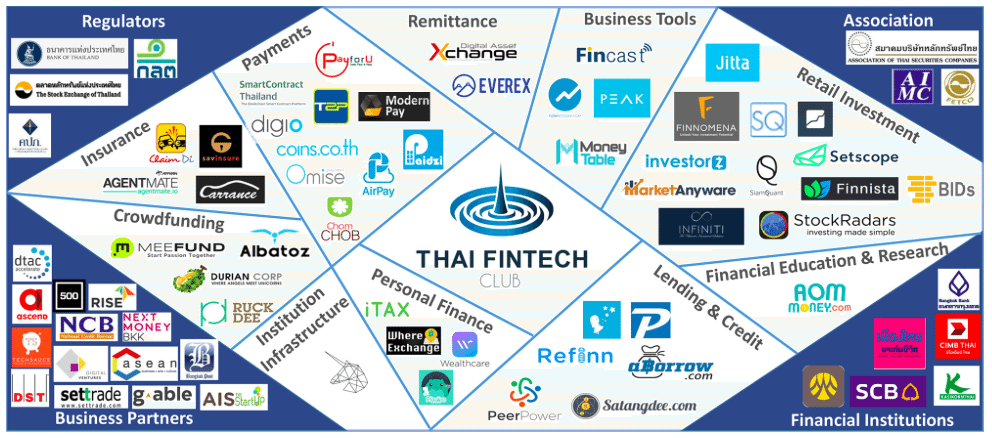

Fintech Ecosystem

This is the number 1 agency for the creation of fintech ecosystem in India. It comprises fintech operators, financial institutions and regulatory agencies, investors, incubators, business partners and more. Fintech Club of Thailand has grown in status as a centre for the coordination of the fintech ecosystem and other agencies of all sectors involved. Through its 96 agencies and organisations, the club aims to act as a hub for the exchange of information on fintech ecosystems, thus optimising the operation of all parties. This of course will drive the country’s progress in the fintech industry.

A Successful Tech Sauce Summit

At the Tech Sauce Summit at the Centara Grand in Central World in the heart of Bangkok in July, Thai small and medium business entrepreneurs gathered to discuss how to move into a more digitally driven business era by bringing together the tech and business communities. The location is ideally placed, close to Makkasan station, where trains from the airport arrive frequently.

Some notable names were in attendance at the event including: Akira Morikawa, CEO of C Channel Corporation and ex-CEO of LINE; Nick Nash, Group President – Garena Online; Dr. Gang Lu, Founder and CEO – TechNode & TechCrunch China; Korn Chatikavanij, Former Minister of Finance – Royal Thai Government; Hao Xu, Co-Founder and CEO – Camera360; and Willson Cuaca, Co-Founder and Managing Partner – East Ventures.

Thailand is developing quickly and working hard to keep pace with the big hitters in fintech in Asia; Singapore and Hong Kong. Serious progress has been seen in categories such as: Mobile Banking Solutions; Wealth Management; SME Banking Solutions; Payments and Collections; Risk Management; Big Data Analytics; and

Customer Experience and Management. The finance Industry is involved in helping to build teams, that understand the needs of start-ups. They create programmes designed for finding new innovations, and are investing in fintech start-ups. With improvements to banking laws and policies, the future looks good.

The Fintech Association of Thailand

Also in July the formation of The Fintech Association of Thailand was announced at the ‘Positioning Thailand’s Fintech Ecosystem’ conference, which was held at C-Asean. The association brings together members from the private, public and financial sectors in order to boost Thailand’s fintech potential. The Thai Government joined private and financial sectors to promote fintech innovation. The event drew huge crowds and an impressive number of speakers.

Dr. Veerathai Santiprabhob, Governor of Bank of Thailand said, “Thailand’s sectors must encourage friendly, collaborative competition in order to advance the country’s fintech growth without fear of cannibalisation. Traditional industries are being disrupted, which means Thailand is moving towards a new phase.” 2016 was the the first year that the Bank of Thailand saw more requests to close down bank branches from commercial banks than to launch new ones. Huge changes are underway.

The conference heard calls for regulators to act more like ‘innovation facilitators’ rather than strict governors. Regulations for fintech needs to be principle based rather than strictly rule based, thus leaving more room for innovation. Bearing this in mind the Bank of Thailand is working with the government to revise many of its financial regulations.

The Thailand Fintech Association is now driving the progress of fintech in Thailand. However, it needs to be mindful of consumer requirements for the challenges that the industry faces, both in regard to infrastructure, and regulations. Together we can all movie forwards towards a cashless society.