SMEs’ Limited Access to Financing is an Untapped Opportunity for Banks

by Fintech News Singapore September 21, 2015In the ASEAN region, Small and Medium-sized Enterprises (SMEs) still have limited access to financing. Despite their critical economic role in countries such as Malaysia, Indonesia, Thailand, the Philippines and Singapore, the segment represents a major untapped opportunity for banks and financial institutions, according to a new report.

In a joint report entitled ‘Digital banking for small and medium-sized enterprises: Improving access to finance for the underserved,’ Deloitte and Visa address the poor financial inclusion of SMEs in the ASEAN region, as well as how new business models offered by challenger banks and fintech startups can address their financial and non-financial needs.

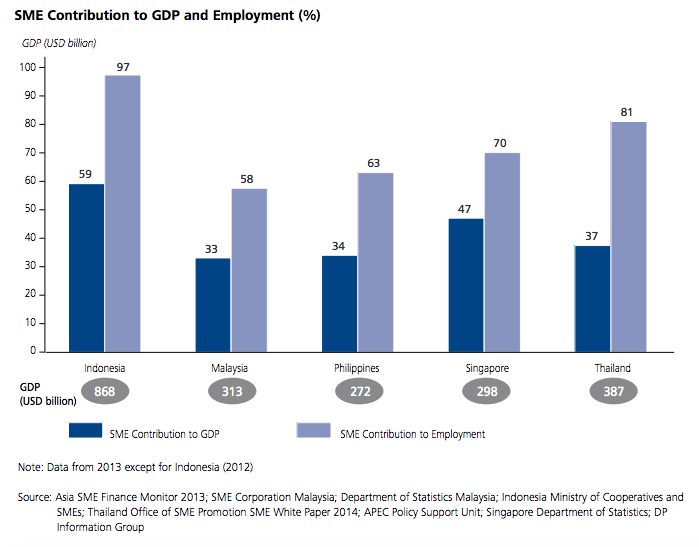

According to the report, SMEs in Malaysia, Indonesia, Thailand, the Philippines and Singapore contribute between 30% and 60% of the countries’ gross domestic product (GDP), while employing between 60% and 90% of the workforce.

SME Contribution to GDP and Employment – Deloitte

Despite their massive economic implication in their respective home countries, these SMEs commonly have financial and non-financial needs that still need to be addressed.

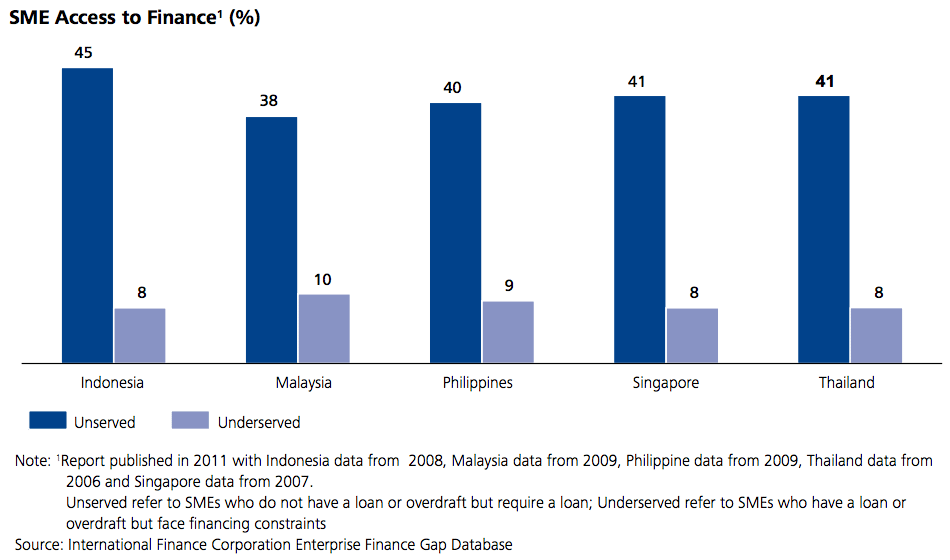

According to the report, less than 60% of SMEs in these countries have access to bank loans and around 50% are unserved or underserved by financial institutions.

SME Access to Finance – Deloitte

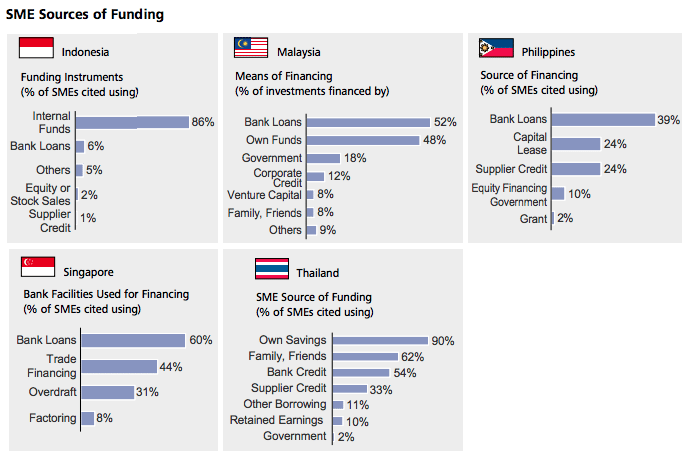

Figures also show that most of SMEs in the ASEAN region still rely solely on their owners’ private funds and savings.

SME Sources of Funding – Deloitte

The ASEAN Economic Community, a plan seeking to establish ASEAN as a single market to increase dynamism and competitiveness, is set to be launched later this year and should considerably increase competition between SMEs in the region, the report says.

As local SMEs will be increasingly exposed to further liberalized trade and investment, operating in a more and more competitive economic environment, they will require better cash flow management, access to external financing as well as more efficient payments system – a windfall for banks and financial institutions.

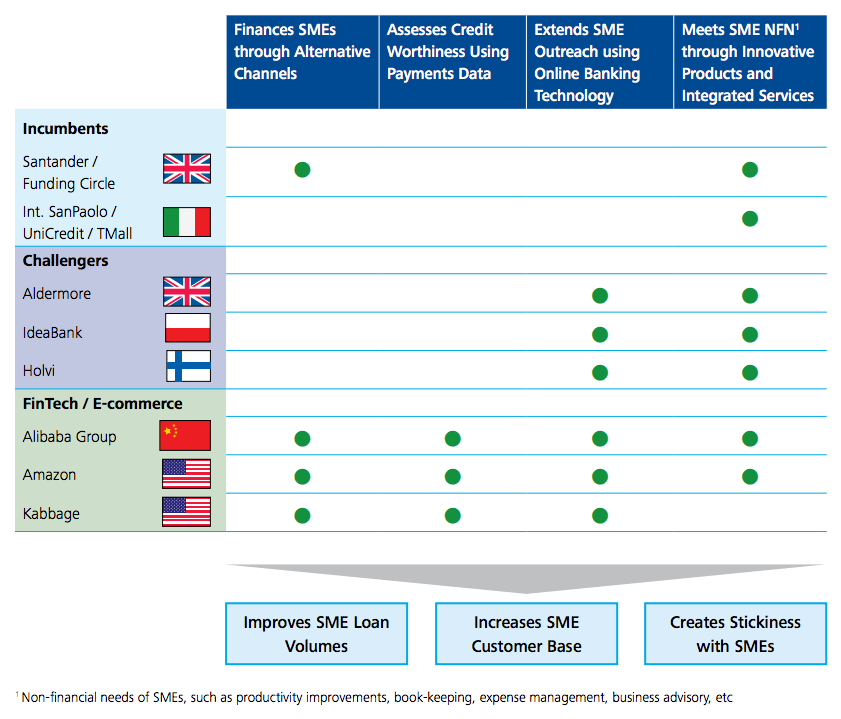

However, although the business opportunity is apparent, these companies have specific needs and constraints. Challenger banks betting on technology-based solutions, as well as fintechs, are more likely to target and engage with this particular market, the report claims.

According to Mohit Mehrotra, Partner at Deloitte:

“With the advent of the digital age, financial institutions in the ASEAN region have to rethink the role banks want to play in the SME banking space to address the financing gap and capitalize on the SME banking opportunity.”

For instance, SMEs can turn to services such as Funding Circle to access alternative funding sources that are not regulated by Basel requirements. Additionally, inadequate distribution channels limit banks from reaching out and servicing SMEs, making these companies more likely to turn to digital banks such as Aldermore.

Incumbents vs. Challengers Banks vs. Fintechs, comparison table – Deloitte

The report says:

“These emerging business models with challenger banks, FinTechs and e-commerce providers include benefits such as improved cash flow visibility and the convenience of an integrated purchasing order, e-invoicing and e-payments solutions. They help SMEs establish an e-commerce presence.”

In order to tap into this massive market opportunity, incumbent banks need to leverage on digital solutions providers and form strategic partnerships with key innovators.

Deloitte advises governments, policymakers and regulators to “work in tandem to encourage an innovation-friendly business climate which encourages collaboration.”

It concluded:

“If captured effectively and responsibly, the benefits to banks, SMEs, national economy and society will be immense.”

Read the full report: https://www2.deloitte.com/content/dam/Deloitte/sg/Documents/financial-services/sea-fsi-digital-banking-small-medium-enterprises-noexp.pdf

Image credit: Pixabay.