Sea’s MariBank Now Available to the Public on an Invite-Only Basis

by Fintech News Singapore March 14, 2023MariBank, a digital bank licensed by the Monetary Authority of Singapore (MAS) and wholly-owned subsidiary of Sea, is now available to the public on an invite-only basis as it is in the midst of rolling out its services progressively.

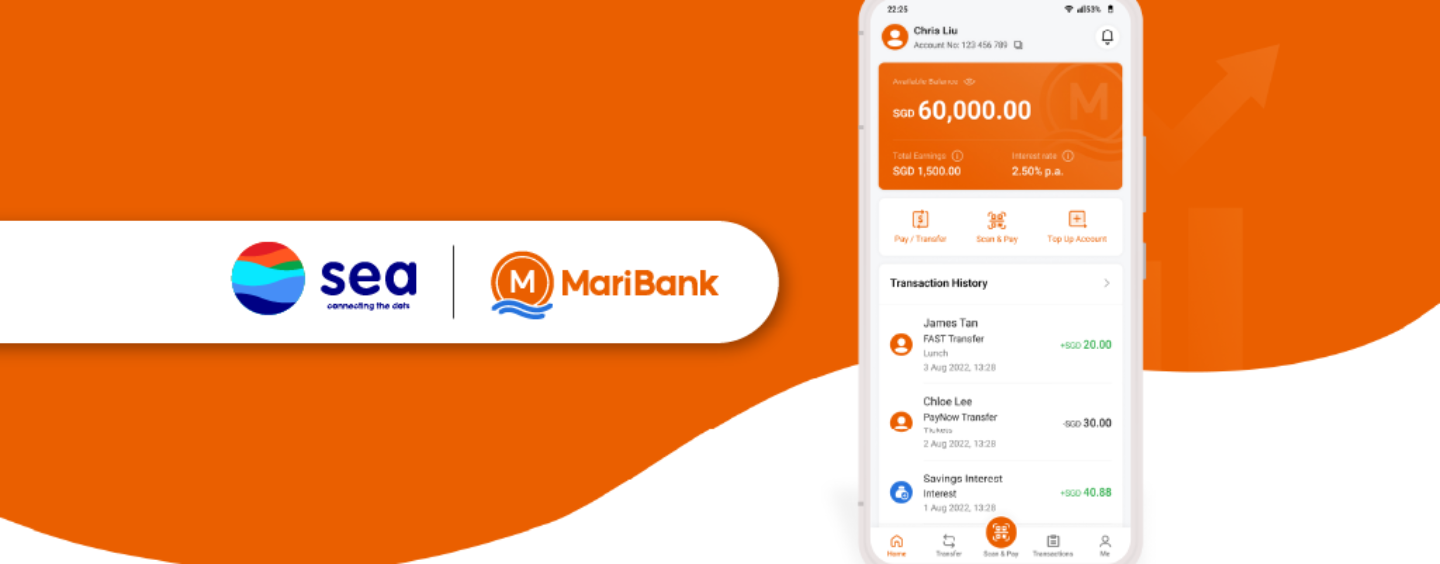

Interested parties who have received the invite from the digital bank can set up a Mari Savings account by downloading the app from Apple App Store, Google Play Store, or Huawei AppGallery.

The Mari Savings account offers 2.5% p.a. interest earnings credited to the user’s account daily which does not require any minimum deposit, salary credit requirement or minimum spend amount. The earnings calculated based on the user’s previous day’s balance.

Users will need a valid Singapore mobile number to be able to open a Mari Savings Account digitally with Singpass Myinfo. According to MariBank, the applications will be processed instantly or otherwise within 1 working day.

Additionally, customers will also be able to send and receive money instantly with PayNow. They will also be able to make payments at stores which accept PayNow QR codes.

MariBank is already a member of the Credit Bureau Singapore (CBS) and is required inter alia to submit consumer data related to credit reporting to the bureau.

This will enable the bank to monitor its credit risk exposure more effectively once it begins the roll out of its lending services.

MariBank is among the two full digital banks besides Grab and Singtel’s GXS Bank. The regulator had also doled out two digital wholesale licenses to Ant Group’s ANEXT Bank and Green Link Digital Bank.

Trust Bank, a partnership between Standard Chartered and FairPrice Group, operates under the incumbent bank’s Significantly Rooted Foreign Bank (SFRB) categorisation.

MariBank is the latest digital bank to launch its services in Singapore.