Singapore Fintech Festival Round Up: Key Announcements And Partnerships; All you have to Know

by Fintech News Singapore November 21, 2016The inaugural Singapore Fintech Festival, a week-long event organized by the Monetary Authority of Singapore (MAS) in partnership with The Association of Banks in Singapore (ABS), was one of the biggest fintech events ever organized, drawing over 10,000 participants from more than 50 countries.

Singapore’s “Smart Financial Centre”

The event was the opportunity for Singapore to further demonstrate its commitment to fintech and underline MAS’s ambition to create a “Smart Financial Centre” where the pervasive use of technology would allow to increase efficiency, manage risks better, create new opportunity and “improve people’s lives.”

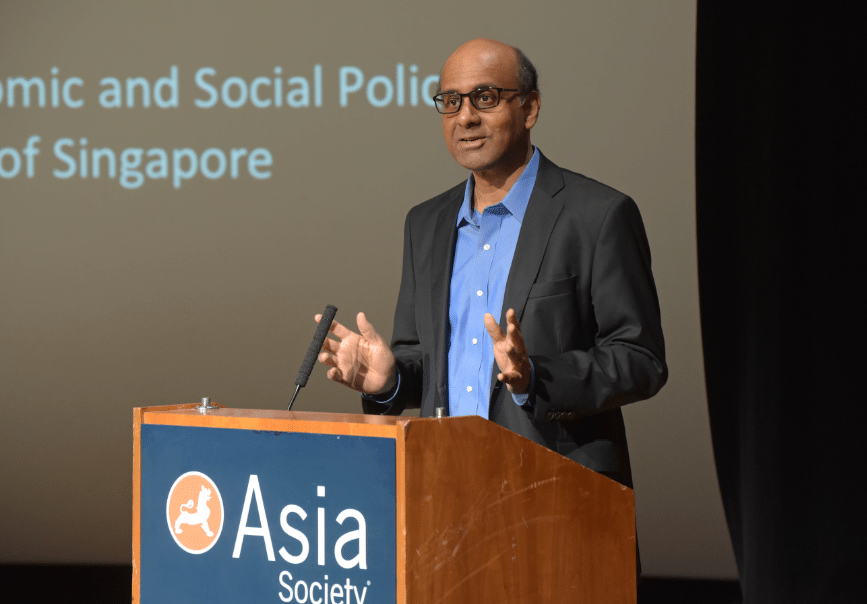

Ravi Menon, Managing Director of MAS

“Last year, MAS laid out a vision for a Smart Financial Centre, where innovation is pervasive and technology is used widely,” Ravi Menon, managing director at MAS told the audience during a speech at the event on November 16, 2016. “Since then, MAS has been working closely with the financial industry, FinTech start-ups, the institutes of higher learning and other stakeholders towards this shared vision.”

“MAS has committed to support this fintech journey in two-fold: by providing regulation conducive to innovation while fostering safety and security, and by facilitating infrastructure for an innovation ecosystem and adoption of new technologies,” Menon said.

S$200,000 for Proof of Concepts

This includes for instance the introduction of activity-based regulation, specific guidelines to promote secure cloud computing, enabling digital financial advice and insurance, a regulatory sandbox to innovative ideas, and strengthening cybersecurity.

MAS has also set up a number of government support schemes for fintech players and startups. On November 17 at the Fintech Awards ceremony, Tharman Shanmugaratnam, deputy prime minister and chairman of MAS, said that the central bank will provide “strong support” for proof-of-concept trials. Notably, MAS will fund 50% of the costs, up to a maximum of S$200,000 per project, for Singapore-based trials of promising fintech ideas.

Shanmugaratnam said that the grant is aimed at “ideas that can benefit not just an individual financial institution or start-up, but the financial system at large, in Singapore or abroad.”

DBS Bank launches innovation space

The Singapore Fintech Festival was also the opportunity for top tech firms, banks and governmental agencies to announce some of their latest initiatives in the fintech area. Notably, DBS Bank launched DBS Asia X, a 16,000 square feet innovation space dedicated to “designing iconic customer experiences” and fostering greater collaboration with the fintech startup community.

DBS Bank’s CEO Piyush Gupta said that the initiative underscored the bank’s ongoing commitment to “shaping the future of banking and embracing the future of work.”

DBS Bank’s CEO Piyush Gupta said that the initiative underscored the bank’s ongoing commitment to “shaping the future of banking and embracing the future of work.”

“It is a purpose built facility for DBS employees from all over the region to come together (…) We look towards helping to further Singapore’s Smart Nation agenda as we transform DBS into a 22,000 person startup,” Gupta said.

Welcome to our new innovation space, DBS Asia X! Learn more at https://t.co/Y4hz1XpjKB #DBSInnovates #DAXlaunch #SGFinTechFest pic.twitter.com/PkJ2wm13vC

— DBS Bank (@dbsbank) November 15, 2016

MAS joins R3-led blockchain initiative

MAS unveiled that it has joined R3 and its consortium of financial institutions on a proof-of-concept project to conduct interbank payments using blockchain technology. The project aims at developing a payment system for participants to transact in different global markets round-the-clock, and will provide guidance on future projects such as cross-border payments, automation of securities issuance, trading and settlement using blockchain technology.

Tim Grant, CEO of R3’s lab and research center said:

“Payments and the representation of fiat currency on blockchains is a potentially significant use case for distributed ledger technology and we firmly believe that partnership between regulators, central banks and the financial services sector will accelerate solutions to maturity.”

IBM teams up with KYCK! for new blockchain project

Ashley Loo, co-founder of KYCK!, IBM Innovation Lab Crawl, via @IBMSingapore, Twitter

Another blockchain-related project that was unveiled last week was the partnership between IBM and Singaporean startup KYCK! to use blockchain technology to enhance the customer on-boarding process for financial services providers.

The new system seeks to leverage the technology to streamline operations and provide a one-time process with secure data protection and enhanced identity verification.

Fintech Asia 100 revealed

The opening networking event of the Singapore Fintech Festival on November 14, included the unveiling of the Fintech Asia 100 list which recognizes this year’s top 100 fintech movers and shakers. The Fintech Asia 100 is compiled by Next Money, in partnership with EY and supported by Visa.

This year’s Fintech Asia 100 includes Mikaal Abdulla, CEO of 8 Securities, Yu-Shin Jeong, chairman of Korea’s Fintech Center, Jayne Chan, head of StartmeupHK of InvestHK, Janos Barberis, founder of Fintech HK, Richard Eldridge, CEO of Lenddo, Simon Loong, founder of WeLab, Mikko Perez, founder and CEO of Ayannah, and Ericson Chan, head of Ping An Technology of Ping An Group, among others.

Fintech Awards winners pocket S$1.15 million in prize money

On November 17, MAS and ABS announced the ten winners of the inaugural Fintech Awards, an event organized as part of the Singapore Fintech Festival that recognizes top innovative fintech solutions that have been implemented by startups, financial institutions and tech companies.

Fintech Awards Night, Singapore Fintech Festival 2016, via @Anjupatwardhan, Twitter

The ten awardees are BioCatch, Fastacash, M-DAQ, Pole Star Space Applications, Tookitaki, Turnkey Lender, Funding Societies, CashRun, Aimazing and FinChat Technology.

FitSense, AIDA Technologies and Beacon Interface win Global Fintech Hackcelerator competition

Alongside the Fintech Awards, which rewarded the ten startups with a total of S$1.15 million in prize money, the Global Fintech Hackcelerator granted FitSense, AIDA Technologies and Beacon Interface a cash prize of S$50,000 each for the technology solutions they presented at the Demo Day.

The Global Fintech Hackcelerator aimed at solving 100 problem statements solicited from the financial services industry covering topics such as KYC/identity authentication, customer engagement, payments and portfolio management.

Fintechnews.sg was an official community/media partner for the event.

Featured image: Singapore Fintech Festival 2016, by @MAS_sg via Twitter.