Gen Z are Avid Investors and Largely Influenced by Social Media, New Research Found

by Fintech News Singapore March 28, 2023Members of Generation Z (Gen Z), or those born between 1997 and 2012, are avid investors, participating in stock and cryptocurrency investing at a higher rate and from a younger age than their predecessors, a new report by the Oliver Wyman Forum and social-first media company The News Movement says.

Compared with millennials, or those born between 1981 and 1996, Gen Zers were found to be 45% more likely to start investing by age 21, according to a research from Oliver Wyman and Zeldis Research Associates. This result continues a pattern in which each generation is found to be investing more by population and money than the previous generation.

Gen Zers were also found to be the main driver of the ongoing demographic shift towards greater gender and racial diversity in the investing landscape. Twenty years ago, about 36% of white households in the US reported owning stocks, compared with less than 10% of black and Hispanic households, according to a 2000 study by the US Social Security Administration. Today, the Oliver Wyman Forum/The News Movement report claims the investing cohort of Gen Z investors in the US and the UK has 60% more black and Asian representation.

Broader participation can also be observed for alternative investments, where black and Hispanic Gen Zers in the US were found to be 1.7 and 1.4 times more likely, respectively, to invest in crypto than their older counterparts. Similarly, women now make up for half of Gen Z crypto investors, compared with only 37% in older generations.

Findings from the Oliver Wyman Forum/The News Movement research are consistent with those of other recent studies. A 2022 survey conducted by American financial and investing advice company The Motley Fool, polled 1,200 investors and found that Gen Z and millennial investors were more likely than previous generations to own stock options (30% for Gen Z and millennial investors versus 18% for previous generations) and crypto (59% versus 48%, respectively).

Influenced by social media

The Oliver Wyman Forum/The News Movement report also notes that, compared with other generations, Gen Zers were more likely to cite social media as the impetus for investing, showcasing the power of social media in influencing decision making.

Nearly half of Gen Zers said they learnt investing basics and about a third learn advanced financial strategies via social media, and 30% reported buying stocks recommended by social media investing communities such as those found on Reddit.

According to the report, this can be problematic because, while social media is a treasure trove of entertainment, connection, and information, differentiating good advice from bad advice on the Internet can be challenging. A testament of that is that nearly half of the Gen Zers who reported having taken stock recommendations from social media said they lost money or were negatively impacted.

This ecosystem is ripe for innovation, the report says, especially considering that many leading banks in the US and the UK are either not present or not engaging on popular social media platforms like TikTok.

Trust in traditional financial institutions high among Gen Zers

Despite being avid adopters of new digital financial services, Gen Zers also value traditional financial institutions, with nearly half stating that they “trust banks to look after my long-term financial wellbeing.” That’s almost as many as older generations and shows that regardless of generations, consumers are still confident established banking incumbents have their best interests at heart.

Additionally, findings from the research show that bank branches remain of relevance, even for younger customers who mostly use digital channels. More than 40% of Gen Zers polled said that “physical bank branches are important to me – they provide a sense of assurance and peace of mind.”

A separate study conducted in 2021 by Deloitte shared similar findings with 56% of Gen Z consumers indicating preferring to visit branches when opening a new checking account.

Different preferences

Gen Zers represent 25% of the world’s population and US$7 trillion or more in purchasing influence. They represent a considerable market but have very different preferences than their older counterparts.

For example, Gen Zers and millennials are more likely to use digital banks, although the majority still use traditional ones for primary bank accounts. A 2021 retail payments analysis survey by Oliver Wyman showed that 21% of people age 18 to 24 used digital banks, compared with only 3% of those in the 55-64 age group.

Younger generations also diverge from older ones in the payment methods they prefer. For instance, they have a much lower tendency to use credit cards but are more willing to use alternative payments, including buy now, pay later (BNPL) arrangements, crypto and super apps.

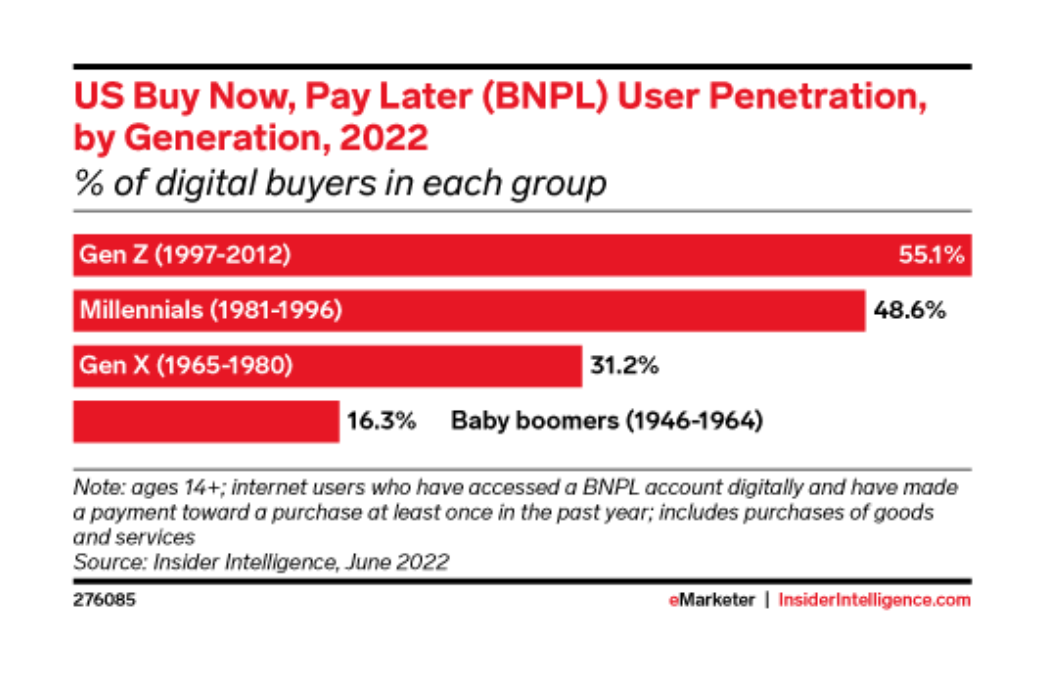

According to the Oliver Wyman study, Gen Z usage of store credit cards was only 27% in 2021, compared with 48% for Baby Boomers, or those born from 1946 to 1964. In the US, 55.1% of Gen Z digital buyers aged 14 and older used a BNPL service at least once in 2022, making this generation the biggest adopter of BNPL arrangements, data from market research company Insider Intelligence show. In comparison, US BNPL user penetration stood at 48.6% for millennial digital buyers, and at 16.3% for Baby Boomers.

US BNPL user penetration by generation, 2022, Source: Insider Intelligence, 2022

Featured image credit: edited from Freepik