Singapore P2B Invoice Financing Platform SmartFunding Secures Seed Funding

by Fintech News Singapore November 28, 2016SmartFunding, a platform that provides small and medium businesses (SMEs) alternative financing solutions, secures SG$700,000 in seed funding.

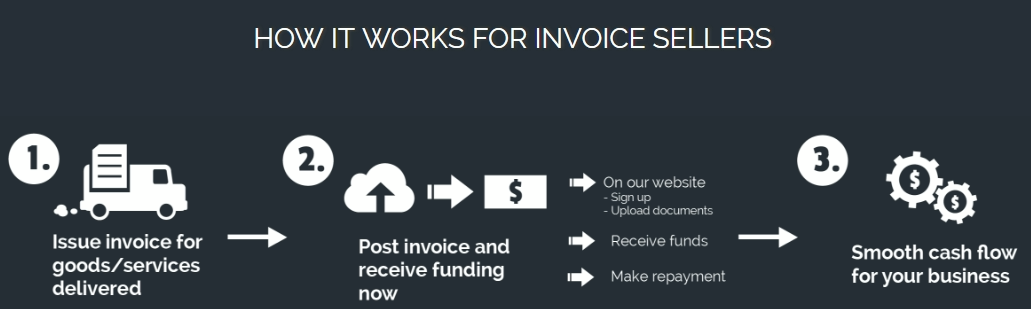

The Peer-to-Business invoice financing platform bridges the SME funding gap by allowing SMEs to sell their yet-to-be-paid invoices to investors who want to purchase future cash flows. SmartFunding aims to deliver strong returns to investors looking to invest in online invoice financing, while finding more funding options for SMEs in Southeast Asia to help support their growth potential.

Driven by this two-pronged objective, SmartFunding acts as a neutral and reliable platform that match-makes SMEs with investors, who stand to make high returns of between 1.7% and 2.5% a month, or 20% – 30% return a year by purchasing invoices sold by SMEs on the SmartFunding platform. As an innovative fintech platform, SmartFunding’s role involves:

• Sourcing for investors

• Credit assessment of Invoice Sellers and Invoice Debtors (those to whom the unpaid invoice was issued)

• Legal servicing and facilitation of transactions

• Fund disbursement and monthly payments collection

• Bad debt resolution

This round of seed funding is led by Fintech Asia Group, a member company of the Australia-listed venture builder Fatfish Internet Group (ASX: FFG), and strategic investor Investorlend, a licensed investment firm in Australia specialising in safe, secured and innovative lending solutions.

SmartFunding is run by experienced professionals from the fintech and fund management industries across various international markets. Their Chief Technology Officer, whose extensive experience includes working with the world’s biggest peer-to-peer lending platform Lending Club as well as the Chinese version of it Dianrong, Diego Rojas explained that “their vision is to provide the best-of-breed technology and operational practices that meet the needs of SMEs and investors”.

“At SmartFunding, we want Singapore’s SMEs to benefit from a flexible way to improve their cash flow. We look forward to working closely with our invoice sellers and investors to ensure that our platform is aligned with the interests of both parties, where risks are credibly managed and transparency is upheld,” said Sandra Ernst, CEO, SmartFunding.

The SmartFunding platform is now live and those interested in joining as Investors can sign up at www.smartfunding.sg. In addition to P2B invoice financing, SmartFunding aims to roll out other innovative Fintech products in the near future.