In 2022, usage of digital wallets and account-to-account (A2A) payments continued to grow in Asia-Pacific (APAC), carrying on a trend that was accelerated by the COVID-19 pandemic and the expansion of real-time payment systems, a new report by global financial technology leader FIS says.

Consumers eagerly embraced alternative credit products, including buy now, pay later (BNPL) arrangements and point-of-sale (POS) financing, showcasing a broadening of consumer credit demand.

At the other end of the spectrum, usage of cash continued to decline, encouraged by cashless policies and governments’ efforts.

These are the main findings drawn from this year’s Worldpay from FIS Global Payments Report. The report, which examines how consumers paid in 2022 both in-store and online across 40 global markets, shares key payment trends, and projects future scenarios for payment method shares as well as market size, reveals several major trends emerging in APAC, including the rise of digital wallets, increased BNPL adoption and a boom in real-time payment usage.

Digital wallets growing fast across APAC

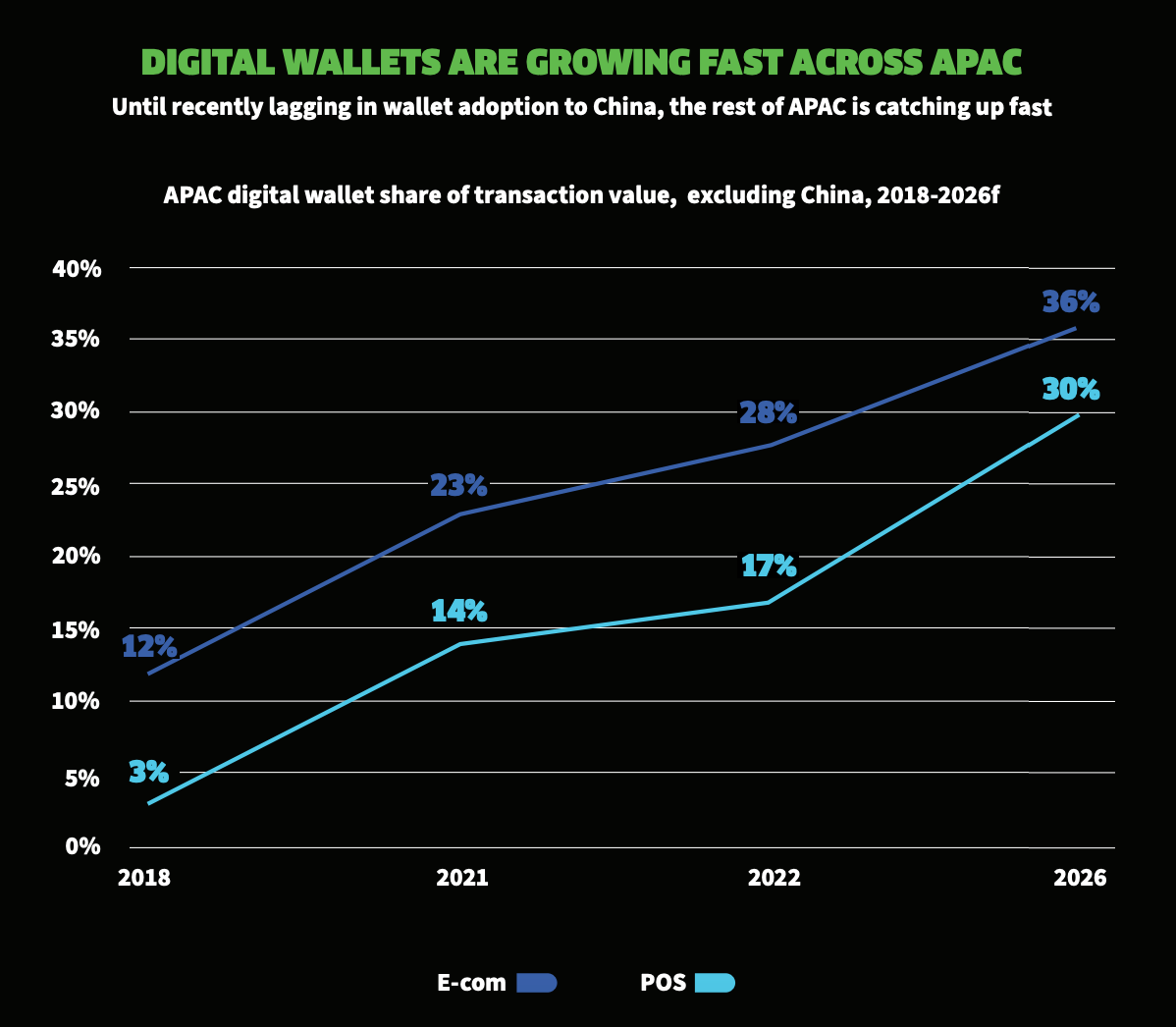

China has historically been the region’s leader in digital wallet usage but results from the FIS research show that the rest of APAC is rapidly catching up.

Between 2018 and 2023, digital wallets in APAC (excluding China) more than doubled their share of e-commerce transaction value, and saw their share of payment transaction value at point-of-sale (POS) grow sixfold.

Last year, digital wallets were the favored payment method for e-commerce transactions in five of the 14 APAC markets covered in the report, namely China, India, Indonesia, the Philippines and Vietnam.

Moving forward, FIS expects digital wallets to continue their growth in APAC, rising from making up for just 12% of e-commerce transaction value in 2018 to 36% by 2026, and from accounting for a mere 3% of POS transaction value to 30% by 2026.

APAC digital wallet share of transaction value, excluding China, 2018-2026f, Source: The Worldpay from FIS Global Payments Report 2023, March 2023

China remained APAC’s biggest digital wallet user in 2022, with wallets accounting for a remarkable 81% of e-commerce transaction value and 56% of POS transaction value.

In India, while cash was dominant just a few years ago, accounting for 71% of POS transaction value in 2019, the pandemic and the huge concurrent success of the United Payments Interface (UPI), the country’s real-time payment system, have shifted consumer habits towards digital payments. In 2022, digital wallets accounted for 50% of e-commerce transaction value and 35% of POS transaction value.

Following global trends, Indonesia too has seen the majority of cash’s share shift to digital wallets. Accounting for just 6% of POS transaction value in 2019, wallets transacted 28% of POS value in 2022. Last year, they were the leading payment method in the e-commerce market, garnering 39% of total transaction value. This remarkable growth is showing no signs of slowing down as digital wallet transaction values are projected to grow at a 22% CAGR at POS and at a 21% CAGR in e-commerce through 2026.

India and Southeast Asia to lead APAC e-commerce surge

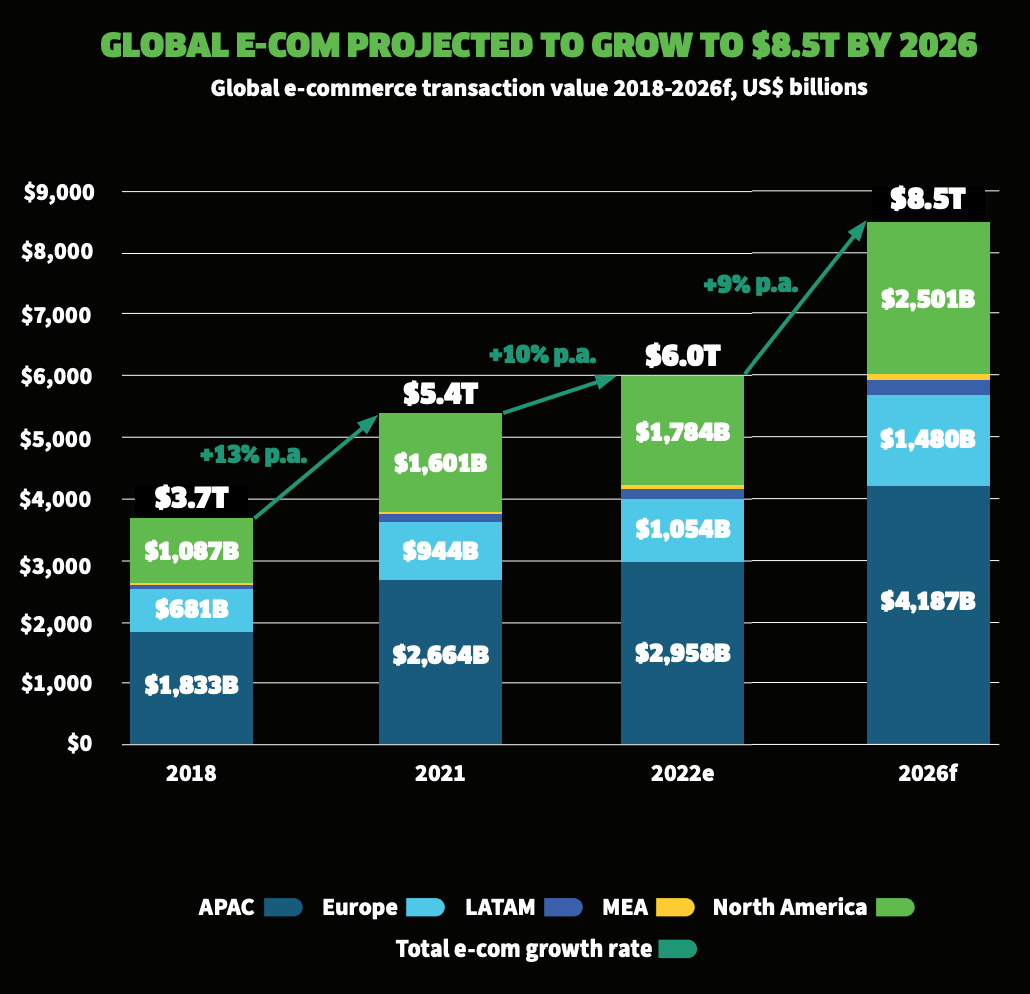

In 2022, APAC remained the world’s biggest e-commerce market, totaling nearly US$4.2 trillion in total transaction value and making up for almost half of the global e-commerce market. The figure represents a 41.5% increase from 2021’s total of US$3 trillion and showcases the rapid growth e-commerce has witnessed in the region over the past year.

Global e-commerce transaction value 2018-2026f, US$ billions, Source: The Worldpay from FIS Global Payments Report 2023, March 2023

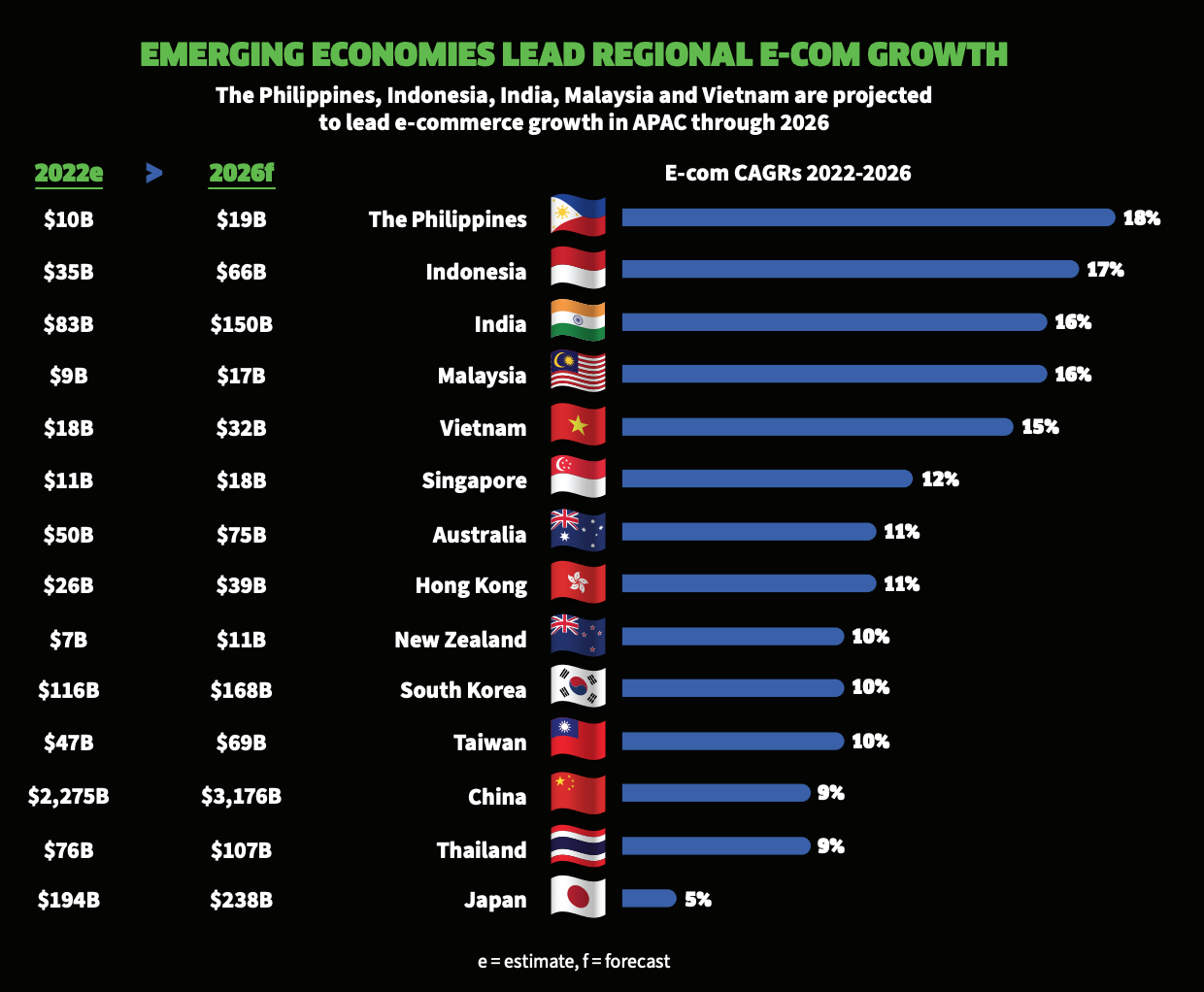

In APAC, Southeast Asia and India are expected to see the region’s strongest e-commerce growth through 2026, with the Philippines (18%), Indonesia (17%), India (16%), Malaysia (16%) and Vietnam (15%) recording the biggest annual growth rates.

E-commerce compound annual growth rates (CAGRs) 2022-2026, Source: The Worldpay from FIS Global Payments Report 2023, March 2023

BNPL arrangements gain popularity for e-commerce transactions

Like in other regions, APAC continued to see increased usage of BNPL arrangements in 2022, a trend that’s been driven by favorable market factors including low credit card penetration and the large population of unbanked.

Across the region, Australia was the biggest adopter of BNPL in 2022, with BNPL arrangements accounting for 14% of e-commerce transaction value, the highest in APAC. Australia also led the way in POS financing, with BNPL accounting for 7% of POS transaction value in 2022.

New Zealand ranked second in BNPL adoption with BNPL arrangements accounting for 10% of e-commerce transaction value and 2% of in-store spending in 2022.

In Southeast Asia, Singapore recorded the highest usage of BNPL arrangements and were used for 5% of all e-commerce spend in 2022.

China, India and Indonesia followed suit, with BNPL making up for 4% of all e-commerce transaction value in these respective markets in 2022.

China’s BNPL sector is led by Internet leaders including Ant Group, JD Finance and Tencent. India has an emerging BNPL market comprising both local and global brands such as Flipkart Pay Later, Amazon Pay Later, Paytm Postpaid, ePayLater and ZestMoney. And Indonesia’s crowded BNPL market features an impressive roster of local providers, including Akulaku, GoPayLater, Kredivo and Traveloka PayLater, as well as SPayLater from Singaporean e-commerce company Shopee and Singaporean BNPL provider Atome, the report says.

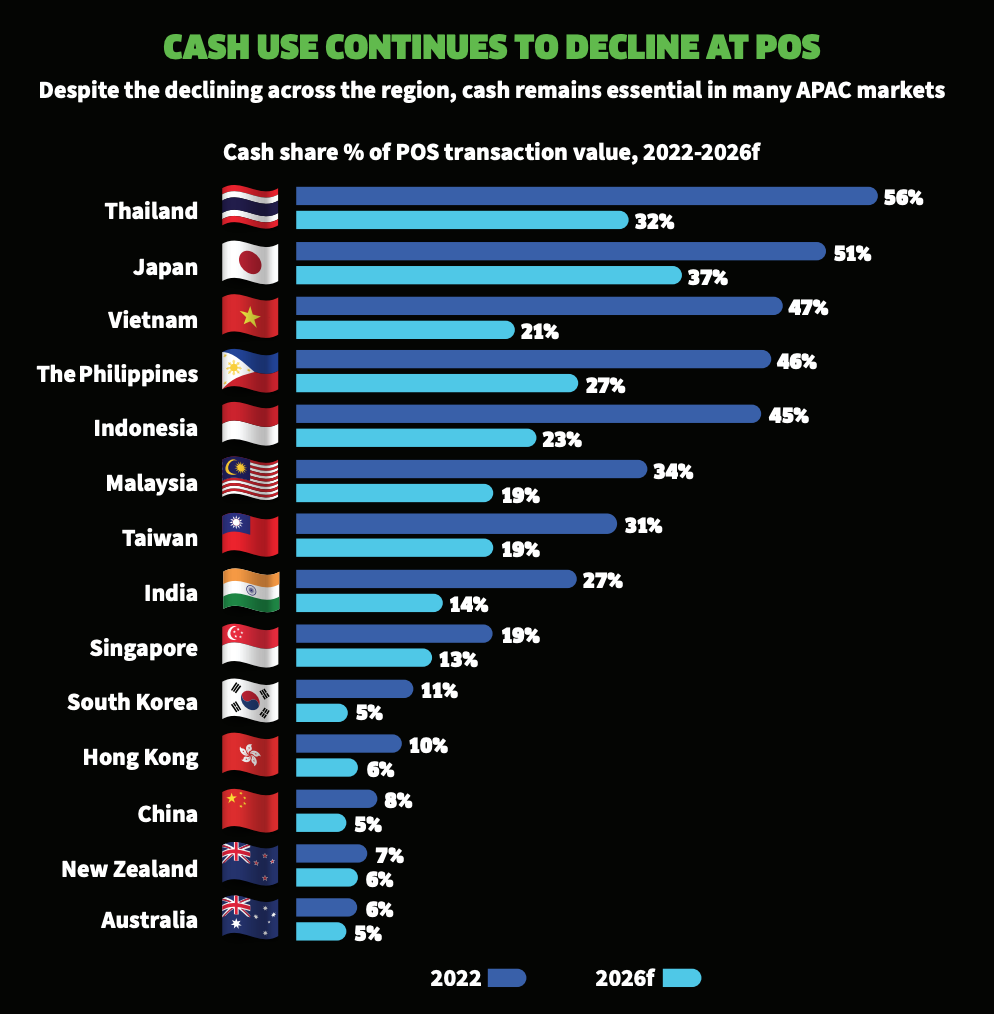

Cash usage at POS continues to decline

Usage of cash in APAC continued to decline in 2022, carrying on a trend that was accelerated by the COVID-19 pandemic and the proliferation of mobile payments and the use of QR codes. By 2026, cash use in APAC is projected to fall by half to make up for just 8% of POS transaction value, the report says.

Vietnam, Thailand and Indonesia are set to witness the sharpest decline. In Vietnam, cash transactions are forecast to make up for 21% of all POS transaction value in 2026, down 26 percentage points from 2022. In Thailand, cash share of POS transaction value is expected to decline by 24 percentage points to 32% in 2026. And in Indonesia, the share of cash use in POS transactions is projected to decline by 22 percentage points to reach 23% of POS transaction value.

Cash share % of POS transaction value, 2022-2026f, Source: The Worldpay from FIS Global Payments Report 2023, March 2023

A leader in real-time payments

In APAC, real-time payment schemes have proliferated over the past years. These schemes are now increasingly interlinked. For example, Singapore’s PayNow system is linked with India’s UPI, Malaysia’s DuitNow and PromptPay in Thailand. Indonesia, Malaysia and Thailand are also connected through their QR code payment systems.

And in November 2022, the central banks of Indonesia, Malaysia, the Philippines, Singapore and Thailand agreed to strengthen cooperation on payment connectivity to support real-time cross-border payments.

As part of the cooperation, these ASEAN nations joined Project Nexus earlier this month. The initiative, which is led by the Bank for International Settlements BIS, aims to link domestic real-time payment systems between one another to enable instant cross-border transactions.

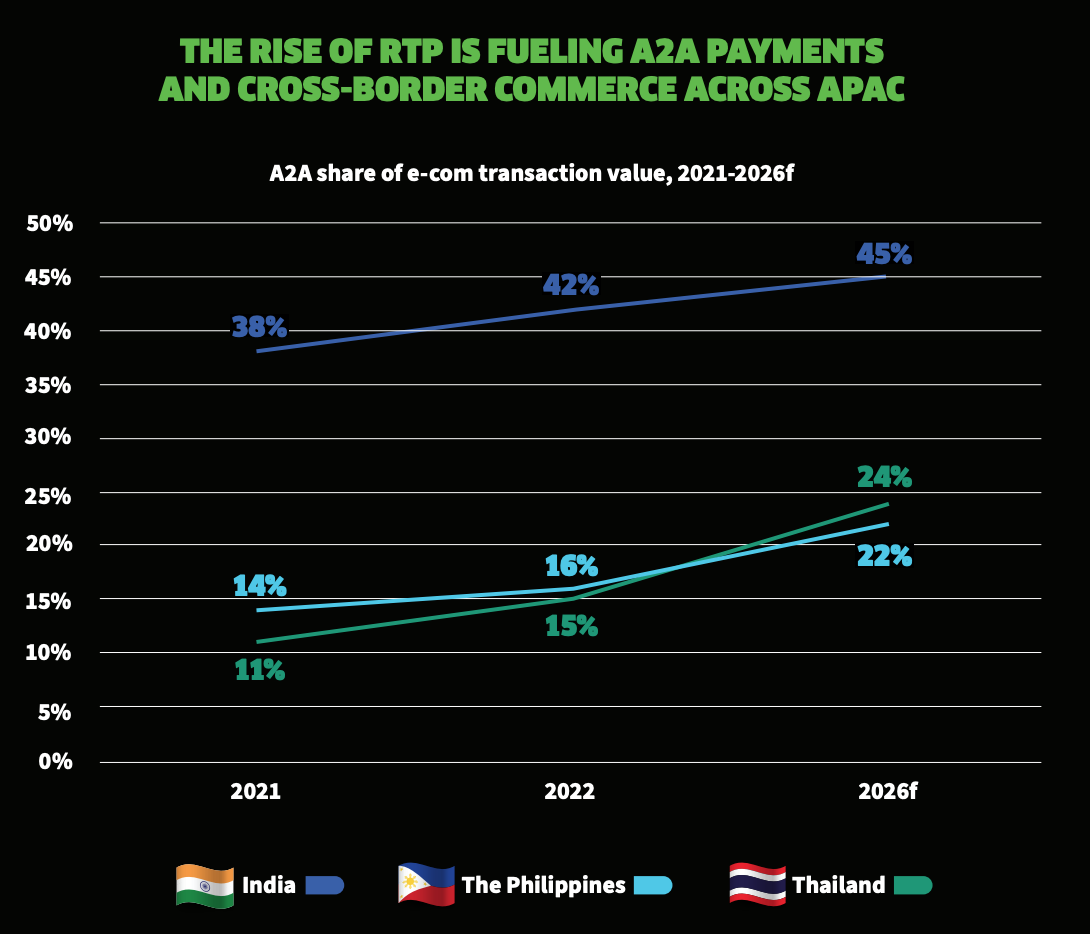

The proliferation of real-time payment systems has fueled the rise of A2A transactions in APAC. In Thailand, for example, PromptPay has propelled A2A payments to become the country’s leading payment method online, accounting for 42% of all e-commerce transaction value in 2022, up from 38% in 2021. Similarly, Malaysia’s DuitNow real-time payment system has fueled usage of A2A transactions, which made up for 37% of all online purchases in 2022.

A2A share of e-commerce transaction value, 2021-2026f, Source: The Worldpay from FIS Global Payments Report 2023, March 2023

Featured image credit: edited from Freepik