In the face of a gloomy international economic forecast and a dwindling liquidity pool, profitability has become a pressing concern for the chief executive of any digital bank emerging in the ASEAN region.

Digital banking is in its nascent stages within ASEAN, with fledgling digital banks in Singapore, Indonesia, Malaysia, and the Philippines having either launched in the recent past or are in the process of preparing for live launches in the near term.

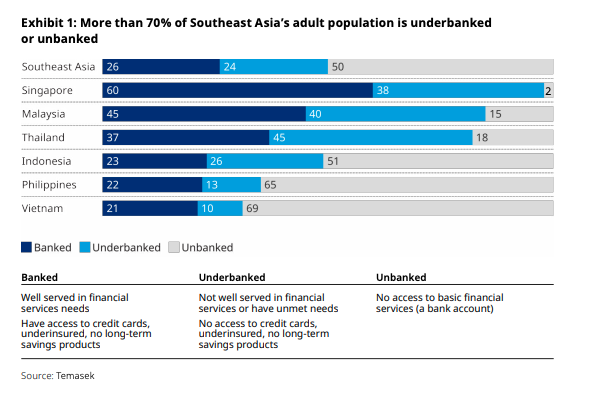

Whilst gaining a foothold amongst the underbanked or unbanked populace is a primary objective, it has become apparent that lending could be the golden ticket to a successful and profitable strategy, as evidenced by some digital banks outside of of the region, particularly in Hong Kong.

However, CEOs of ASEAN digital banks face several common obstacles in the current economic environment. One of the most formidable challenges is the substantial cost of establishing a digital bank in the ASEAN region, despite the absence of traditional banking infrastructure to eat up funding.

Constructing a new digital bank in the Asia-Pacific region can set one back by around US$20 million to US$45 million, as detailed in ‘The Road Ahead for Asia’s Digital Banks’ report. The report is informed by discussions held during the Asian digital bank CEOs strategic roundtable at the Elevandi Insights Forum, presided over by the Monetary Authority of Singapore, Synfindo, Affinidi, and the Asian Development Bank. For the first time, the roundtable convened CEOs from leading digital banks across Asia as well as experts from Oliver Wyman.

Licensing and regulatory requirements for digibanks

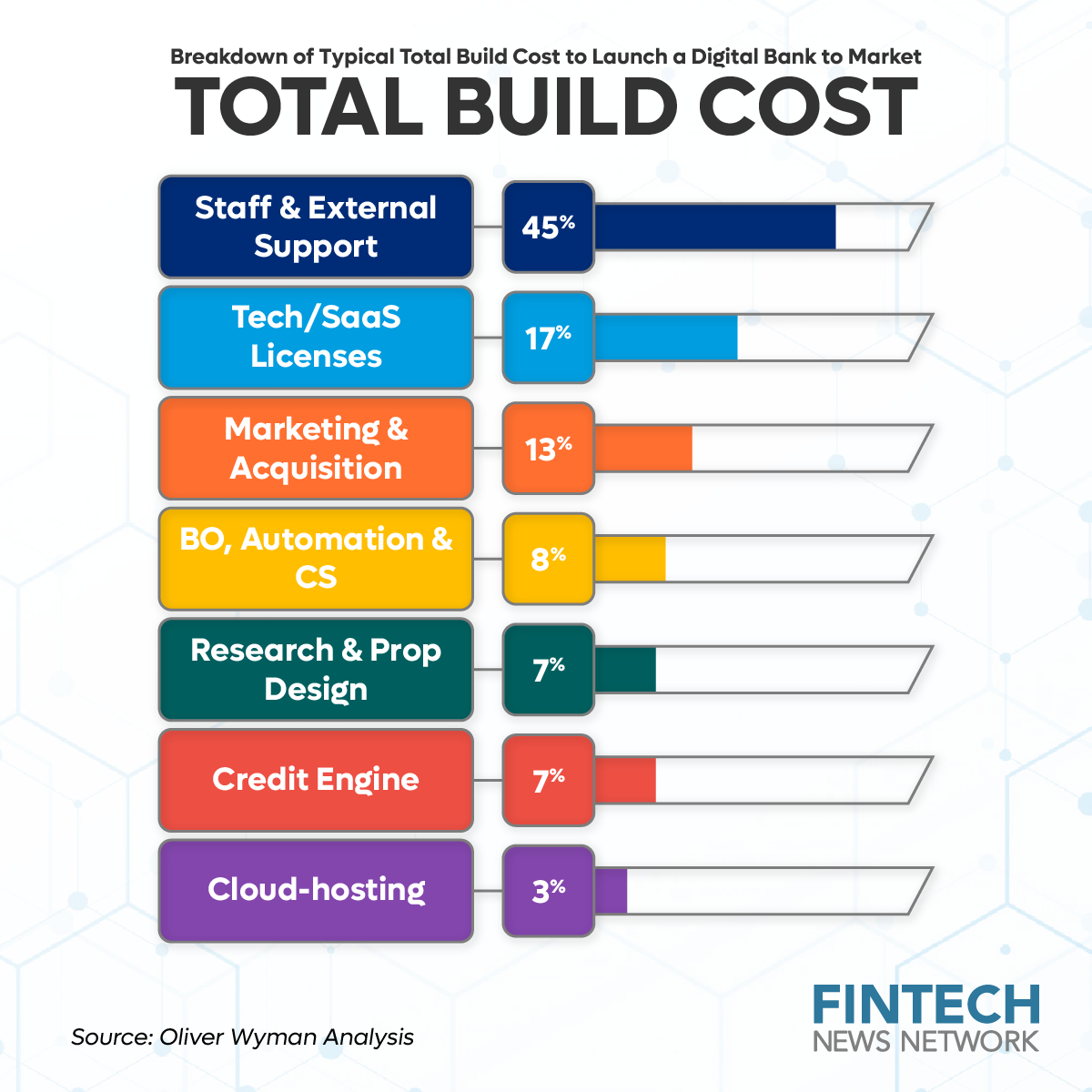

As demonstrated in the report technology, and software licenses constitute a significant 17% of the total build costs. ASEAN regulators have made commendable progress by issuing digital banking licenses, but the kickoff costs of acquiring further SaaS and technology licenses can be a stumbling block.

After all, established banks would have legacy infrastructure, hardware and programmes to fall back on, but a digital pure play would be starting from scratch. And much of that upfront build cost would be software licenses, as each digital bank in ASEAN would have its own unique, differentiated value proposition it would bring to the market.

As many SaaS licenses would be recurring annual or fixed period fees, digital entrants need to ask themselves which do they really need. Questioning along certain filters would be ideal to recognise individual needs — is the software or licensing regulatorily compliant? Is it fundamental to the digital player’s value proposition? How much customisation would be required for the SaaS or tech solution once out-of-the-box, to suit requirements?

And finally, how necessary is solution purchase, or can it be built in-house if given enough time and development runway?

The price of competitive talent and customer management

Notably, staff expenses claim the majority of costs at 45%, whilst marketing and customer acquisition costs make up a 13% share. Effective talent management will be vital for a digital bank in ASEAN to achieve their objectives and maintain competitiveness.

According to global research by Boston Consulting, a traditional bank typically devotes up to 90% of its workforce to daily operations, leaving a mere 10% for innovation and change management. The introduction of digital banks into the region certainly intensifies competition for talent in this in-demand aspect.

To distinguish themselves from traditional banks, an ASEAN digital bank must bolster its brand as an appealing employer and build a positive reputation in the market. They should also utilise technology to optimise the recruitment process, attract candidates with the necessary skills and experience, and provide continuous training and development opportunities to keep their workforce up-to-date with industry trends.

Vendor costs as critical infrastructure for ASEAN digital banks

The report further states that out of the total costs of US$20 million to US$45 million, approximately “US$3.5 million to US$7 million could be allotted to vendor costs.” Though vendors are not typically considered critical infrastructure for incumbents, they can incur substantial costs for a digital bank, from core banking infrastructure to integrating Banking-as-a-Service (or BaaS) digital banking services directly into third-party platforms.

Innovation holds the key to delivering value in the form of products and services to digital bank customers, according to digital bank CEOs across Asia. As a result, a digital bank’s foundational infrastructure must be modular to facilitate swift product testing and launches, and ensure secure data exchange with ecosystem partners.

The Oliver Wyman study identifies minimising vendor costs as a key strategy for profitability for ASEAN digital banks. Other tactics include developing distinctive propositions to deliver personalised customer experiences that the marketplace is demanding, and introducing unique product differentiators from the onset to distinguish themselves from traditional financial services and competing digital banks.