Posts From Fintech News Singapore

Singapore Government Sets up S$1.5 Billion Fund to Spur IPO Growth

The Singapore government has announced a package of initiatives to support high-growth enterprises to raise capital in the country’s public equity market and broaden its proposition as a financing hub. The government and Temasek will establish a new co-investment fund

Read MoreDBS Set to Hire Tech Talent to Bolster AI, Blockchain Capabilities Through Hack2Hire

DBS plans to hire around 150 of Singapore’s top technology talent through its Hack2Hire hackathon to bolster its AI and blockchain capabilities. Following a year-long hiatus due to Covid-19, DBS Hack2Hire will enable candidates to meet like-minded technologists and participate

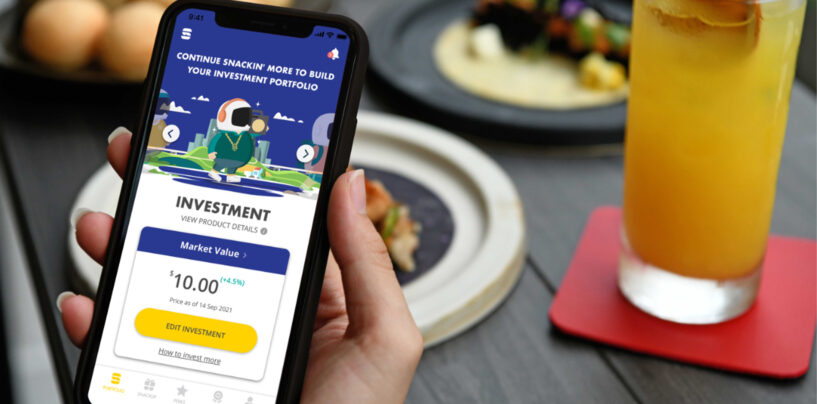

Read MoreNTUC Income Launches Micro Investment-Linked Plan On SNACK App

NTUC Income, an insurance cooperative in Singapore, announced that it has launched a micro investment-linked plan (ILP) on the SNACK by Income mobile app. Touted to be an industry-first, SNACK Investment adopts a stackable approach that allows consumers to build

Read MoreMAS, SEC Thailand Boosts Cross-Border Investment With Stock Markets’ Linkage

The Monetary Authority of Singapore (MAS) has joined forces with the Securities and Exchange Commission of Thailand to enhance connectivity between the two markets for increased cross-border investment opportunities for investors. The regulators announced the launch of the Thailand-Singapore Depositary

Read MoreSingapore’s PayNow to Link Up With India’s UPI for Real-Time Payments by 2022

The Monetary Authority of Singapore (MAS) and the Reserve Bank of India announced plans to link Singapore’s PayNow and India’s Unified Payments Interface (UPI) real-time payment systems by July 2022. The PayNow-UPI linkage will enable users to make instant, low

Read MoreEmpowering SMEs to Take the Friction Out of Card Payments With Suppliers

Cash is king. Every business owner knows these three words by heart, and for good reason. Cash is the lifeblood of every business: more cash means better access to working capital, which means more flexibility in business operations, and a

Read MoreSwiss Wealthtech vestr Partners Julius Baer to Drive Singapore Expansion Plans

vestr, a Swiss platform that digitises the life-cycle management of actively managed investment products, has expanded to Singapore following a partnership with Julius Baer though F10’s fintech incubator programme. vestr Pte Ltd, the Singapore branch of vestr, was awarded the

Read MoreWise Slashes Remittance Fees by up to 42% On Transfers From Singapore to 19 Countries

Wise, formerly known as TransferWise, has dropped prices by up to 42% on transfers from Singapore to 19 countries across 5 continents. This announcement is part of a global price drop where 52% of Wise customers around the world will

Read MoreIn Southeast Asia, New Digital Habits Boost Digital Payments and Consequently Fraud

COVID-19 has sparked a global spike in e-commerce sales and online businesses as lockdowns force consumers to turn to online channels to shop. As everyone embraces e-commerce, cashless payment methods including cards and digital wallets have surged, bringing with it

Read MoreSDAX Gets Go-Ahead to Operate as Digital Asset Exchange From MAS

SDAX announced that it has obtained its Recognised Market Operator (RMO) license from the Monetary Authority of Singapore to operate a digital asset exchange. Founded and headquartered in Singapore, SDAX is an institutional grade digital asset exchange. It leverages blockchain

Read More