Blockchain Needs a Super-Connector to Live up to Its $1.1 Trillion Trade Finance Promise

by Fintech News Singapore November 15, 2018Blockchain has the potential to radically transform trade finance by erasing current bottlenecks and streamlining international trade transactions.

The technology could potentially increase global trade volumes by US$1.1 trillion by 2026, from the current base of US$16 trillion, according to a new Blockchain Trade Finance report by Bain & Company and HSBC.

Blockchain proven to speed up processes and reduce costs dramatically

While to the uninitiated, blockchain for trade finance seems like a pipe dream, but to those who are privy like Sen Ganesh, they are well aware that these innovations are already taking place.

“Blockchain has the potential to transform global trade, removing the inefficiencies and costs by digitizing heavily paper based processes. After years of proof-of-concepts and pilots, this is now becoming real.”

points out Sen Ganesh, Partner at Bain & Company.

Some real life examples of blockchain in action includes HSBC and ING carrying out the first commercially viable trade finance transaction via blockchain for a Cargill shipment of soybeans from Argentina to Malaysia in May.

The transaction, on a single shared platform, took less than 24 hours to complete after details were shared with the banks, compared with 5 to 10 days for conventional paper-based, letter-of-credit transactions.

The Voltron project is another excellent case study, consisting of a consortium of 8 banks, it launched used R3’s distributed ledger platform Corda to reduce inefficiencies and costs by streamlining the processing of sight letters-of-credit.

The report also illustrated several other notable projects in this space, which we’ve consolidated into a

chart for your easy reference on the technology and sample participants currently active:

Bain Introduces the Idea of Superconnectors to Solve the Trade Finance Challenge

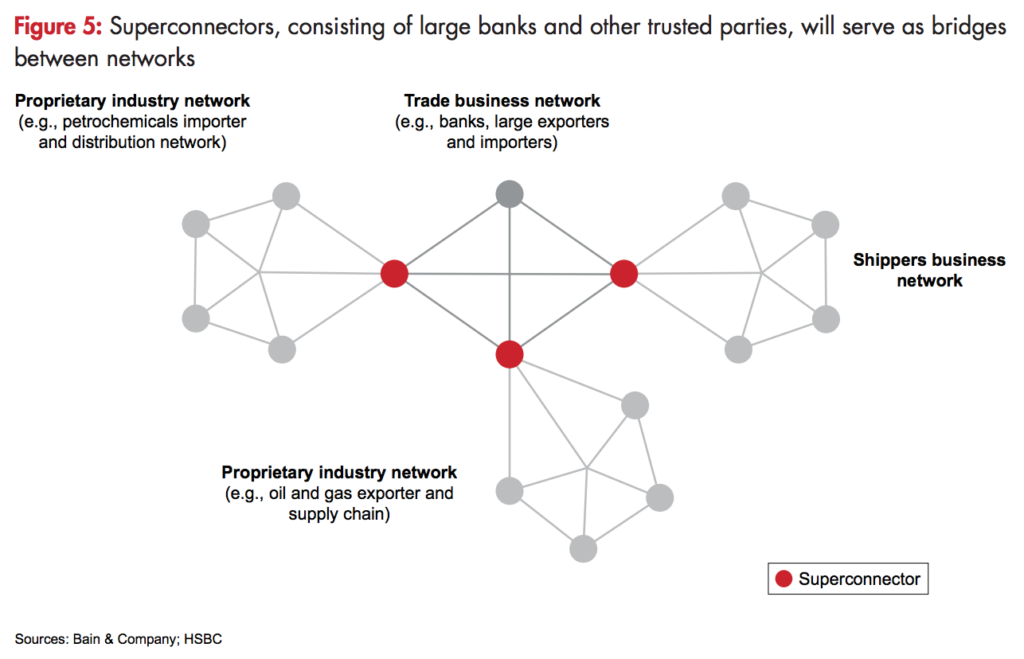

A single global trade network might be most ideal but that is unlikely to occur. Instead, Bain foresees the future is a world of network-of-networks linked by “superconnectors” with no single ubiquitous trade network servicing the global trade ecosystem.

Each network would have technology standards and business rules to govern member interactions. These business networks, which are private permissioned networks, will use blockchain for several tasks such as know-your customer compliance and cross-border payments.

Trusted parties, whether large banks, government agencies, large corporates, will play the role of

superconnectors, serving as a bridge among networks to share critical information.

These superconnectors will share information between, say, a shipping network and an oil and gas network. The shipping network tracks the flow of goods and deals with customs documents, while the oil and gas network tracks data pertinent to the producer sending the oil and the refiner receiving it.

A bank that is a member of multiple networks can also add information on financing and collateral. It would be a natural superconnector, in part because accessing more networks provides the bank with more information that helps it reduce risk.

The key is in recognizing that there is a strong business case for adopting blockchain to increase trade efficiency, mitigate risk and expand trade especially for smaller companies and regions with less robust trade mechanisms.

Sources:

Read the full Study here:

“How Blockchain Can Jump-Start Trade Finance“

Infographic: Blockchain Trade Finance Infographic

WEF White Paper: Trade Finance

Blockchain and Trade Finance resource page: