World Bank: Developing Countries Sees Record-Breaking Remittance Inflow in 2018

by Fintech News Singapore December 10, 2018Remittances to low and middle income countries grew rapidly and are projected to reach a new record in 2018, says the latest edition of the World Bank’s Migration and Development Brief, released today.

The Bank estimates that officially recorded remittances to developing countries will increase by 10.8 percent to reach $528 billion in 2018.

Global Remittance Statistics Overview

This new record level follows robust growth of 7.8 percent in 2017. Global remittances, which include flows to high-income countries, are projected to grow by 10.3 percent to $689 billion.

Remittance flows rose in all regions, most notably in Europe and Central Asia (20 percent) and South Asia (13.5 percent), followed by Sub-Saharan Africa (9.8 percent), Latin America and the Caribbean (9.3 percent), the Middle East and North Africa (9.1 percent), and East Asia and the Pacific (6.6 percent).

Growth was driven by a stronger economy and employment situation in the United States and a rebound in outward flows from Gulf Cooperation Council (GCC) countries and the Russian Federation.

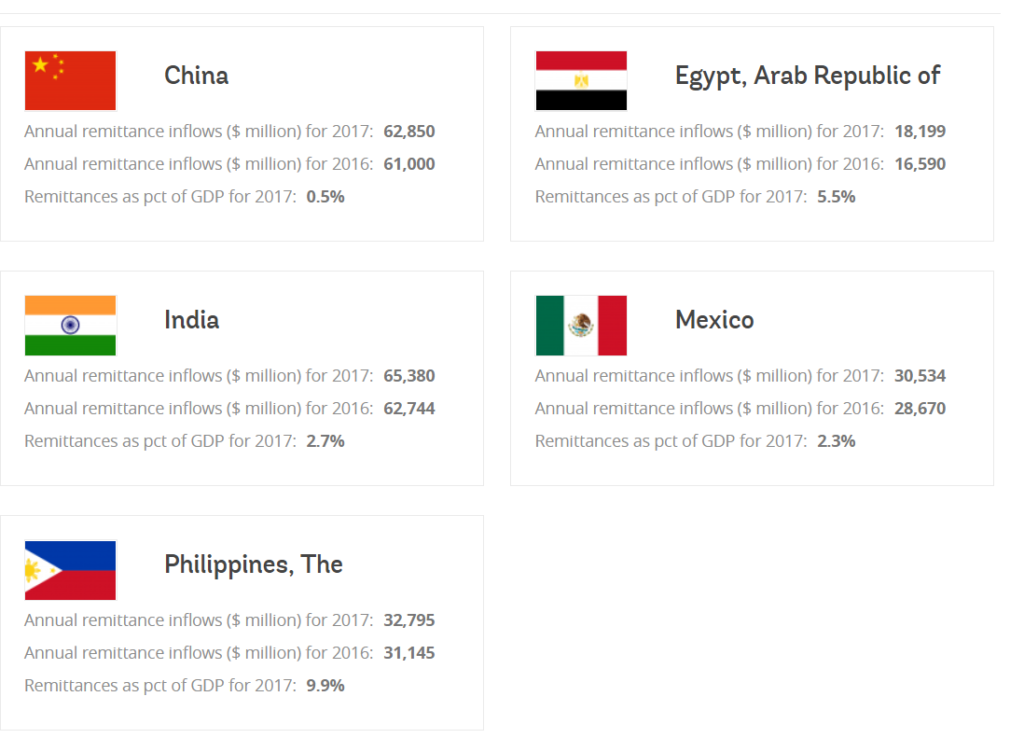

Among major remittance recipients, India retains its top spot, with remittances expected to total $80 billion this year, followed by China ($67 billion), Mexico and the Philippines ($34 billion each), and Egypt ($26 billion).

A sizable growth from previous years

As global growth is projected to moderate, future remittances to low- and middle-income countries are expected to grow moderately by 4 percent to reach $549 billion in 2019. Global remittances are expected to grow 3.7 percent to $715 billion in 2019.

The Brief notes that the global average cost of sending $200 remains high at 6.9 percent in the third quarter of 2018. Reducing remittance costs to 3 percent by 2030 is a global target under Sustainable Development Goal (SDG) 10.7. Increasing the volume of remittances is also a global goal under the proposals for raising financing for the SDGs.

Cost of Remittance Still too High Despite Fintech Advancements

Mahmoud Mohieldin

“Even with technological advances, remittances fees remain too high, double the SDG target of 3 percent. Opening up markets to competition and promoting the use of low-cost technologies will ease the burden on poorer customers,”

said Mahmoud Mohieldin, Senior Vice President for the 2030 Development Agenda, United Nations Relations, and Partnerships at the Bank.

The average cost of remitting in South Asia was the lowest at 5.4 percent, while Sub-Saharan Africa continued to have the highest at 9 percent. No solutions are yet in sight for practices that drive up costs, such as de-risking action of banks, which lead to closure of bank accounts of remittance service providers. Another persistent factor that keeps fees high is the exclusive partnership between national post office systems and any single money transfer operator, as it allows the operator to charge higher fees to poorer customers dependent on post offices.

The Migration and Development Brief, as well as detailed analysis of migration and remittances data, are available at www.knomad.org.

Featured Image Credit: Edited from Freepik