KPMG has released a new report naming the top 50 fintech ventures in China, which include Ant Financial, Baidu Finance, Dianrong.com, WeBank and Zhongan Insurance.

The report, titled 2016 China Leading Fintech 50, aims at promoting the industry’s growth by highlighting the leading mainland companies in fintech. These companies were selected by over 20 senior partners from KPMG international member firms and KPMG China.

The report, titled 2016 China Leading Fintech 50, aims at promoting the industry’s growth by highlighting the leading mainland companies in fintech. These companies were selected by over 20 senior partners from KPMG international member firms and KPMG China.

“China is fast becoming one of the leading fintech markets globally and an important innovation center in the fintech sector,” said Arthur Wang, head of China banking at KPMG China. “The companies shortlisted were distinguished by their innovative business practices as well as their ability to develop technology-driven solutions for some of the biggest issues facing the financial services sector.”

Echoing Wang’s statements, Simon Gleave, Asia Pacific partner-in-charge for financial services at KPMG, “a new ecology of financial industry is taking shape and we believe these innovators will play important roles in a new generation of financial services.”

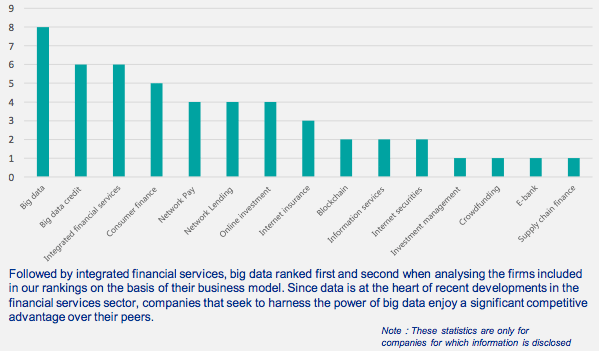

KPMG’s top 50 Chinese fintech companies are mostly tackling big data, integrated financial services and consumer finance.

Nearly 50% (21 companies) of these ventures are located in Beijing. Beijing is followed by Shanghai with 15 companies, Shenzhen with 7, Hangzhou with 5, and Chengdu and Chongping with both 1 each.

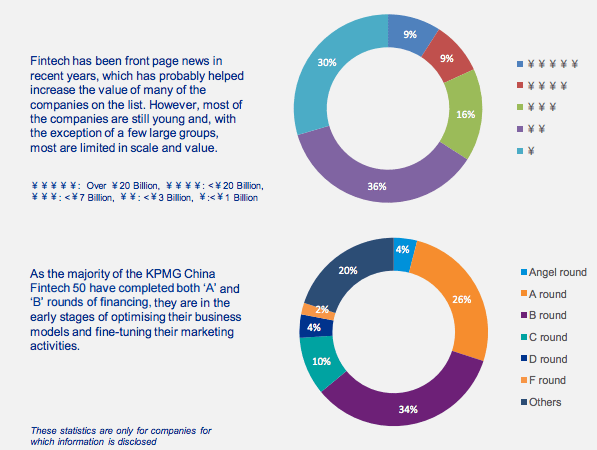

In terms of valuation, these companies are typically young, thus fairly limited in scale and value. The majority of these have completed Series A and Series B funding rounds.

“In recent years, China has been among the most innovative fintech markets globally, especially in relation to consumer finance, big data and third party payment systems,” the report says.

“We expect that with the growth of artificial intelligence, the Internet of Things and blockchain technology, China’s fintech sector will continue to flourish going forward.”

According to KPMG, China’s leading fintech companies include:

Baidu Finance Services Group (Baidu Finance), the financial services arm of Baidu Corporation providing a variety of different services including consumer finance, wealth and fund management, e-wallet payment, and financial asset transaction platform services. The company also offers Internet banking and Internet insurance services through its joint ventures.

Baidu Finance Services Group (Baidu Finance), the financial services arm of Baidu Corporation providing a variety of different services including consumer finance, wealth and fund management, e-wallet payment, and financial asset transaction platform services. The company also offers Internet banking and Internet insurance services through its joint ventures.

Baifendian Group, a company providing a number of services by harnessing big data technology. Its core products include big data operating systems, which fall under the technology product line; tag management systems, under the management product line; and analytics and marketing services, under the applications product line. Baifendian assists mostly Internet companies, financial services institutions and other business entities in building big data platforms and harnessing SaaS technologies.

Baifendian Group, a company providing a number of services by harnessing big data technology. Its core products include big data operating systems, which fall under the technology product line; tag management systems, under the management product line; and analytics and marketing services, under the applications product line. Baifendian assists mostly Internet companies, financial services institutions and other business entities in building big data platforms and harnessing SaaS technologies.

Dianrong.com, an Internet finance company headquartered in Shanghai providing market oriented borrowing and lending solutions for domestic and overseas financial services institutions including banks. Dianrong.com utilizes information provided by third party data and credit consulting companies to select assets based on a risk weighting system. The company has also developed several other products including its e-wallet and its transaction processing system as well as clearing and settlement services.

Dianrong.com, an Internet finance company headquartered in Shanghai providing market oriented borrowing and lending solutions for domestic and overseas financial services institutions including banks. Dianrong.com utilizes information provided by third party data and credit consulting companies to select assets based on a risk weighting system. The company has also developed several other products including its e-wallet and its transaction processing system as well as clearing and settlement services.

ChinaPnR, a company providing a range of services including financial account management, payment and settlement services, operating risk control services and data management for financial services institutions, small and micro businesses and individual investors. ChinaPnR has obtained the relevant payment business, fund payment and fund sales licenses from the regulatory authorities. It has several subsidiaries including ChinaPnR Data, ChinaPnR Finance, ChinaPnR Technology and ChinaPnR Capital and has made investments in a number of financial services companies includingEasier Life, Bund Wealth and the Chengdu Financial Asset Trading Centre.

ChinaPnR, a company providing a range of services including financial account management, payment and settlement services, operating risk control services and data management for financial services institutions, small and micro businesses and individual investors. ChinaPnR has obtained the relevant payment business, fund payment and fund sales licenses from the regulatory authorities. It has several subsidiaries including ChinaPnR Data, ChinaPnR Finance, ChinaPnR Technology and ChinaPnR Capital and has made investments in a number of financial services companies includingEasier Life, Bund Wealth and the Chengdu Financial Asset Trading Centre.

JD Finance Group, which is engaged in seven lines of business: supply chain finance, consumer finance, crowdfunding, wealth management, payment services, insurance and securities services. JD Finance’s services include JingBaobei, its microloan platform, Baitiao, its crowdfunding platform, Jintiao and Xiaobai, which provides wealth management services.

JD Finance Group, which is engaged in seven lines of business: supply chain finance, consumer finance, crowdfunding, wealth management, payment services, insurance and securities services. JD Finance’s services include JingBaobei, its microloan platform, Baitiao, its crowdfunding platform, Jintiao and Xiaobai, which provides wealth management services.

Tiger Brokers, which specializes in services for the global equity markets. Tiger Brokers uses a variety of Internet technologies, which are designed to improve efficiencies in the financial services sector and to facilitate investment in the global securities markets including real-time quotations for assets traded in the global financial markets along with regular updates regarding Chinese business news. It provides investment services for a variety of different investors and has developed relationships with a number of brokerage firms globally as well as major financial services organizations in China.

Tiger Brokers, which specializes in services for the global equity markets. Tiger Brokers uses a variety of Internet technologies, which are designed to improve efficiencies in the financial services sector and to facilitate investment in the global securities markets including real-time quotations for assets traded in the global financial markets along with regular updates regarding Chinese business news. It provides investment services for a variety of different investors and has developed relationships with a number of brokerage firms globally as well as major financial services organizations in China.

Shanghai Lujiazui International Financial Asset Exchange Co., Ltd. (Lufax), an Internet-based wealth management platform owned by Ping An Group. Lu.com aims to provide one of the most comprehensive wealth management platforms globally. Its services include providing risk management expertise, financial assets trading information and related consulting services for enterprises, financial services institutions and other qualified investors.

Shanghai Lujiazui International Financial Asset Exchange Co., Ltd. (Lufax), an Internet-based wealth management platform owned by Ping An Group. Lu.com aims to provide one of the most comprehensive wealth management platforms globally. Its services include providing risk management expertise, financial assets trading information and related consulting services for enterprises, financial services institutions and other qualified investors.

Hangzhou Xinyoulingxi Internet Finance Co., Ltd. (Lingxi Finance), an insurtech company founded in 2012. It provides many insurers and fund companies with online and offline insurance services as well as general e-commerce services. Lingxi Finance has developed two products: Weixiaobao, an insurance platform providing car owners with a number of value-added services such as price quotations, online insurance services and automobile aftermarket services, as well as technical supports for insurers and financial services for insurance agents and car owners; and Xiaofeixia, an online-to-offline based insurance services tool providing technical support services for insurers and financial services for insurance agents and car owners.

Hangzhou Xinyoulingxi Internet Finance Co., Ltd. (Lingxi Finance), an insurtech company founded in 2012. It provides many insurers and fund companies with online and offline insurance services as well as general e-commerce services. Lingxi Finance has developed two products: Weixiaobao, an insurance platform providing car owners with a number of value-added services such as price quotations, online insurance services and automobile aftermarket services, as well as technical supports for insurers and financial services for insurance agents and car owners; and Xiaofeixia, an online-to-offline based insurance services tool providing technical support services for insurers and financial services for insurance agents and car owners.

Ant Financial, Alipay’s parent company and Alibaba’s financial services affiliate valued at over US$70 billion. One of China’s top fintech ventures, Ant Financial has set up a number of subsidiaries including Yu’E Bao, Zhao Cai Bao, Ant Fortune, Aliloan, Ant Check Later, Sesame Credit, Ant Financial Cloud and Antdasq. Sesame Credit uses cloud computing and machine learning to process and evaluate user’s data, subject to their approval. Ant Check Later is a consumer credit platform, which provides users with access to different amounts of credit depending on their profile.

Ant Financial, Alipay’s parent company and Alibaba’s financial services affiliate valued at over US$70 billion. One of China’s top fintech ventures, Ant Financial has set up a number of subsidiaries including Yu’E Bao, Zhao Cai Bao, Ant Fortune, Aliloan, Ant Check Later, Sesame Credit, Ant Financial Cloud and Antdasq. Sesame Credit uses cloud computing and machine learning to process and evaluate user’s data, subject to their approval. Ant Check Later is a consumer credit platform, which provides users with access to different amounts of credit depending on their profile.

Qudian Group, which operates two main business platforms: a consumer finance platform and a micro credit lending platform. The company has a large number of registered users and offers credit to young and middle aged consumers. The group has established several formal partnerships with companies engaged in financial services, e-commence, digital services, FMGG and other sectors. Founded in 2014, Qudian Group aims at broadening the scope of financing available to consumers in China who do not use credit cards.

Qudian Group, which operates two main business platforms: a consumer finance platform and a micro credit lending platform. The company has a large number of registered users and offers credit to young and middle aged consumers. The group has established several formal partnerships with companies engaged in financial services, e-commence, digital services, FMGG and other sectors. Founded in 2014, Qudian Group aims at broadening the scope of financing available to consumers in China who do not use credit cards.

Ucredit, a financial services group that utilizes Internet technology to provide a range of services including personal wealth management, personal loans and other forms of credit. The company has developed three major brands: Renrendai, which provides credit and other consumer finance services to individual borrowers; Wealth Evolution, a platform that allows users to purchase and trade wealth management products; and Black Card, a mobile application for high net worth individuals.

Ucredit, a financial services group that utilizes Internet technology to provide a range of services including personal wealth management, personal loans and other forms of credit. The company has developed three major brands: Renrendai, which provides credit and other consumer finance services to individual borrowers; Wealth Evolution, a platform that allows users to purchase and trade wealth management products; and Black Card, a mobile application for high net worth individuals.

Hangzhou Wacai Internet Finance Services Co., Ltd. (Wacai), which provides personal bookkeeping services, particularly for those that have traditionally been excluded from mainstream financial services. Some of Wacai’s products include Wacai Bookkeeping and Financial Management, the company’s flagship financial management platform; Wacai Bao, a financial management services platform; Wacai Money Manager, a personal wealth management platform; Wacai Credit Card Manager, a tool that allows users to manage their credit cards; Wacai Gushen; and Wacai Community, a popular mobile application that allows users to exchange ideas in different fields including personal finance and education.

Hangzhou Wacai Internet Finance Services Co., Ltd. (Wacai), which provides personal bookkeeping services, particularly for those that have traditionally been excluded from mainstream financial services. Some of Wacai’s products include Wacai Bookkeeping and Financial Management, the company’s flagship financial management platform; Wacai Bao, a financial management services platform; Wacai Money Manager, a personal wealth management platform; Wacai Credit Card Manager, a tool that allows users to manage their credit cards; Wacai Gushen; and Wacai Community, a popular mobile application that allows users to exchange ideas in different fields including personal finance and education.

WeBank, a licensed digital bank that operates Credit Particles, the WeBank mobile application, and WeCar Credit. WeBank has applied several innovative technologies such as face recognition, voice recognition and robotics in its everyday business activities. In 2016, the company launched the Financial Blockchain Cooperation Alliance (Shenzhen), which carries out research on the application of blockchain in the financial services sector. WeBank has also launched We Zhong Financial Management, a mobile application for rural banking, as well as another application for the interbank market.

WeBank, a licensed digital bank that operates Credit Particles, the WeBank mobile application, and WeCar Credit. WeBank has applied several innovative technologies such as face recognition, voice recognition and robotics in its everyday business activities. In 2016, the company launched the Financial Blockchain Cooperation Alliance (Shenzhen), which carries out research on the application of blockchain in the financial services sector. WeBank has also launched We Zhong Financial Management, a mobile application for rural banking, as well as another application for the interbank market.

Zhongan Online Property Insurance Co., Ltd. (Zhongan Insurance), an Internet insurance company founded in 2013 by Jack Ma, Pony Ma and Ma Mingzhe. Zhongan Insurance applies mobile Internet, cloud computing, big data and other new technologies for a variety of different purposes including product design, automatic claims settlement, market positioning analysis, risk control and back-end claims services. Its services help users search for insurance products for a variety of purposes including travel, shopping, medical treatment and investment.

Zhongan Online Property Insurance Co., Ltd. (Zhongan Insurance), an Internet insurance company founded in 2013 by Jack Ma, Pony Ma and Ma Mingzhe. Zhongan Insurance applies mobile Internet, cloud computing, big data and other new technologies for a variety of different purposes including product design, automatic claims settlement, market positioning analysis, risk control and back-end claims services. Its services help users search for insurance products for a variety of purposes including travel, shopping, medical treatment and investment.