OCBC Bank Enables Peer-to-peer Payments Powered By Siri And iMessage

by Fintech News Singapore October 28, 2016OCBC Bank customers can now send money to their friends and family by issuing a simple voice command to Siri, Apple’s virtual assistant. Users just have to tell Siri whom to send the payment to and how much they want to send, then use the OCBC Pay Anyone mobile e-payment service.

Another new channel for customers to conveniently send money to friends is through iMessage: If midway through texting, they need not even leave the conversation screen or open any other mobile app.

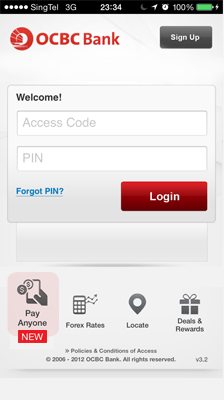

The Siri and iMessage services for OCBC Pay Anyone are available to all OCBC Bank customers using iPhone devices running the iOS10 software and the latest OCBC Mobile Banking app. The payments are fully secure as they are authenticated by the customer using their mobile banking credentials. These innovations were developed by OCBC Bank’s in-house mobile developer, E-Business and Group Customer Experience teams.

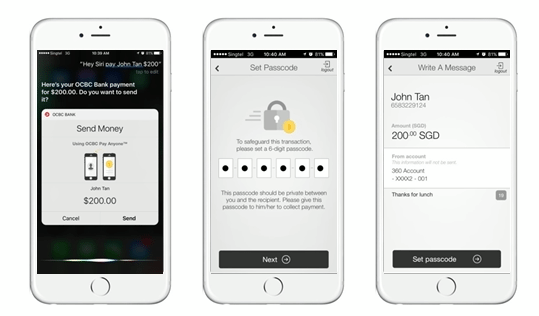

Making a payment via Siri and iMessage

To send money using Siri, users simply need to instruct Siri with a voice command indicating whom from their contact list to send money to, and the amount to send. An example is: “Pay John Tan $50”. Upon making this request, the Siri interface will pop up on the iPhone, asking the user to confirm the payment details which will automatically indicate “John Tan” as the recipient and “$50” as the amount to transfer. Once the payment details are confirmed, the user will be guided to complete the transfer using OCBC Pay Anyone.

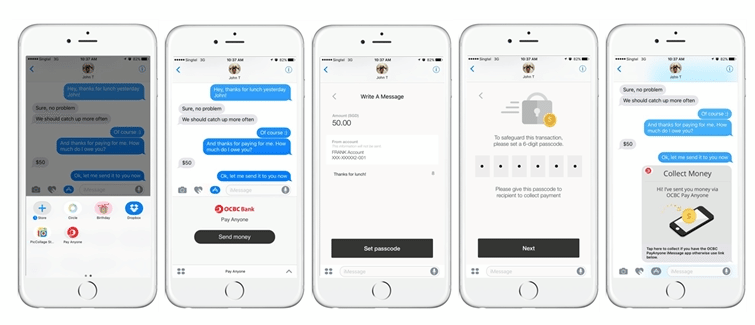

Additionally, users can also choose to conveniently send money via iMessage while texting their friends – without leaving the conversation by closing the messaging app or opening another app. Within the iMessage conversation screen, users can choose the OCBC Pay Anyone iMessage app to initiate the payment directly to the person they are chatting with. The app automatically populates the recipient’s name, and the user just needs to indicate the amount to send and complete the transaction with OCBC Pay Anyone. Once the money is sent, the OCBC Pay Anyone app will close and the user can conveniently resume the chat with their friend within the same iMessage window.

1. Ask Siri to make a payment to a contact on your phone list. Indicate amount and confirm to use OCBC Bank Pay Anyone to send the money.

2. Log in to OCBC Mobile Banking with your access code and PIN. Select an account to pay from. The recipient and amount will be filled in automatically.

3. Complete OCBC Pay Anyone transaction by keying in a six-digit passcode for recipient to collect the money, and a One-Time Password for authentication.

Making a payment on iMessage:

1. While chatting with a contact on iMessage, tap on the “Apps” icon next to the chat box and select OCBC Pay Anyone.

2. Tap on “Send Money” to begin payment.

3. OCBC Pay Anyone will launch within iMessage. Log in to OCBC Mobile Banking with your access code and PIN. Select an account to pay from, and enter the amount to send.

4. Complete OCBC Pay Anyone transaction by keying in a six-digit passcode for recipient to collect the money, and a One-Time Password for authentication.

5. Return to iMessage conversation screen seamlessly. Recipient will receive a link in iMessage to collect the money.

Mr Aditya Gupta, OCBC Bank’s Head of E-Business Singapore, said: “We know that customers now prefer their banking to be embedded in other things they do, rather than having to start their interaction journey from a bank’s platform. We’re pleased to add these two new channels – Siri and iMessage – for customers to make payments with OCBC Pay Anyone. We are integrating payments into our customers’ everyday lives and making it completely frictionless for them to engage us via actions that are second nature to them – using messaging and voice commands.

This is the latest in a series of digital innovations that OCBC Bank has introduced to make day-to-day banking and payments more simple, fast and accessible for customers, and we are confident that they are going to love these new payment channels.

Last month, we increased the OCBC Pay Anyone daily transfer limit from $100 to $1,000 and, since then, the amount of money being sent via our e-payment service has increased 250 per cent. We expect e-payments to have a multi-fold increase and will continue to add more payment channels for customers to our suite of digital services.”

Rise in popularity of OCBC Pay Anyone e-payments

Rise in popularity of OCBC Pay Anyone e-payments

OCBC Pay Anyone remains the first and only account-to-account mobile payment service offered by any bank in Singapore that does not require the sender to know the recipient’s bank account details in order to make payment. OCBC Pay Anyone lets customers send money directly to any bank account in Singapore using just the recipient’s mobile number, email address or Facebook account, without having to perform transaction signing using a security token or to add the recipient as a “payee”. It was first launched in 2014 on the OCBC Mobile Banking app.

In September 2016, OCBC Bank increased the daily transfer limit on OCBC Pay Anyone from $100 to $1,000, bringing greater convenience to customers and making payments for bigger ticket items more seamless.

OCBC Pay Anyone transactions have increased five-fold, with an average month-on-month growth of about 10 per cent since August 2014.

OCBC Pay Anyone e-payment service VS mobile wallets

Unlike a mobile wallet, where both the sender and recipient need to download and register for the same mobile app in order to send or receive money, OCBC Pay Anyone recipients do not need to download any mobile app. They also do not need to take additional steps, after receiving money in the mobile wallet, to instruct the wallet to deposit the funds received into their bank accounts.

With OCBC Pay Anyone, once the recipient has received the payment alert – typically on their mobile device via SMS – they will be instructed to key in their account number and a six-digit passcode provided by the sender. The deposit is then made directly from the sender’s OCBC Bank account into the recipient’s desired account. With the enhancements to the app for iPhone users on Siri and iMessage, e-payments will become even more simple and convenient for customers.