Tag "OCBC Bank"

A Leap into Generative AI for OCBC Bank with OCBC GPT Chatbot

OCBC Bank’s foray into artificial intelligence, spearheaded by Donald MacDonald, OCBC’s Head of Group Data Office, signifies a pivotal moment in the bank’s technological evolution. The recent introduction of OCBC GPT, its AI chatbot powered by Microsoft’s OpenAI, showcased the

Read MoreSingapore’s Top 5 Fintech Stories Last Year That Will Impact the Industry in 2023

It is no secret that the fintech industry in Singapore has been flourishing in recent years. This can be attributed to the city-state’s supportive ecosystem, which includes a pro-business government, a highly educated workforce, and a conducive environment for innovation

Read MoreTop 10 Highlights from Last Week’s Singapore Fintech Festival

The seventh edition of the Singapore Fintech Festival (SFF), one of the world’s largest annual fintech events, kicked off on October 31, 2022 as an in-person event at the Singapore Expo. This year’s event, themed “Building Resilient Business Models amid

Read MoreMAS Initiates Digital Singapore Dollar Trials

The Monetary Authority of Singapore (MAS) has published a report detailing potential uses of a purpose-bound digital Singapore dollar (SGD) and the supporting infrastructure required. The report also marked the successful completion of Phase 1 of Project Orchid which explored

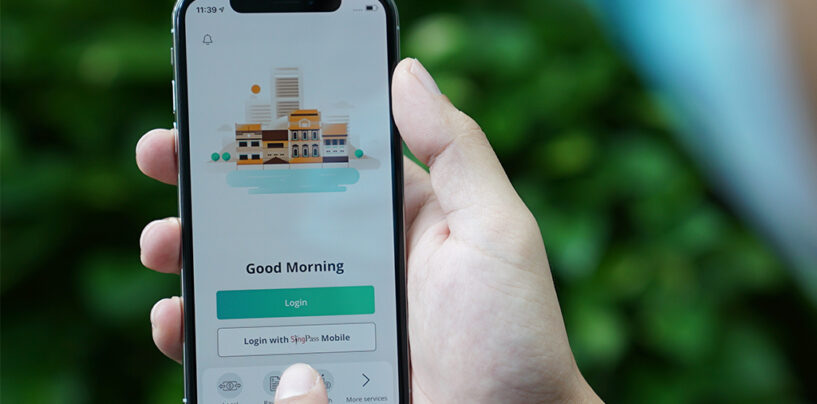

Read MoreOCBC Bank Enables the Use of SingPass as Alternative Login to Access Digital Banking Services

OCBC Bank announced today that is has enabled 1.8 million of its digital customers in Singapore to use the SingPass as an alternative login to access the full suite of digital banking services. They claim to be the first bank

Read MoreOCBC’s Virtual Wealth Advisory Service Sees 45% in Sales During Circuit Breaker

On 18 April 2020, with the Circuit Breaker period still in effect, OCBC Bank took the highly-regulated wealth advisory process – a complex face-to-face process involving over 50 pages of documents and a comprehensive Financial Needs Analysis (FNA) – online.

Read MoreOCBC Bank Enables Instant Car Loan Approvals

OCBC announced today that they have enabled instant car loan approvals, according to their statement, when customers apply for a car loan with OCBC, they can now get it approved within 60 seconds. This service is made possible by a

Read MoreOCBC Enables Account Opening for Startups Immediately After Incorporation

Start-ups are now able to open an OCBC business banking account in Singapore immediately after incorporation, rather than having to wait one day. This is made possible by an API between the bank and global information services provider Experian. Once

Read MoreUnionBank and OCBC Pilots Blockchain Based Remittance from Singapore to the Philippines

UnionBank of the Philippines recently became the first Philippine bank to successfully pilot blockchain-based remittance from Singapore to the Philippines. This was done in partnership with OCBC Bank, Singapore, using the Adhara liquidity management and international payments platform. Amid a

Read MoreCalm Down, Grab Isn’t Trying to Become a Bank—Not in the Way You’re Thinking, at Least

Followers of this page are well aware that Grab, one of Singapore’s premier unicorns, has dabbled in many different areas of fintech-fuelled offerings in its drive to become what it self-describes as a “super app”. Most recently though, it seems

Read More