“The Deed of the Dying”

Many ‘digital wallet” companies in Asia (ex. China) are finding it hard to demonstrate any meaningful value for the users. Wallet Players have experimented with various business models to monetize, but primary focus thus far has been on ‘customer acquisition and usage — through deals, offers, promotion, zero fees, etc.

If 2015–16 was “rapid scale up time” for ‘wallet companies,’ then 2017–18, very soon, will be the year of M&A, strategic partnerships, and consolidation for these startups.

Mobile payments is primarily a DATA business, where business economics is ‘tight,’ and viable only at SCALE.

Sub-optimal scale leads to ‘slow death.’

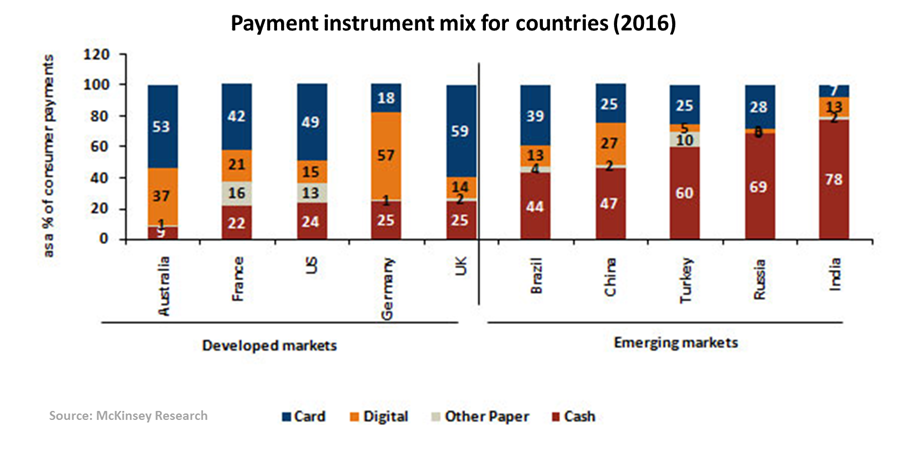

Asia is huge, fragmented, and heterogeneous market very different from the west, with strong cultural nuances and varied levels of readiness to embrace digital payments.

Although cashless payments are growing across Asia, the growth is not universal. In some countries, cash remains the king because of fears of identity theft, lack of infrastructure and knowledge of the digital world.

Despite claims of simplicity, most users find cash to be more convenient than any digital or mobile wallet.

It is no surprise that mobile wallets — in countries such as Singapore, India, Indonesia, Malaysia, Philippines — contribute less than 4% of the overall digital payments transactions. Wallets, as a payments instrument, are very far off to rate comparable with plastic cards for online and in-store payments.

Wallet companies are struggling with nascent local regulations, evolving consumer behavior, lack of infrastructure, weak business models, strong competition, and cash-as-a-habit.

The cumulative impact of all these factors is creating an existential crisis for wallet companies. Let’s deep dive into some of these threats:

“Empty Hands”: Cash is more than 3000- year-old habit

Cash has “no visible cost” to the user. The persistent strengths of cash — convenience (cash is versatile and widely accepted), control (cash is final and spend limited to cash in wallet) and value (it’s free, at least in appearance) — are difficult to replace in a digitizing world

Cash is more than 3000-year-old habit, deeply embedded in the customer and merchant ecosystems, created to overcome the trust, convenience, and transaction barrier.

The biggest obstacle to widespread mobile payment usage lies in the consumer’s mindset where cash and plastic card is perceived as more secure payment options

For non-users, the barriers are — cash as a habit, complexity of the app, lack of core value proposition, and affordability of smartphone. A vast majority of people in Asia still use a ‘low-end’ smartphone with limited storage and regularly delete apps that do not qualify the ‘toothbrush’ test.

In India, only 27% of mobile phone users have smartphones — compared to 70% in China — and the remaining use feature phones.

A large chunk of micro transactions in the world still happen in CASH. In India the number is, as high as 95%.

Cash transactions require no technical knowledge whatsoever. To a vast majority of consumers, the process of operating a digital wallet, chip, and pin credit card or even using one-time password (OTP) as a second factor of authentication is technically challenging and reason in itself to avoid electronic payments

Another reason: A significant % of the workforce in Asia, in the informal economy, gets paid in cash. Changing consumer behavior is hard, especially if you get paid in cash, you like to pay others in cash. There is no compelling reason to change.

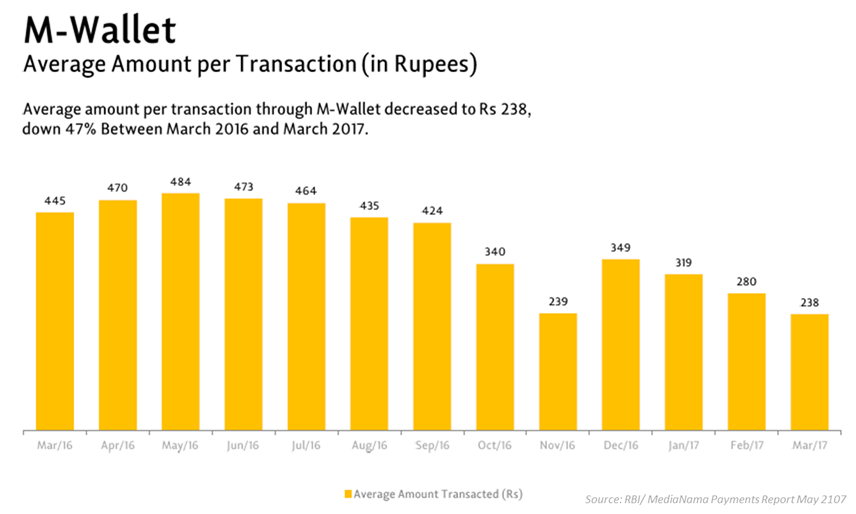

For example, According to the RBI (Reserve Bank of India), wallet transactions, which had skyrocketed in December 2016, post demonetization, dropped subsequently with enough cash entering back in the system. Overall digital payments peaked again in March17 with 307 million transactions (with mobile wallets contributing only ~3% of that). The average value for a wallet transaction has also come down to INR 238 ($3.66).

In addition, societal and cultural reasons also play a big role in developing markets such as India, Indonesia, and Malaysia.

Even people who already use plastic (credit or prepaid) cards find no compelling use for digital wallets. The business of financial services (money) is based on ‘Trust.’ Building Trust takes time. Brands like Visa, MasterCard, Amex were etched on consumers mind over several decades. Their product is not convenience. The product is CERTAINTY. The product is TRUST.

It is still a long road before digital payments become the norm in cash economies. Remember this is not about technology, this is about human behavior.

To paraphrase Mark Twain, “the reports of the death of cash have been greatly exaggerated.”

“Revelations”: China is a unique model and cannot be copied elsewhere.

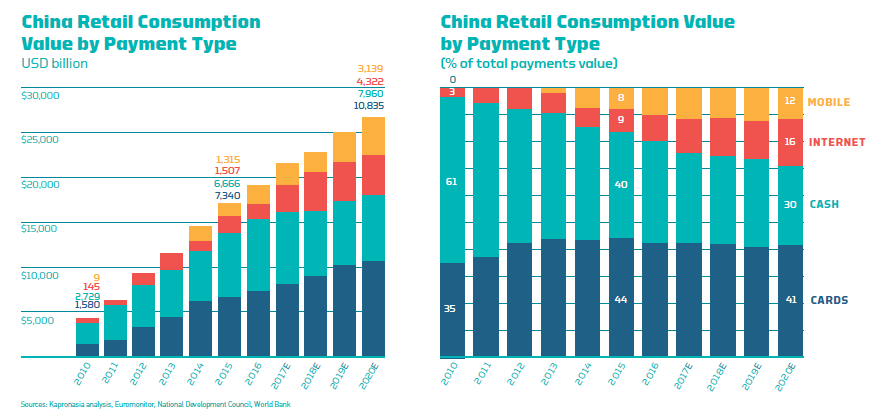

China’s digital payments market is today 50 times larger than that in the US.

Long a cash-first society, China’s slow adoption of plastic together with the spectacular growth in smartphone adoption in the past five years created a perfect storm for e-wallet providers such as Alipay and WeChat Pay to enter the fray.

Alipay by leveraging Alibaba/TMall and WeChatPay by leveraging WeChat /QQ messaging have built formidable mobile payment business.

They’ve managed to crack the holy grail of payments: scale, commerce & community.

China had 540 million mobile payment users last year, 40 percent of Chinese consumers use new “wallet” payment methods daily, compared to just 4 % in Singapore, and less than 3% in India.

While China is home to the largest and fastest growing mobile payment market, mobile payment adoption around the world is picking up at a different speed.

Despite the brouhaha, people in S.E.A. aren’t taking much to digital wallets — for electronic payments.

Regulations are still evolving in most of these Asian countries, and each country is following a unique adoption path, based on several local factors — cultural nuances, regulations, mobile commerce infrastructure, and data and smartphone penetration.

Mobile payments only accounted for 26 percent of the total electronic payments in Taiwan. In contrast, they are 77 percent in South Korea, 65 percent in Hong Kong and 56 percent in China.

Around 95% of all consumer payments in India still use cash. India tried “shock doctrine” to dismantle cash, but with limited success. Cash is back in the system to pre-September 2016 levels. The number of transactions and money withdrawn at ATM’s remain significantly higher than the number and amount spent at point-of-sale terminals.

Access does not automatically translate to usage. A significant segment, particularly women, still don’t use smartphones, often due to conservative social norms.

“Shadow Games”: Digital money adoption follows an evolutionary process.

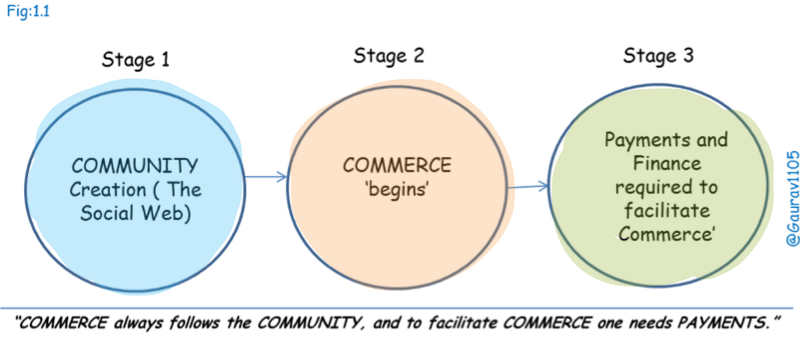

Digital money adoption is an evolutionary process. Stage 1 is “SCALE and critical mass,” and Stage 2 is “USAGE.” Without SCALE, there’s not a hope or a prayer for mobile payments ROI. Getting to scale requires looking at dominant cash replacement use cases. Once the scale is achieved in terms of customer base, diversification into other payments services and merchant acceptance becomes an important business proposition.

Customers do not need one more digital container of money. Bank accounts and other plastic cards serve that purpose very well. Most consumers think that mobile wallets are less convenient and harder to use than credit and debit cards.

Customers want “universal solutions,” hence payments product ‘ubiquity’ is critical to driving positive ‘network effect’ for commercial success. “Ubiquity” means widespread merchant acceptance network, a broad set of use cases, with multiple ‘cash in-cash out’ options.

What customers need is a “universal wallet” (A single wallet/app with ‘multiple’ use-case rather than several ‘single-use’ apps) that enables them to use it everywhere they like to shop, not limited by the fragmentation we see in current payment instruments.

To win this war, a payment “wallet” cannot be captive to just one mobile operating system or device. The winner needs scale and should work across operating systems, shopping channels, browsers, and technology platforms. Now put that in perspective to an apparent lack of interoperability amongst wallet instruments in Asia.

“The problem for mobile wallets is that their payment experience is just one piece of a checkout flow that is outside of their control. The danger here is that mobile wallets will catch on as a payment option, but remain undifferentiated from other forms of payments.” — Donald Richard

This is why the future of mobile payments isn’t going to be about “the device” that enables payment, but about who can enable a consumer’s digital payments experience across any app, any device, inside of any ecosystem or shopping channel they pick to buy what they want to buy.

The future of mobile payments is in— invisible payments, powering contextual commerce, by providing superlative user experience, bundled together with Loyalty.

“The Thing in the Pit”: Business Model, Scale, and Core product Value

Signing up people is the easy part, building a profitable and scalable business is another deal. No wonder, all closely-held mobile wallet companies are loss-making.

With initial growth and customer acquisition-fueled by ‘quick’ use case around mobile/utility recharge, cab payments (on-demand taxi), coupled with promotional offers, digital wallets positioned themselves as a platform for processing online and offline merchant payments.

But, they failed to account for the two most important things that are essential to mobile payments success: CORE PRODUCT VALUE and CRITICAL MASS, without which there’s not a hope or a prayer for mobile payments ROI (Return on Investment)

Core product value is about solving a real problem that is valuable enough for people to want to pay for a product, and getting to scale requires replacement of dominant cash use cases.

Most wallet companies suffer from an absence of Core Product Value. All Wallet companies started expanding (growth steroids) even before the “value hypothesis” was proven.

Predictably ‘darwinian economics’ — -terrible unit metrics, platform leakages, poor customer loyalty, an absence of ‘virtuous loop and network effects,’ poor retention curves, weak business models, unproven “value” hypothesis, and cash-as a habit — — is fast thinning out the digital wallet herd.

There are 45+ wallet companies in Asia(ex China), but only 4 or 5 of them have DAU (Daily Active Users) > 20M. Most operate with zero revenue model and complete absence of community or commerce axis. Majority of early users acquired (bought) are ‘dormant,’ leading to high acquisition and retention costs, and low transaction value.

Creative ways of monetization are required to make these businesses viable. It starts with building a product that is “as easy as cash” to use across all target segments, form factors, interfaces, and UX.

Community, Commerce, and Payments are inter-connected in the Digital World. Thus far, all successful mobile payment plays, globally, are centered on the commerce and community axis. PayPal started with Ebay, Alipay with Alibaba/TMall/Taobao, WeChatPay leveraged WeChat/QQ, and Amazon Pay has Amazon.

Due to this very reason, standalone payments/wallet business will struggle. Companies with primary ‘relationship’ with users through a community, commerce or messaging platform are likely to be ‘winners’ in the long term.

THE VALUE IS IN THE NETWORK.

The problem, of course, is that a payment type can become a wallet, and a wallet can become a payment type. As Alex Rampell wrote earlier:

As a stack, we have hardware — your mobile phone — at the top and bank accounts holding the actual treasure at the very bottom. But it’s better to think of this “stack” as actually a system of pointers, in this case downwards. And the goal for businesses is finding and occupying a defensible position in this stack that allows them to intercept payments, capturing and controlling value to become that ultimate financial platform.

Since wallets alone are not capable of sustaining a profitable business model, all mobile wallet co.’s are beginning to talk about “Payments ++” model (i.e. Credit, Data, AI). ‘Credit’ is a very different ball game and requires a unique set of capabilities and playbook. Read my views on credit-marketplace dynamics here.

As the scramble to fight for survival gathers pace, only the deep-pocketed will survive. So, if you don’t have Ant-Financial, Tencent, Amazon, or an equivalent in your captable, you should be worried.

“Chosen Path” : Solving for Merchants (acceptance)

China’s mobile payments trajectory is off the charts. In 2016, payments made through mobile devices reached US$5.5 trillion, more than half the nation’s GDP. Let that sink in for some time. I’ll write more about that later.

However, in most South East Asian countries, users still aren’t exactly flocking to mobile wallets, and that’s probably because merchants aren’t that thrilled about them either.

As my friend Brian Roemmele says: “Any payment company that focuses on one side of the payment landscape is ultimately doomed. Just give it some time.”

While consumers would like to use a single wallet across transactions, the merchants would like to use the cheapest mechanism. Cash is the most popular and ubiquitous option, and other payment options are only used either for convenience, credit or because there is a discount associated.

Many small merchants say they run on “wafer thin” profit margins and additional tax and payment charges would drive them out of business. There is also a big fear around “tax and digital trail” within the merchant ecosystem, especially in “low trust and high corruption ecosystems.” Only 3% citizens pay taxes in countries such as India, Indonesia, Philippines, etc.

Another example: In India, post demonetization, millions of people stood outside the ATM’s (in queues, sometimes for weeks) to withdraw cash, realizing that they cannot survive without cash. And mind you, this was not due to the absence of a digital payment instrument. Although there are more than 800+ million debit (plastic) cards in circulation, its usage is mostly limited to “ATM cash withdrawal.”

Also, for an estimated 30 million retail merchants in the country, there are only 2 million POS machines in operation. The biggest obstacle to widespread mobile payment usage lies in the consumer’s mindset where cash and card are perceived as more secure payment options and the merchant who remains unconvinced of ‘digital payments’ benefits.

This is a very long road.

“Gods of the Arena”: The March of the Giants — Tencent, AntFinancial, Amazon, Google, Facebook, Apple

Asia presents a huge opportunity in payments and commerce. Mobile payments volume in China exceeded $5.5T in 2016. This is 50X the mobile payments volume in United States.

No wonder, all large consumer tech, commerce and payment companies are getting very aggressive with their “Win Asia” playbooks.

All big tech companies want to scale and establish a strong market presence as fast as they can.

For this very reason, the mobile payments landscape in Asia will be shaped by the big boys, while local regulations and m-commerce trends will define the payments growth.

Two companies that have managed to build a true ‘transactions ecosystem’ are Alipay (Ant Financial) and WeChatPay (Tencent) from China. They are now rapidly expanding their portfolio to offer loans, insurance, and wealth management products.

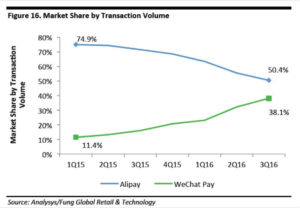

Although Alipay had an early lead, WeChat Pay is fast catching up, thanks to deep advantage around “Commerce” (official accounts within WeChat platform), and “Community” (WeChat/QQ Messaging app).

These two companies now control 90%+ of Chinese mobile payments market.

Phase 2 of growth strategy, for Chinese FinTech giants, is outbound M&A and investments, both in Asia and other parts of the world. This playbook is reflected in recent investments, acquisitions, and partnership announcements: Ascend Money (Thailand, SEA), PayTM (India), and Kakao Pay (South Korea), MoneyGram (US), First Data (US), Flipkart (India).

Also, major US technology companies are planning to get in the arena: WhatsApp Pay, Amazon Pay, PayPal, Android Pay, and ApplePay. Incumbents, Telco’s and Mobile OEM’s are also bringing out their warheads “SamsungPay, CitiPay, and DBS PayLah, etc. yet adoption and usage remain modest at best.

All this is leading to very exciting times for mobile payments market in Asia.

Expect consolidation and more casualties as Chinese and US payments giants “go for the kill” across Asia.

“Bitter end of many & glory for few” : So what’s next ?

Most FinTech “solutions” have been created to do “technology for technology sake” –solving for ‘perceived’ rather than ‘real’ needs.

Most of these wallet companies don’t address the core of issues, i.e. a lack of credit and a large population of underbanked people throughout SEA.

Key Asian markets will follow a mobile payments adoption trajectory very different from that in China, with regulations playing the role of a “launcher” or “spoilsport” at times.

Some wallet companies will also try to “pivot” towards i.e. Credit, Data, Loyalty, AI, etc. to revive their dwindling fortunes.

Struggling wallets companies without proprietary Commerce or Community axis will shut down, consolidate, or get acquired by large payments companies.

Cash to non-cash ratio will invert over the next decade, and consolidation will drive “Ubiquity”.

Payments in Asia may witness a combination of the Indian model of identity and authentication infrastructure and Chinese model of service aggregation at the application layer.

The future of mobile payments in Asia will progress along(or a combination of) these axes:

1) Large (social) commerce platforms controlling the payments pipes (e.g. WeChatPay, AliPay, AmazonPay);

2) Retail Merchant apps that combine customer identity, loyalty programs and seamless payment experience (e.g. MessengerPay, Wal-Mart Pay and Starbucks’ mobile app);

3) Large Payment gateways solving for the merchant side (Omni-channel approach), but well integrated into commerce and community platforms (e.g. Adyen, Stripe, PayU, etc.).

Ultimately, the winners will have all three:

SCALE, COMMUNITY, and COMMERCE.

This article first appeared on Medium

Featured image via Piabay