Fintech can help improve the relationship between Banks and their Customers

by Fintech News Singapore August 9, 2017A report by the The Economist Intelligence Unit noted that while Fintech is an emerging industry that is growing more influential in the banking industry, retail banks will still retain a huge advantage.

By 2020, the bank may no longer manage real-time digital transactions or new account opening, said the report, which was conducted on behalf of banking software giant Temenos and which surveyed 200 global banking executives. Banks, however, still have the three “big Cs” of customers, compliance and capital, said the report.

Yet established banks generally still fail to create a good user experience, added the report. They have much to learn from the fintech providers—consumers want service at their fingertips. Rather than competing with fintech, banks are learning to love fintech in the hope that it will lead to an improvement in their customer relationships.

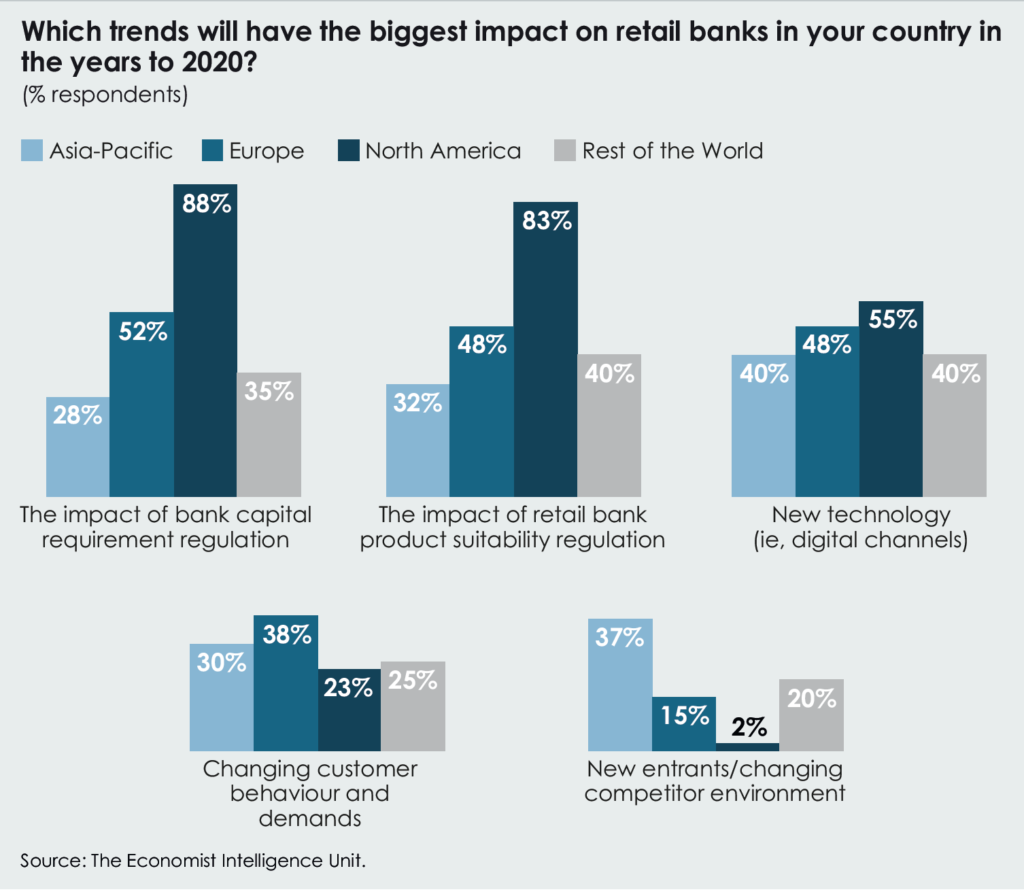

The report noted that 2017 will be the year where a new regulatory front will open up to bring fintech under control. North America, in particular, feels this way.

This regional divergence is particularly striking when it comes to bank capital and product suitability, with over 80% of North American respondents saying they are worried, whereas in Asia the numbers are closer to 30%.

The report also noted that product suitability and transparency rules are tightening. Europe is already way ahead of the US and Asia on product choice, fees and charges. European politicians may soon agree disclosure rules for all retail products, including popular insurance-linked investments, in effect ending bank staff being paid commission.

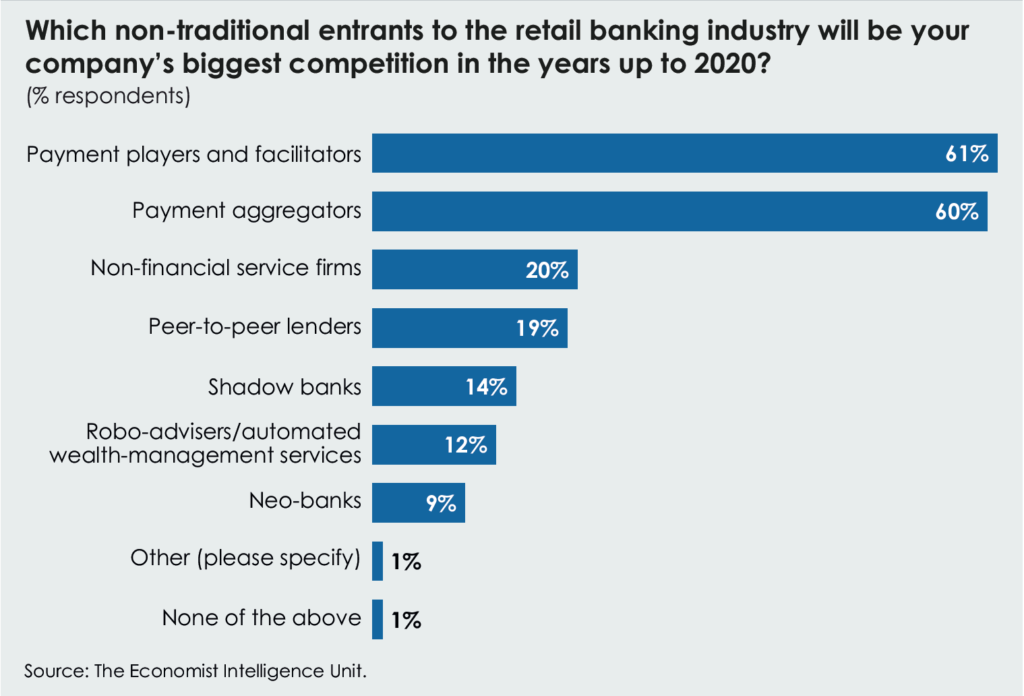

The report highlighted that fear of fintechs has receded quickly, most markedly in North America, as banks finally realise they should either collaborate with each other or with fintechs to ward off attacks. If successful, they could even disrupt the disruptors, undermining the business case for payment apps and lifestyle-led account aggregators, the report continued.

What banks could do to adapt to the new reality

Banks may fear being disintermediated entirely by slick user interfaces (UIs) that integrate lifestyles, shopping, budgeting tools and multiple accounts and cards. But seamless banking poses a serious conundrum for them too. The faster and more automated it becomes, the more open to abuse it is. As a result, regulators are revamping the rulebooks.

The Economic Intelligence Unit cited Peter Brooke, managing director at FTI Consulting, who thinks banks should share information more effectively, rather than report every suspicious transaction. But banks are loath to talk to each other when the police and intelligence, tax and regulatory agencies are listening in, noted the report.

On the other hand, anti-money-laundering and know your customer (KYC) rules could force fintechs to add more staff and new processes, adding to their costs. Investors may not want to pump in more money if profitability is less assured and forced fintech sales could be on the cards.

And as the banking system is forced to open up in the name of fair competition, they need to invest in the customer experience or lose their position of trust. This is also in light of the Second Payment Services Directive (PSD2) debuting in Europe in 2018. PSD2 will force banks to provide account data to non-banks which want them, so apps can grab payments directly rather than politely asking banks for them.

Cloud solutions are indeed a life saver in this regard. Today, third party cloud solutions can bridge the gap while an upgrade is under way, or deliver a full offsite solution at a fraction of the cost of a shiny new mainframe five years ago, said the report.

For banks and fintech to collaborate effectively, the culture at banks must also change. Rigid corporate structures often stifle creative thinking. Bureaucratic purchasing procedures can easily mean that new bank apps often follow—not lead—the market. It added that the more staff realise the potential—and that tech is not just a job destroyer—the more quickly cultures can change.

Fintechs also need to consider their cultures. Tighter regulation and customer mistrust can hit them hard and fast. They will need to find a place for more compliance staff among the app developers and marketeers, said the report.