Buzz vs. Life Changing Innovations. A systemic, a consumer and an innovator point of view.

A couple of months ago, when I read Barclays’ CEO Jes Staley say “Fintech won’t challenge us” I couldn’t help but think of this other quote from Ed Zander in 2006: “Screw the Nano. What the hell does the Nano do? Who listens to 1,000 songs?” (more here CB Insights).

The power of true Innovation can be hard to comprehend. Even industry leaders and the most visionary and creative people have sometimes failed to understand the implications of a truly innovative idea.

Consider this: it took only 7 years for Apple to become the world’s largest music retailer, 18 months for Google to erase 85% of the market capitalization of top GPS companies and only 9 months for Alibaba to become the world’s 4th largest money-market fund (source: Accenture).

There is no doubt that change is on the way with no stop sign in sight. And it’s coming faster than we have ever seen. But where is innovation happening? how much of a threat is it really for banks? what can happen to them? Why is what we hear and what we actually see differ so much?

Civil War: the Assault of the FinTech super-heroes

FinTech startups have been assaulting Financial Services on every front by:

- Lowering customer acquisition cost via an all-mobile customer obsessed strategy and robotic process automation: Monzo and Tandem “neo-banks” 100% mobile and branchless banks;

- Leveraging data science to better handle regulation including anti-money laundry and fraud: Pelican and Riskified provide software-as-a-service fraud and chargeback prevention using machine learning

- Enabling financial inclusion with seamless omni-channel payments and new value-add services: Conversable and AI enable conversational commerce via chatbots and social media and LevelUp enable pre-ordering and payment at many fast food places via QR code & NFC

- Creating new innovative business models via disintermediation like Lending Club and Kabbage.

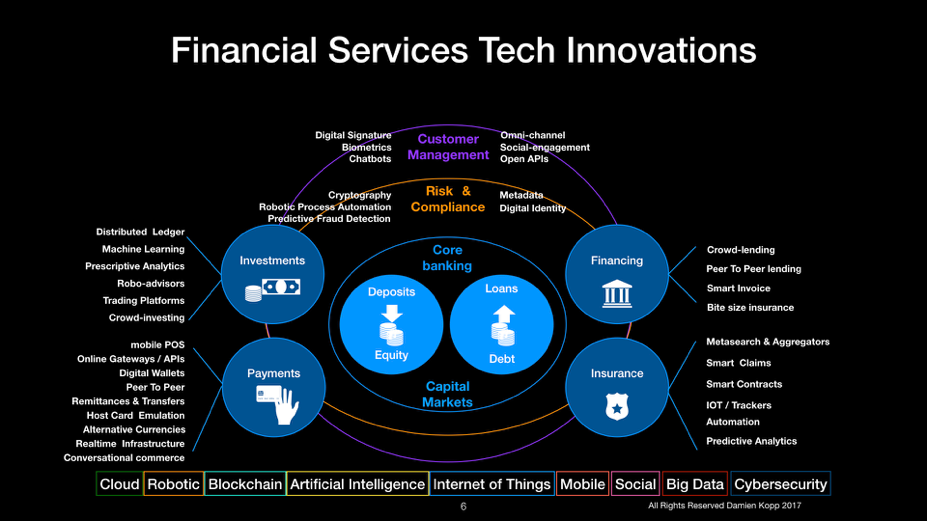

Below is a map of key tech innovations by capability:

FinTech 2.0 is all about collaboration between new entrants and incumbents. But make no mistake: new entrants mean business. Big business. So, at the moment, each side is building up the resistance in the search of an equilibrium playing on each other’s strategic advantage:

- New entrants are focusing on rapid, agile, tech-enabled and low cost solutions. They operate subsidised business models (via external funding from Venture Capital or others) in a green field environment and for the most part, they try to focus on the non-regulated parts of Financial Services. They are provocative and controversial in nature, which creates a wind of change usually welcomed by both consumers and regulators.

- But incumbents also play with their own strategic advantage including their established and captive customer base as well as their trust (although eroded since the 2008 financial crisis). They understand and manage compliance to regulation, know how to operate secure and fire-walled environments, have huge amount of customer data. They have an established brand, scale and usually a regional and often global footprint. Finally, Financial Institutions are systemic to our economies and benefit from a relative protection from most governments: no one knows what will happen if too many fail.

But how much time before new entrants capitalize on their customer relationship? Create massive customer base and capture its data? Master and even influence regulation? It is very likely that complementarities in the collaboration model will erode significantly over time.

Lala Land: Hopes & Disillusions

It’s a fact: there are less deals, less funding, on less start-ups, less seed investments on new techs. About 10% less between 2015 and 2016; and a potential for as low as 18% less based on current Q2 2017 trend according to Venture Scanner.

It’s a fact: there are less deals, less funding, on less start-ups, less seed investments on new techs. About 10% less between 2015 and 2016; and a potential for as low as 18% less based on current Q2 2017 trend according to Venture Scanner.

But to put things into perspectives:

- VC-backed FinTech companies raised $13B across 836 deals in 2016 (CB Insights) and global FinTech investment is estimated at $36B USD (Let’s Talk Payments)

- The combined market capitalisation of top 15 largest banks worldwide is worth $2,500B USD

- JP Morgan market cap alone is worth $311B USD (as of June 2016).

In short: breaking big old markets requires significant capital. So, even with money pouring in, even with great collaboration models, how much time before these innovations become a life changing reality?

Anger Management: The Hype Factor

Peter Thiel said “We wanted flying cars, and instead we got 140 characters”. What is Hype? What is true Innovation?

Peter Thiel said “We wanted flying cars, and instead we got 140 characters”. What is Hype? What is true Innovation?

Hype vs. Innovation

Blockchain

Although Blockchain sounds promising in many aspects, there are critical challenges to be addressed before making significant impact on the existing ecosystem:

- Speed: because decentralisation is made at the expense of speed, blockchain in the context of bitcoin has a capacity of 7 transactions per second when VISA processes 2,000 tps on average

- Energy: the blockchain network’s miners are attempting 450 thousand trillion solutions per second in efforts to validate transactions, using substantial amounts of computing power.

- Adoption: its decentralized nature can be seen as a new risk for personal data leak by the consumers, as well as a control gap by the operators.

Artificial Intelligence

Let’s be clear: AI does not exist, at least not today. What is AI today is “non-sentient and focuses on narrow tasks” as Michael Olaye put it, CEO of Dare and CTO at Oliver Group.

“The promise of AI is generalizable intelligence, the ability to not only learn but to reason, to pattern match, to interact, and I think what we have today is best described as artificial narrow intelligence” said Graciano from Credit Karma, a credit scoring FinTech.

Let’s also consider some frustrating examples on the consumer side:

- Why can’t I get a simple monthly report from my bank(s) about where my money went?

- Why do I see signs all over the place that say “Credit/Debit cards accepted over 10 dollars”?

- Why do I need to pay a financial advisor a fixed percentage fee even if he makes me lose all my money?

None-sense and frustrations are a great source of innovation for entrepreneurs: clearly FinTech have only scratched the surface to date. Why? Because adoption is still very low for many of these new “hype” solutions.

Innovation vs. Execution

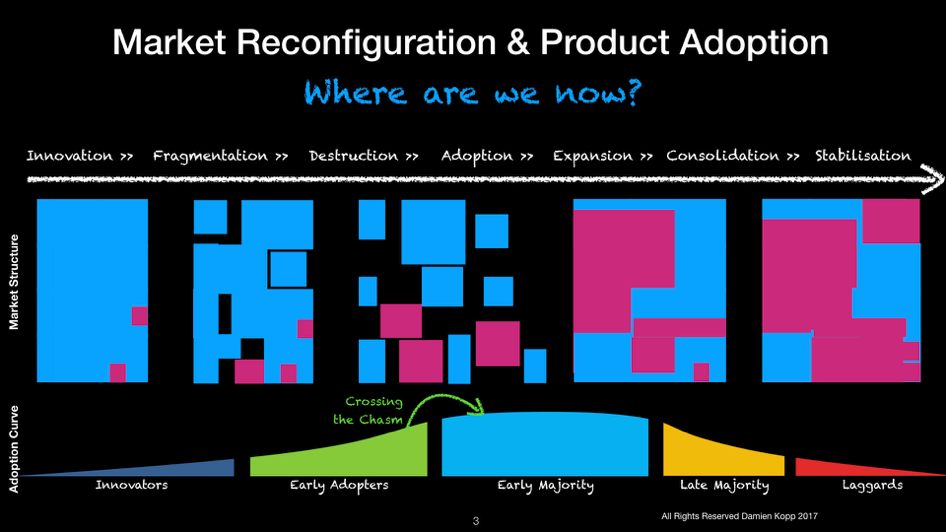

Market reconfiguration and product adoption follow a parallel and correlated path:

- Innovation leads to market fragmentation

- Adoption leads to market consolidation

- Stabilization leads to market reconfiguration

Most of the FinTech innovations have not crossed the chasm yet: main stream consumers have not experienced many of the new benefits they can provide. And perhaps never will.

Because it takes time; and not all changes will succeed:

- Near Field Communication (NFC) barely took off before Apple Pay

- Omni-channel is still not implemented yet by most retailers

- Bluetooth Low Energy (BLE) and beacons are still not mainstream

Very few companies are able to capture the full value of technological innovations.

Conclusion

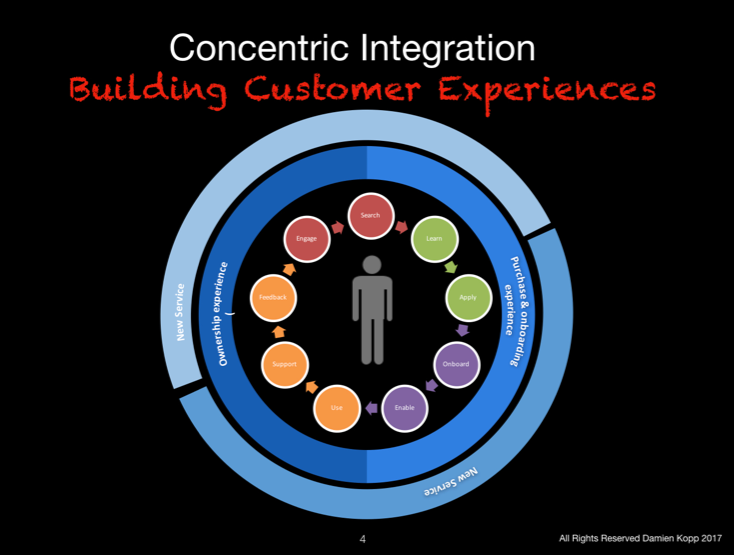

So what’s next for Financial Services? FinTech 3.0 will be about controlling and owning the customer relationship, managing security and mastering how to deal with regulation efficiently (and even lobby, influence and pressure regulators to change it). The key to success is based on their ability to build unforgettable user experience and build around them a portfolio of services: that’s what I call concentric integration.

Big ideas may look stupid to many: if Georges Lucas’ had pitched the first Star Wars movie to you: would you have given him your money?

entrepreneurs are people who see an opportunity where others see an impossibility

Finally, technological progress brings new risks and means more accountability and responsibility. We have a duty to embrace change but also to help building a financial system that is efficient, accessible, secure, resilient.