Fintechnews.PH picks every Friday for you the top 5 Fintech Philippines News of the week:

Here we go:

Growth Of Fintech Gives Filipinos Better Access To Mobile Banking, Loans, Remittance, And Credit

Mynt, the financial technology (fintech) subsidiary of Globe Telecom, said ordinary Filipinos can now avail of affordable financial products and services like mobile banking, remittance, insurance, loans, and credit as the use of technology and innovation continues to be more pervasive in the Philippines. (Read more)

Dynamic, but below the radar: Fintech in the Philippines

Despite having one of the youngest populations in Asia that enjoys steep mobile penetration rate and soaring internet usage, the Philippines struggles to become a digital economy. (Read more)

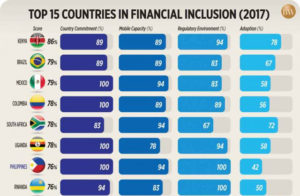

PH tops Asia on financial inclusion list as policies expand banking access

MANILA – The Philippines remains Asia’s leader in financial inclusion due to policies supportive of wider banking access, the Brookings Institution said in a report, even as the country slipped a rung from its rank a year ago. (Read more)

IDC Urges Local Fintechs To Be ‘More Aggressive’

Philippine financial technology (fintech) companies should take advantage of growing market opportunities by taking aggressive action, market intelligence and advisory services provider International Data Corporation (IDC) said. (Read more)

Financial inclusion still lacking in PH

Consumer access to financing remains in issue in the Philippines despite inclusion advances, an official of a micropayment services firm said. (Read more)