Essentia Analytics: Using Behavioral And Data Science To Improve Investment Peformance

by Fintech News Singapore December 29, 2015Essentia Analytics uses behavioral science and data science to provide professional investors with an enhanced understanding of their own behavior. The purpose is for them to become aware of their strengths and avoid acting on cognitive bias.

Clare Flynn Levy, Essentia Analytics’ founder and CEO, launched her startup after having worked ten years as a fund manager. The idea of Essentia Analytics emerged following the observation that up to date decision support tools monitor data from outside, gathering data about what people are doing.

“We look inward. If your bad habits or lack of self-awareness are causing you to not maximize your own skills or engage in investment decisions that are inefficient, than no amount of outside data will help you,” Flynn Levy told Finextra in an interview in January.

Hence, with the help of leading neuroscientists, software engineers and ex-fund managers, Essentia Analytics has built a technology that allows traders and portfolio managers to focus on their own behaviors, allowing them to improve their productivity and referenceability of their investment processes.

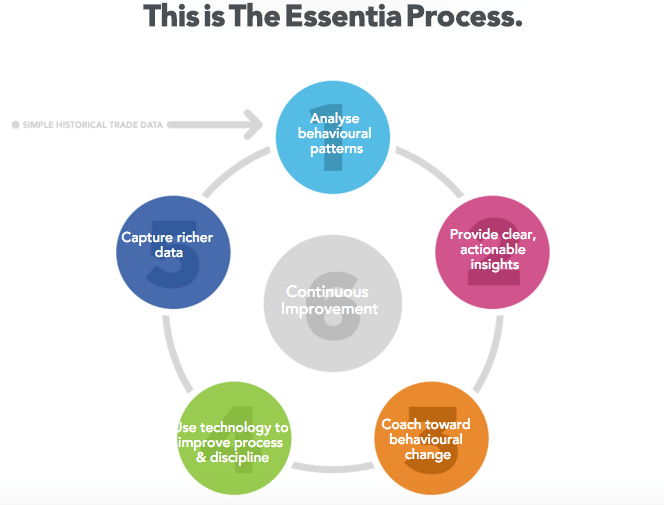

Infographic Essentia Analytics – Image credit: http://www.essentia-analytics.com/

“What Essentia does is make it simple to track and reflect upon your own investment process,” Flynn Levy told Water Technology in an interview back in 2014.

“Essentia is the software I wish I had when I was a fund manager.”

Essentially, the technology focuses on understanding the full context in which investment decisions are being made and is all about making it easier for professional investors to use big data analytics and benefit from these techs.

Along with analyzing historical trade data, Essentia Analytics also provides productivity tools that allow portfolio managers and analysts to organize their investment ideas while collecting data about the intent behind, and contexts surrounding those ideas.

The company has been extensively recognized for its work, earning in early January 2015, the Best Performance Data Analytics Award at The Hedge Fund Journal Awards, and named in March as one of the world’s 20 most promising capital market technology solution providers by CIO Review.

Other fintech startups have been using behavioral science, for instance, to help individuals refinance their debt, as it is the case of Payoff.

Instead of managing multiple, high-interest payments each month, Payoff simplifies them down to one monthly payment. With lower rates than credit cards, the Payoff Loan is designed to allow people to get rid of US$5,000 to US$25,000 of their credit card debt as quickly as possible.

To determine appropriate offers to applicants, Payoff looks at three behavioral elements: historical credit performance, cash flow and behavioral data.

Clare Flynn Levy, the founder and CEO of Essential Analytics, in an interview with CXO Corner:

Image credit: Data, Analytics, Shutterstock.com.