OCBC Bank Singapore Goes Voice Recognition Technology For Business Banking Mobile Solutions

by Fintech News Singapore October 4, 2017OCBC Bank continues to break new ground in its drive to make banking simple, fast and convenient for its business customers.

In its latest industry-leading innovation in Asia, its SME customers will be able to initiate funds transfers to business associates’ OCBC Bank accounts and make account balance enquiries using Siri, Apple’s voice-controlled personal assistant. These features will be available from 9 October 2017 to SME customers using iPhones running on Apple’s iOS 11 mobile operating system. Over 120,000 Singapore registered users of OCBC Bank’s internet business banking portal, Velocity@ocbc, stand to benefit.

OCBC OneTouch | via OCBC.com

This use of voice recognition technology will allow SME owners to perform banking transactions while on the move. They will only have to tell Siri whom to send the payment to and how much they want to send or ask Siri to check their account balance. Validation will be done via fingerprint authentication (“OCBC One TouchTM”) and One Time Passwords (OTP) sent via SMS, which are secure and quick. e-Payments to other OCBC Bank business accounts and account balance enquiries are two of the more commonly-used business banking services.

The volume of e-payments between OCBC Bank business accounts performed via Velocity@ocbc saw 33% growth from July 2015 to July 2017; enquiries relating to business account balances via the business mobile banking app, OCBC Business Mobile Banking app, has increased by 110% since June last year.

e-Payments to other OCBC Bank business accounts and account balance enquiries are two of the more commonly-used business banking services. The volume of e-payments between OCBC Bank business accounts performed via Velocity@ocbc saw 33% growth from July 2015 to July 2017; enquiries relating to business account balances via the business mobile banking app, OCBC Business Mobile Banking app, has increased by 110% since June last year.

Said Mr Linus Goh, Head of Global Commercial Banking, OCBC Bank:

Linus Goh

“We are pleased to be leading the charge in Asia in introducing voice banking to our business customers. SME business owners are time-starved and constantly on the go, and we believe these innovative solutions based on voice recognition technology will vastly improve the way in which our customers manage their everyday business banking needs.

“We started a journey with our SME customers more than a decade ago to deliver simple, fast and convenient banking services and continue to collaborate with them today to challenge the way banking is served, offering a glimpse of the future of banking in a digital world. This launch of voice banking signals the beginning of a new wave of digital services that we will deliver for our business customers.”

OCBC Bank in April last year became the first bank to offer a business mobile banking app, OCBC Business Mobile Banking app, that featured biometric authentication. This was made possible by OCBC OneTouchTM, which allowed users with Touch ID enabled iPhones to view account balances, check the status of incoming and outgoing funds as well as view debit card transactions at the touch of a finger. This innovation – developed by OCBC Bank’s in-house mobile developer team – together with the new Siri features, are in line with Singapore’s Smart Nation and e-payments push as they encourage business owners to embrace paperless transactions.

Said Mr Praveen Raina, Senior Vice President, Group Operations & Technology, OCBC Bank: “The e-payments push is not just about

Mr Praveen Raina

“The e-payments push is not just about peer-to- peer payments, but encompasses business-to-business payments too. We have already made online and mobile banking easy for SMEs in order to encourage them to go cashless. Voice recognition technology is integral to this, and it is easy to envision the use of Siri to make e payments, or to check account balances, becoming second nature to business owners.

“But to really improve e-payment adoption rates, we have to make e-banking more intuitive and seamlessly integrate it into everyday life, so that our business customers have all their banking needs at their fingertips. This is very much aligned to Singapore’s Smart Nation vision.”

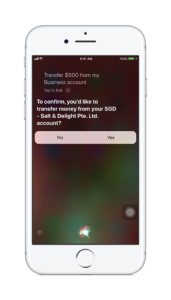

Making an e-payment with Siri

Step 1: Ask Siri to make a transfer from your business account, verifying the request using OCBC One TouchTM authentication.

Step 2: Confirm the account the payment is to be made from.

Step 3: Select the account from the payee list.

Step 4: Verify amount and click “Transfer”.

Step 5: Enter SMS OTP to review payment details and complete the transfer.

Checking account balances with Siri

Step 1: Ask Siri to check your account balance.

Step 2: Verify the request using OCBC One TouchTM authentication.

Other OCBC Business Mobile Banking app enhancements

OCBC one-time password

iPhone users will also benefit from the following enhancements to the OCBC Business Mobile Banking app from 9 October 2017:

- Add new payee in one step

SME owners will be able to add a new payee when making a first-time e- payment to them, in just one step via the app. Once verified via security token, the transaction will be carried out and the new payee simultaneously added to the payee list to make future payments even more convenient.

- Authorisation of transactions using SMS One-Time Password instead of Security Token

SME owners will be able to use an SMS OTP to authorise transactions instead of a security token, which will minimise the friction associated with making funds transfer via the app. This applies to transactions of amounts up to S$20,000, to those on an SME owner’s payee list.

OCBC Business Mobile Banking app is available on the App Store.