Often in conversation with industry players in Malaysia, the sentiment is that Malaysia is lacking in activity within the fintech space and the the fintech startups in Malaysia are still pretty nascent. The general impression from the market is that there’s a lack of innovative fintech startups in Malaysia.

My belief is that, these statements are often a misconception, the reality is that there are some fintech startups in Malaysia with strong growth potential however, the challenge is that many of them often fly under the radar.

This article intends to highlight some fintech startups in Malaysia that we feel are noteworthy. Do note that, the list is arranged alphabetically and does not indicate hierarchy or ranking.

1. Capital Bay

Image Credit: Vulcan Post

What Does the Company Do?

Capital Bay helps corporations optimise their working capital and provide businesses real-time technology to collaborate with a wider network of financial institutions to access financing opportunities. They were among the 5 startups selected for Hong Leong Bank’s inaugural Launchpad programme.

Who’s Behind the Company?

The company is founded by Edwin Tan, Ang Xin Xiang and Dion Tan. Both Edwin and Ang Xin Xiang graduated from Oxford and then had a career in consulting . Dion Tan who is the person leading business development for the company is also currently the Group Managing Director for a large public listed property development company in Malaysia named Tropicana Corporation Berhad.

Funding

Seed Round – 472310.84 USD ( 2 Million MYR) KK Fund

Why We Selected Them

- Cashflow is the lifeblood of many SME businesses, CapitalBay addresses this need

- 98.5% of all Malaysian businesses are SMEs

- Niche business – there are no incumbent players operating in this space within Malaysia

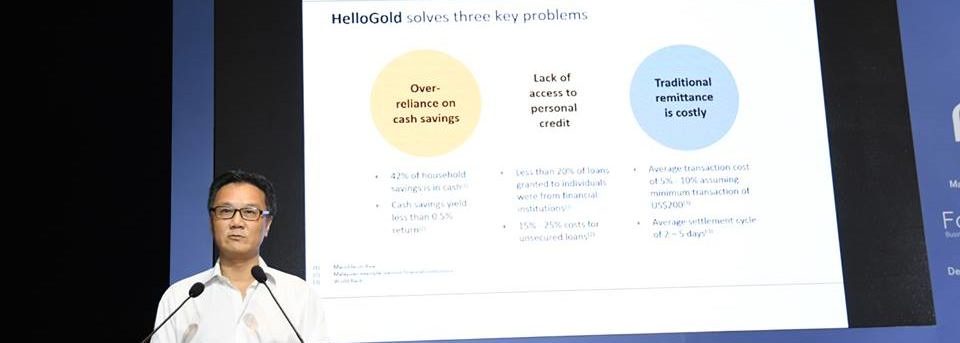

2. HelloGold

Image Credit: Hello Gold Facebook Page

What Does The Company Do?

Founded in 2015 and headquartered in Kuala Lumpur, HelloGold blends gold trading with blockchain technologies. Its app allows for customers to buy and sell physical gold for a minimum price of RM 1. In 2017, Hello Gold was one of the 8 startups out 400 startups across 44 countries selected to be select under the UOB FinLab fintech accelerator programmes.

Who’s Behind the Company

The founder of the company, Robin Lee was a former CFO for the World Gold Council. He is supported by a team of experienced former bankers and retail professional with experiences ranging from marketing. The team is also backed by an experienced lead developer with expertise in blockchain technology.

Funding

ICO – USD 4 Million

Why we selected them

- Asia’s affinity strong for gold

- Partnerships with AEON (a retailer with over 4 million customers in Malaysia) and UOB FinLab

- A strong management team

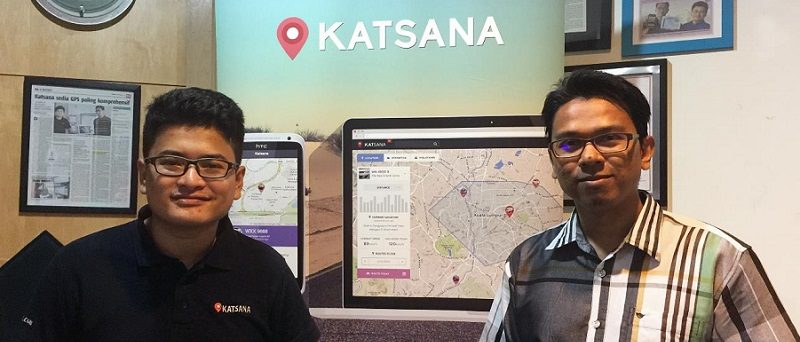

3. Katsana

Image Credit: Digital News Asia

What Does the Company Do?

Founded in 2013 Katsana develops connected car technologies for usage based insurance and to reduce motor claims using behaviour data. The company has analysed over 400 million kilometres of driving behaviour and recovered 96% of the vehicles that are stolen.

Who’s Behind the Company

The company is founded by Fuqaha and Mohd Irwan. Fuqaha comes from an architecture background he then moved on former project manager for JomSocial, a social platform for Joomla. Irwan brings hardware expertise at Katsana.

Funding

893,356 USD – Axiata Digital Innovation Fund

Why We Selected Them

- Motor detarification is in full-gear and Katsana is well positioned to take advantage of it

- Malaysia ranks 20th in the world for death by road accidents

- With little recent innovations in the insurance industry in Malaysia, it is prime for disruption

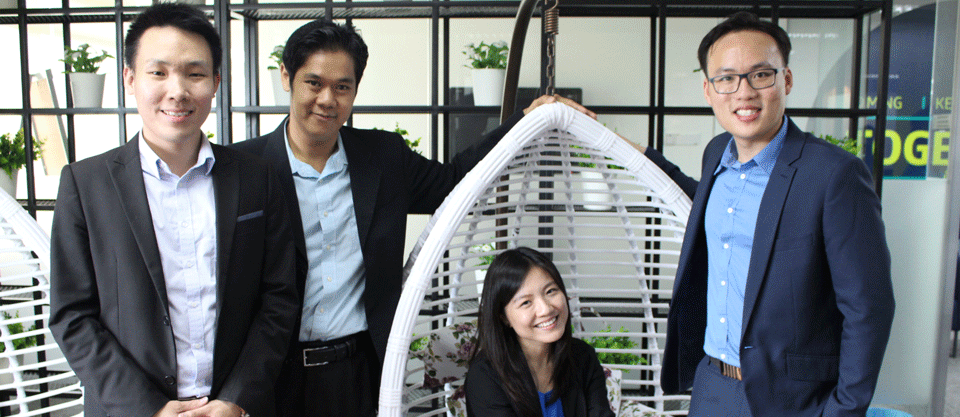

4. MHub

Image Credit: MHub

MHub is real-estate fintech platform for property developers, agents and bankers to connect, communicate and collaborate towards faster, higher conversion. It enables a digital showroom, credit check and loan tracking.

MHub is real-estate fintech platform for property developers, agents and bankers to connect, communicate and collaborate towards faster, higher conversion. It enables a digital showroom, credit check and loan tracking.

Who’s Behind the Company

The company is founded by Quek Wee Siong, Jason Ding, Joshua Ong, and Jon Saw. Their experience include sales, marketing, design, web development, banking, real estate and full stack development

Funding

Undisclosed

Why We Selected Them

- Strong numbers – Over 184 Million USD (800 Million MYR) bookings made on their platform

- Established business relationship with 15 banks

- Credit tightening for mortgage loans in Malaysia makes for an appealing case for Mhub services of providing qualified leads to banks

5. MoneyMatch

Image Credit: MoneyMatch

What Does the Company Do?

MoneyMatch is one of the four fintech companies approved under the Bank Negara Malaysia Sandbox. The company provides peer to peer currency exchange and cross border remittance which are both powered by a one-time e-KYC verification.

Who’s Behind the Company?

The management consists of individuals with diverse skill sets,ranging from investment banking to creative digital marketing.

Funding

- Pre Seed from WTF Accelerator – 18,000 USD

- Seed from Kosciuszko Holdings – 150,000 USD

- Pre Series A Funding – Undisclosed Amount lead by angel invest Azran Osman Rani, CEO iflix

Why we selected the company?

- Malaysia Remittance Industry is expected to record outflows of USD 28.8 billion by 2019

- MoneyMatch is one of the 4 companies approved under the Bank Negara Malaysia’s Fintech Sandbox

- Experienced management team and board member

6. MyCash Online

Image Credit: MyCash Online

What Does the Company Do?

Founded in 2016 MyCash is an E-Marketplace for migrants that enables migrants to top-up their mobile phones, purchase bus tickets and make bill payments. Recently MyCash Online won the Best Social Impact Startup at the Malaysian Rice Bowl Awards.

Who’s Behind the Company?

The is founded by Mehedi Hassan who himself a migrant from Bangladesh, he’s been in Malaysia for 10 years and started his career as Software & Mobile Application Developer. In 2014 he founded his first startup that is focused on providing streaming content for the migrant community.

Funding

Series A Funding -306929.54 USD (MYR 1.3 Million) through funding round lead by Cradle Fund on ECF platform pitchIN

Why We Selected Them

- Malaysia’s strong migrant population of 11.3% makes for a compelling case MyCash Online

- Untapped market – there is little competition addressing this space

- The founder being a migrant himself offers insights that what the market needs

7. Neuroware

Image Credit: Neuroware

What Does the Company Do?

Neuroware helps organisations future proof themselves by defining new opportunities by adoption blockchain technologies. They have worked with organisations such as Maybank, Bank Negara Malaysia, & Securities Commission Malaysia.

Who’s Behind the Company

The company is founded by Mark Smalley, Ruben Tan & Zayan Hassin. Both Mark and Ruben has strong technical expertise in blockchain and they are supported by Zayan who leads the marketing initiatives.

Funding

Undisclosed

Why We Selected Them

- Early pioneer – Neuroware was one of the first companies providing blockchain-agnostic solutions in Malaysia

- Business plan – while they do and have work with banks they do not restrict themselves to the FSI market

- Malaysian Government agencies are increasingly open to exploring blockchain

8. Policy Street

Image Credit: Policy Street

What Does The Company Do?

Founded in 2017, PolicyStreet sells a wide range of curated and simple insurance policies. It offers insurances products for common consumer needs such as travel, dental and personal accidents as well as niche ones such as musical instruments, photography gear and pets.

Who’s Behind the Company?

The company is founded by Lee Yen Ming, Wilson Beh and Winnie Chua. They are an experienced group of former banking and insurance professionals. As a team they are backed by a wealth of experience in marketing financial products and underrating profitable insurance portfolios in their past careers.

Funding

Seed Fund from KK Fund- 500,000 USD

Why We Selected Them?

- They fill a niche that’s not generally addressed by traditional insurance agents.

- Low barrier of entry – they offer affordable insurance policies

- Big market opportunity – Malaysia is a severely under insured country hovering at 55%

9. pitchIN

Image Credit – Dealstreetasia

What Does The Company Do?

pitchIN is one of the 6 crowdfunding platform approved under the Securities Commission of Malaysia in 2015. In this two years they have helped local startups like BabyDash, Wobb, Kakitangan.com, MyCash Online raise fund for their businesses.

Who’s Behind the Company

The company is lead by seasoned professionals who hailed a wide range of expertise with some of the founders being former regulators, bankers, entrepreneur and running tech accelerators.

Why We Selected Them?

- Strong numbers – they have crowdfunded over RM 12 Million (approx 2.8 million USD) for startups since their operations started.

- Business Acumen – pitchIN has been able to pick and attract great startups to raise on their platform

- Strong partners – pitchIN works closely with Cradle Fund to lead investment rounds. Cradle Fund is Malaysia’s early stage start-up influencer, incorporated under the Ministry of Finance Malaysia

10. PrimeKeeper

Image Credit: PrimeKeeper

What Does the Company Do?

PrimeKeeper is a fintech startup with two core services.Prime ID which is a digital identity that is intended to be used for any formal applications that requires legal identification such loan applications, insurance applications and more. PrimePay enables CASA to CASA payments whether to businesses or individuals.

Who’s Behind the Company

PrimeKeeper is founded by Jeremy Chong who’s a music executive turned fintech entreprenuer.

Why We Selected Them

- Innovative solution that links directly to bank accounts which enables CASA to CASA payments

- Malaysia gearing up towards acceptance of cashless payments

- Bank Negara Malaysia’s push towards cashless payments

11. Sedania As-Salam Capital

Image Credit: BFM

What Does the Company Do?

Sedania As- Salam capital runs the As-Sidq™ platform, which is an Islamic Financial Tawarruq (Fund-raising) Trading Platform by 20 financial institutions in Malaysia.

Who’s Behind the Company?

Most recently he co-founded RHT Solutions The company was founded by Mohd Ridzuan Abdul Aziz with 12 years of compliance experience. Prior to that Ridzwan worked with a Malaysian regulator for 4 years.

Funding

Acquisition by Sedania Innovator – 2.8 Million USD ( 12 million MYR)

Why We Selected Them

- Islamic Capital Market consist of 60% of the Malaysian Capital Market

- Strong fundementals – adopted by 20 banks in Malaysia and processed over 300,000 transactions worth over 5.9 Billion USD (25 Billion MYR)

- Strong potential for regional expansion to Pakistan, Indonesia and Bangladesh

12. Soft Space

Image Credit Soft Space

What Does The Company Do?

Soft Space is a digital payments company that focuses on the development of solutions for the e banking and payment industry. Soft Space is considered as one of the first companies to successfully introduce mPOS to the market. The company has more than 17 banking clients in 10 countries.

Who’s Behind the Company

The team consists of a top management team that has strong background in technology, risk management, and a wealth of experience running startups and payments companies. In 2014 Soft Space acquired Fasspay bring on board Joel Tay as the CEO for Soft Space while the founder Chang Chew Soon assumes the Group CEO role.

Funding

Series A from transcosmos Inc – 5,000,000 USD

Why we selected them

- Business savvy management team

- Solid track record of regional clients

- Strong growth since its inception in 2012

These are the 12 Fintech Startups in Malaysia that we feel deserves your attention, do you agree with our list? Feel free to leave a comment below and let us know. If you want to find out more about the fintech landscape in Malaysia do check out Fintech Malaysia Report 2017 or if you’d like to check out the full list of fintech companies and startups in Malaysia do check out our list here.