Posts From Vincent Fong

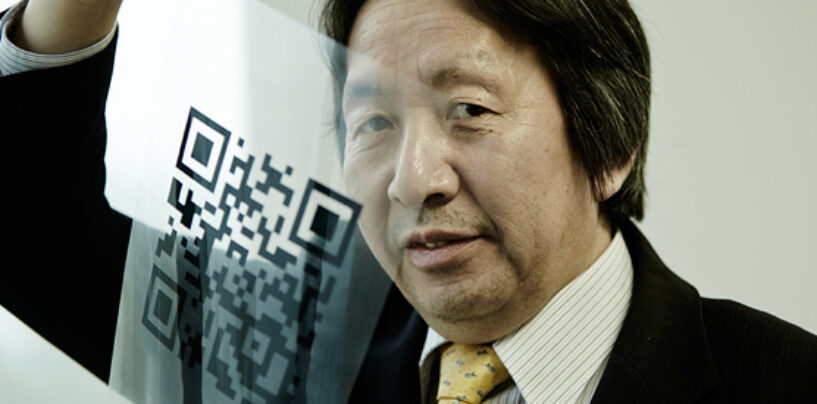

With Mobile Payments on the Rise, Creator of QR Codes Thinks It Needs a Security Revamp

QR Codes were first invented in 1994 by Japanese engineer Masahiro Hara. When it was created for Denso, they were originally used for manufacturing and issuing tickets and coupons. Never in Masahori Hara’s wildest dream did he imagine that his

Read More“Satoshi Nakamoto” Apparently Lost 980,000 Bitcoins to Hard Drive Failure

One of the biggest veils of mystery surrounding the world of cryptocurrency is the identity of Satoshi Nakamoto the creator of Bitcoin. His/her (their?) whitepaper, of course, laid the foundation to an entire blockchain and cryptocurrency industry today. Given the

Read MoreIs Singapore Gunning to Be an Islamic Fintech Hub?

Singapore recently declared its intention to develop the ‘most advanced’ halal hub in Southeast Asia within the next two years. While the announcement primarily looked Singapore as a halal hub within the food industry, given Singapore’s status a fintech hub

Read MoreRipple Secures Their First Malaysian Bank Partnership with CIMB

CIMB Group and Ripple have entered into a strategic collaboration to enable instant cross border payments across its various markets. On the back of this partnership, CIMB will join Ripple’s network RippleNet, which will facilitate access to other RippleNet members

Read MoreNeo Banks and Challenger Banks in Asia: Ready for Prime Time?

When challenger banks were first introduced to the markets in Europe many pundits have touted it (perhaps over-enthusiastically) the destroyers of banks. Promising to upend the banking sector as we know it and drastically transform the way consumers experience financial

Read MoreOpen Banking In Asia – A Breakdown of Initiatives Across The Region

Globally the open banking movement is gaining traction, fueled largely by EU’s P2D2 and the UK’s CMA Open Banking and a combination of banks’ internal efforts and market initiatives. While during the earlier years, much of the open banking initiatives were

Read MoreFintech Malaysia 2017 in Review

The year 2017, has been an interesting year for the Fintech Malaysia scene, while there’s been progress in this scene in the past few years it was really in 2017 that we see fintech being increasingly mainstream in the Malaysian

Read MoreSecurities Commission Malaysia Regulatory Sandbox Calls for Participation

The Securities Commission Malaysia (SC) today announced that parties interested in establishing and operating an Alternative Trading System (ATS) in Malaysia can apply to participate in the Securities Commission Malaysia regulatory sandbox sessions. The Securities Commission Regulatory sandbox will be

Read MoreStartup Korea: Is Korea Conducive for Fintech Startups?

Earlier this month I had the opportunity to the attend the Korean Startup Festival 2017, which is part of the efforts of the Korean Ministry of SMEs and Startups to gather thousands of startups, VCs and international media to shine

Read MoreBank Negara Malaysia Seeks Public Feedback on Cryptocurrency Regulation

The rapid development and adoption of cryptocurrencies have driven regulators from around the globe to adopt various approaches and regulatory measures and Malaysia is no exception. Following the announcement by Bank Negara Malaysia Governor, Tan Sri Muhammad Ibrahim in late

Read More