Singapore recently declared its intention to develop the ‘most advanced’ halal hub in Southeast Asia within the next two years.

While the announcement primarily looked Singapore as a halal hub within the food industry, given Singapore’s status a fintech hub and its past attempts to tap into the islamic finance market, it might not be too far fetched to extrapolate that Singapore might soon have its eyes set on being an Islamic fintech hub.

The fact that there are are close to 2 billion Muslims in the world and a market size that worth US$ 2 trillion would serve as pretty a pretty strong motivation for Singapore to steer towards this direction.

In this piece, we explore how likely it is for Singapore cement itself as an Islamic fintech hub and how it might fare against its neighbours.

Singapore will have a hard time competing with its neighbours

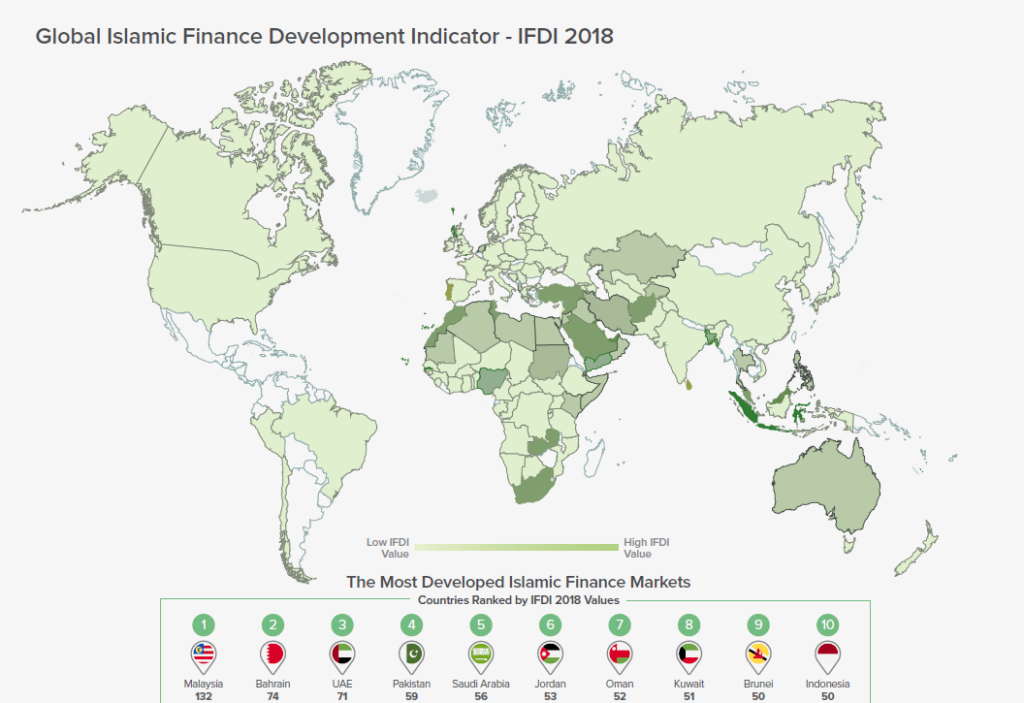

This would be a journey that is fraught with challenges, in terms of Islamic fintech or Islamic finance in general, Singapore has a lot of catching up to do compared to its neighbours Indonesia and Malaysia — both of which are ranked top 10 in the world.

Image Credit: Salaam Gateway, Islamic Finance Report 2018

Malaysia and Indonesia’s success in this space is thanks in no small part to its large Muslim population and strong governmental support. With its small Muslim population of 14%, it would seem laughable to some for Singapore to even think of competing with its neighbours’ largely Muslim citizens.

Fortunately, Singapore doesn’t have to

More likely than not, Singapore will turn to its regular playbook of positioning itself as a gateway to these lucrative markets instead of fighting these countries head on.

This notion seems to be echoed by CIMB Singapore’s Country Manager, Baharom Sazali. He feels that Singapore has an advantage of being in proximity of the most populous Muslim countries.

If Singapore’s position as ASEAN’s fintech hub is any indication, an addressable market size is not only factor at play. A combination of conducive regulation, funding availability, favourable business conditions, and talent availability all play a big role.

It’s matter of flipping a switch

Singapore already have all the right ingredients to make this work, all it needs to do is flip a switch. While the island nation have yet to completely flip that proverbial switch, there are pockets of activities that suggest that there is some degree of interest in this space.

As recent as last year, FTSE Russell, Singapore Press Holdings (SPH), and Singapore Exchange (SGX) launched the FTSE ST Singapore Shariah Index, the index consists of a combination of 100 the largest companies from Japan, Singapore Taiwan, Korea and Hong Kong that are Shariah compliant.

This signals the city-state’s renewed interest into Islamic finance products after an unsuccessful first attempt many years back.

In theory many of Singapore’s fintech startups like Stashaway, Funding Societies and Bambu could create a dedicated shariah compliant product line to cater to this growing market.

If marketed correctly, many of the Muslim retail investors within Malaysia and Indonesia would even be interested in investing in these product line simply because they don’t not want to have their investment portfolio purely limited to their respective local currency.

Should Malaysia and Indonesia be afraid?

For now, maybe not. Singapore has not formally announced any strategic plans to position itself as an islamic fintech hub.

But we can’t rule out the possibility of Singapore using what it has learned from positioning itself as ASEAN’s fintech hub and do the same with Islamic fintech.

When you consider that Asia Pacific makes up over 60% of the global Muslim population, and the fact there’s a growing trend of non-Muslims’ growing interest in Islamic finance; it’s not hard to imagine a future where Singapore tries to make a name in this space.

In short, Malaysia and Indonesia should not rest on its laurels — Singapore might be coming for you.

Featured Image Credit: National Heritage Board Facebook