Secretive Startup Tests Wealthtech Product in Singapore Fintech Regulatory Sandbox

by Fintech News Singapore October 26, 2017Did you know that next to PolicyPal there is one more Fintech Startup in the MAS Singapore Fintech Sandbox?

A secretive fintech startup is currently experimenting with a wealthtech product in the Monetary Authority of Singapore (MAS) Fintech Regulatory Sandbox.

The startup, called Kristal Advisors, provides an artificial intelligence (AI) enabled digital asset management platform that gives investors access to curated portfolios from the world’s top portfolio managers. The portfolios are based on the in-depth financial knowledge and investment experience of experienced traders across the world.

“At Kristal.ai, we leverage on … machine learning techniques to build our investment robo-advisor,” reads a blog post.

“We mirror the semantics of how financial advisors have always operated – analyzing the market, clients’ existing portfolios, and clients’ needs to make a recommendation.

“Just like how financial advisors make better recommendations when they become more familiar with the client and markets, the robo-advisor learns the same way – and will be able to give more appropriate recommendations with more experience and training.”

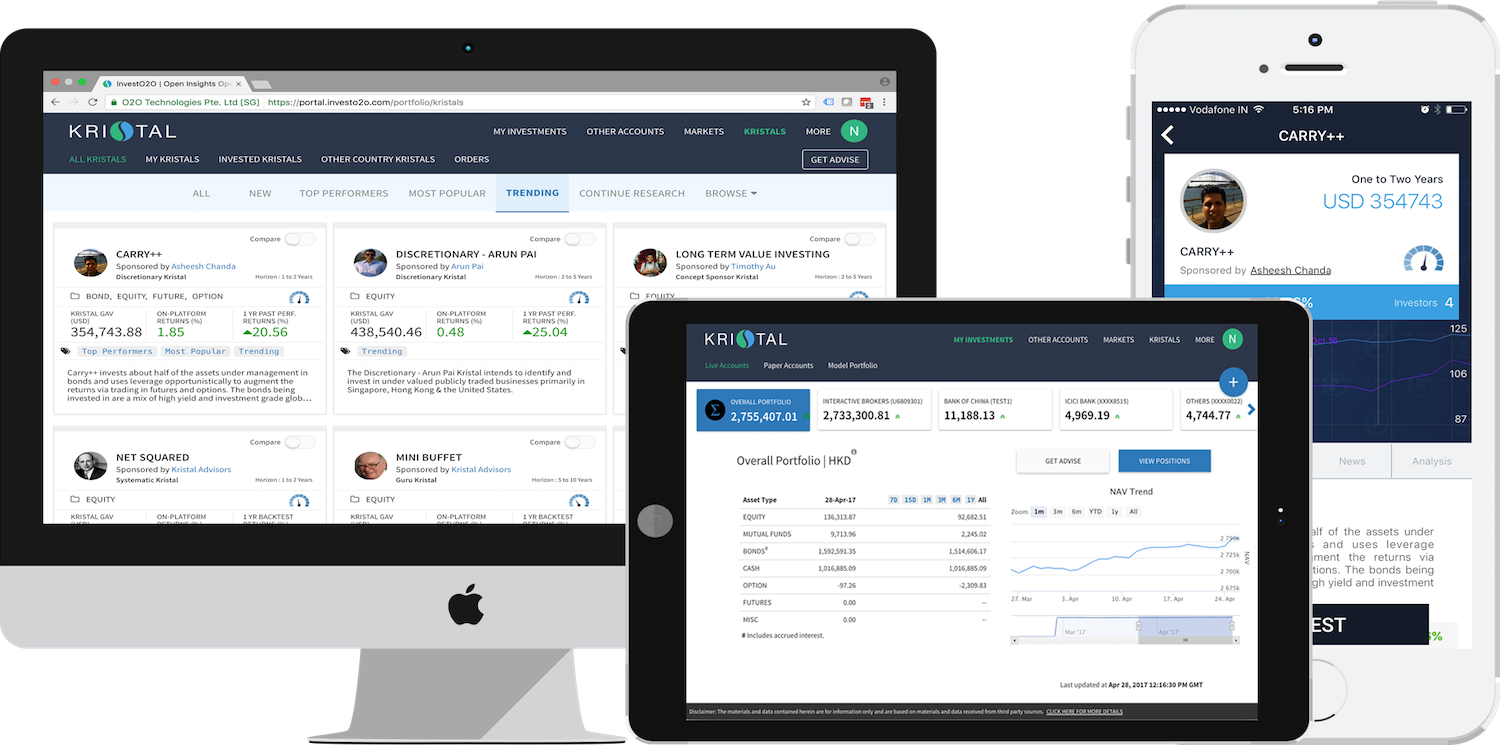

On the Kristal platform, users can search for “Kristals” or portfolios, understand the investment style, and check past performance. Using the company’s recommendation engine, it chooses Kristals that match a customer’s investing style and objectives.

The client then completes the KYC process, confirms the amount he or she wishes to invest and places orders online. He or she can also open accounts online with the required brokers if needed.

Customers can track their Kristals’ performances transparently on the platform with real-time view into their investments via the web portal or mobile app.

Kristal is licensed in three countries and operates in Singapore (through the MAS sandbox at the moment), Hong Kong, and India.

Kristal entered the MAS Fintech Regulatory Sandbox on August 10 and will be experimenting with its product until May 10, 2018. It followed PolicyPal, the first startup to graduate from the sandbox back in August.

PolicyPal, which began operations as a registered direct insurance broker and exempt financial adviser after completing the program, has developed an app that uses AI to simplify and digitize insurance, allowing both customers and organizations to simplify the management of insurance policies.

The MAS Fintech Regulatory Sandbox was launched in June 2016 to allow startups and firms to experiment with fintech solutions in a “safe environment.”

Depending on the experiment, MAS provides the appropriate regulatory support by relaxing specific legal and regulatory requirements.

Upon successful experimentation and on exiting the sandbox, the startup is required to fully comply with the relevant legal and regulatory requirements.