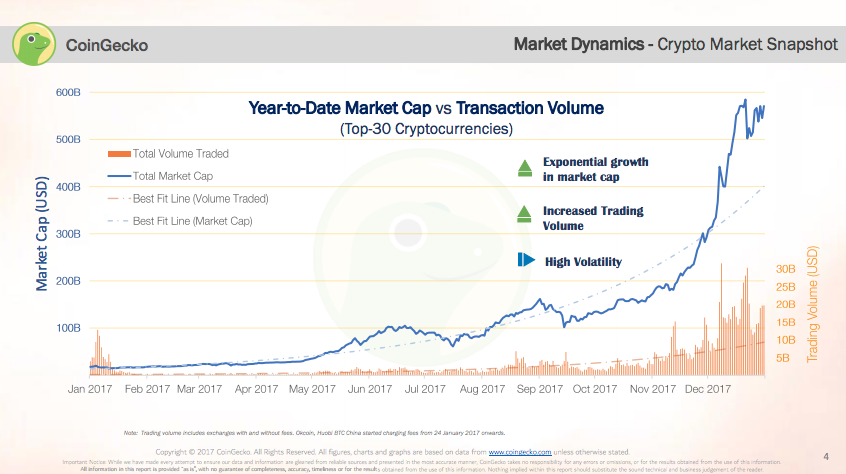

2017 was an incredible year for the cryptocurrency space which saw the creation of more than 100 crypto-based hedge funds, a market capitalization that surpassed half a trillion dollars and billions of dollars raised through initial coin offerings (ICOs), according to a new report by CoinGecko.

2017 brought the overall cryptocurrency market under the spotlight with the altcoin market rising from US$2.2 billion at the beginning of the year to more than US$350 billion by the end of it.

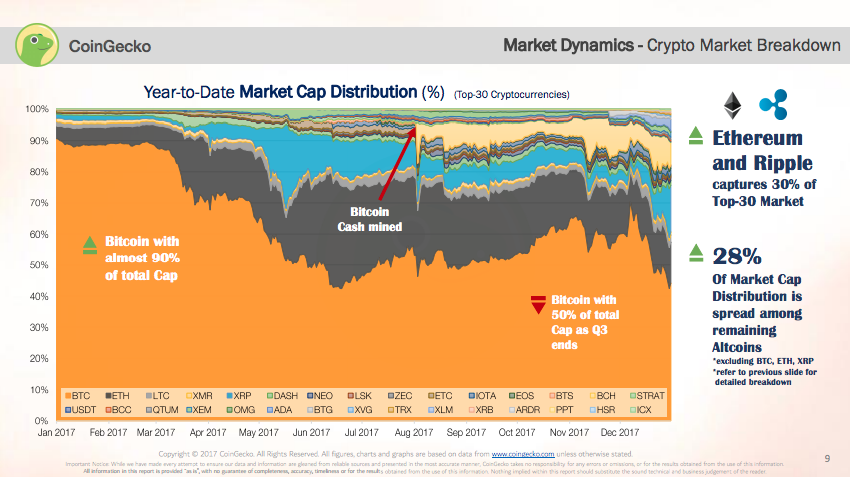

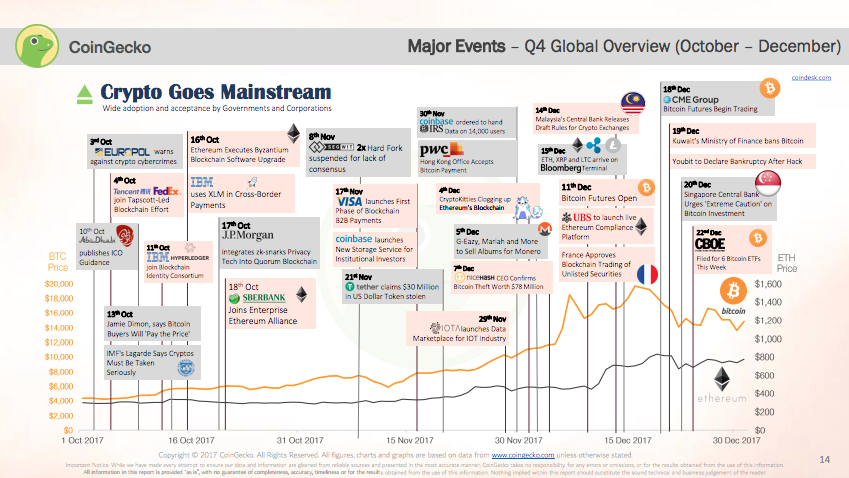

Bitcoin’s dominance shrank towards the end of 2017 to fall below 50% and reach new all-time low levels. Meanwhile, Ripple surged past Ethereum to become the second largest cryptocurrency (for a brief period of time), representing at some point 14% of the total market.

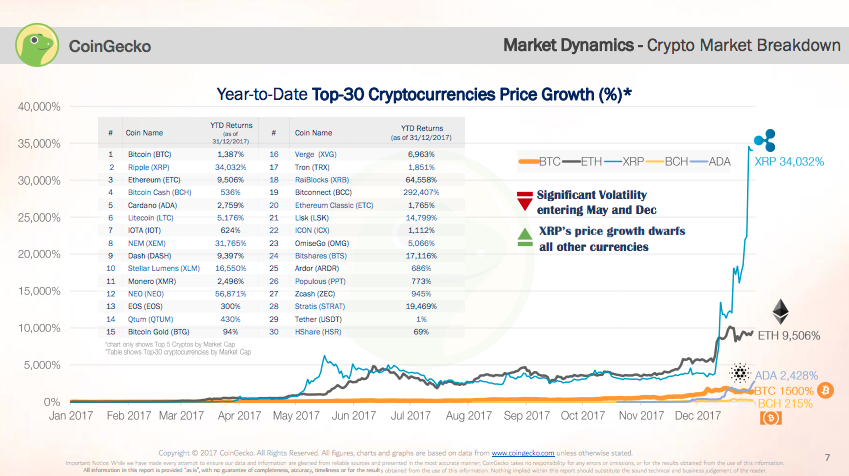

Among the top performing cryptocurrencies, Ripple, unsurprisingly, was number one, rising 34,000% in value. Ripple is followed by Ethereum with 9,500%, ADA 2,400% and Bitcoin 1,500%.

2017 was also the year ICOs exploded in popularity. An ICO or token sale is a fundraising mechanism in which new projects sell their underlying cryptocurrencies in exchange for bitcoin and ether.

Startups raised more than US$4.5 billion through token sales in 2017, or nearly 20 times more than in 2016. The largest deals went to Filecoin with US$250 million, Tezos with US$232 million and EOS with US$187 billion.

According to a recent report by PwC, the ICO fundraising method is gradually disrupting traditional venture capital funding with new hybrid models now “en vogue” as they combine smart money and crowd support.

In a hybrid funding model, a startup receives initial funding from business angels and venture capitalists after releasing a business plan and prototype, and after team validation. Then, it raises ICO funding from retail investors after releasing a proof-of-concept and assessing the potential of the idea.

But the cryptocurrency and ICO frenzy has posed pressing issues to address for financial regulators.

Countries like China and South Korea straight out banned ICOs, while others like Singapore, Australia and Hong Kong opted for a more “laissez-faire” approach, issuing guidelines and warnings. Japan emerged as one of the most permissive jurisdictions in 2017, officially recognizing cryptocurrency as a legal tender in April and granting 11 Virtual Currency Exchange licenses in December.

What to expect in 2018

According to the CoinGecko report, more venture capitalists will jump on the ICO bandwagon as the novel fundraising method increases in popularity.

But the practice is likely to get regulatory attention with ICO funds pouring into more permissive countries such as the US, Japan, Switzerland and Singapore, and withdrawing from others.

With the surge in the use of cryptocurrencies, the industry will need to focus substantial efforts in overcoming scalability challenges. Perhaps Ethereum will establish the best practices on how blockchain network scalability is to be achieved.

The cryptocurrency market is set to grow further in 2018 with more prominent financial institutions likely joining in by creating cryptocurrency trading desks and by designing a variety of structured products for interested investors.

The full report can be found here for those who are interested to read further