Top 10 Fintech Accelerators In Southeast Asia And Hong Kong for 2018

by Fintech News Singapore February 14, 2018In 2017, Asia Pacific attracted the largest amount of investment in fintech with a total of US$14.8 billion, according to a report by PwC and Startupbootcamp Fintech. The region represented 56% of the world’s total fintech funding, highlighting Asia’s growing importance in the global fintech scene.

According to industry experts, Asia’s large pool of underbanked and its growing middle class have been fueling the surge of fintech and the emergence of startups providing new solutions to address their wealth management and banking needs.

The rise of fintech has encouraged the establishment and creation of acceleration programs in the region to help promising startups grow and connect with potential partners and investors.

Here are ten of the top fintech acceleration programs in Southeast Asia and Hong Kong:

Fintech Innovation Lab

Facilitated by Accenture, the Fintech Innovation Lab Asia-Pacific is a 12-week mentoring accelerator and incubator program.

The Lab brings together leading financial services institutions, angel investors and venture capital firms across Asia to provide startups with the opportunity to work with future customers, perfect propositions, gain insights to the banking industry and build strong relationships.

The program’s purpose is to nurture early-stage companies from around the world that are developing new technologies for the financial services sector with a particular focus on the Asia-Pacific region. The Lab is supported by Cyberport, which provides workspace for the selected entrepreneurs.

SuperCharger

SuperCharger is 12-week acceleration program designed for fintech startups and scale-up companies. SuperCharger does not take any equity and the program gives selected startups access to partner institutions and firms, as well as regulators and legal experts.

SuperCharger started in Hong Kong where it sought to leverage on Hong Kong’s traditional strength as Asia’s finance and technology gateway. It began its expansion into ASEAN in late-2017, with Malaysia as the first country of entry. It recently selected the 10 fintech companies to join its first Malaysian cohort.

SuperCharger is backed by prominent partners from the financial services industry including Standard Chartered Bank, and Fidelity International.

Startupbootcamp Fintech

Startupbootcamp Fintech is one of the leading accelerators focused on fintech in the world. It currently has accelerator programs in five cities: Mexico City, London, Mumbai, Singapore and New York.

Each year, Startupbootcamp Fintech Singapore provides funding, mentorship, office space in the city-state and access to a global network of corporate partners, mentors, investors and VCs, to up to 10 selected fintech startups across the globe.

For over three months, the selected startups collaborate with 400+ mentors, partners, and investors to build world-class fintech products, with the ultimate goal of becoming industry-leading companies.

InspirAsia

Launched in 2015 by Singapore VC firm Life.SREDA, InspirAsia is an accelerator program tailored for mature startups to support them in scaling: expand to other markets or verticals, organize international partnerships between teams, find synergy between products to create brand new bundles for customers.

InspirAsia privileges startups in the fields of mobile payments, mPOS and online acquiring, online lending and scoring, peer-to-peer lending, mobile banking, e-wallets and remittances, among others.

Life.SREDA provides selected startups with support in developing strategy and vision, assistance in efficient business modeling, enhance products to global standards, assist in global market expansion, help with tech, business, financial and VC partners from global network.

It also provides free work space for fintech oriented startups in its co-working space. The customized training program lasts between one and six months.

The OCBC Fintech Accelerator

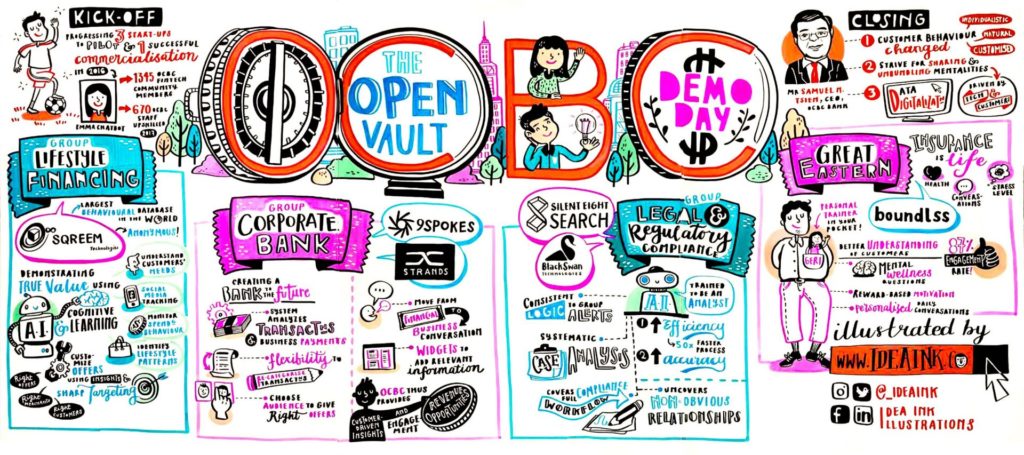

OCBC Fintech Accelerator 2017 Demo Day in a Nutshell

Established in February 2016, the OCBC Fintech Accelerator is a 12-week program designed to help entrepreneurs build the fintech companies of the future, faster and more efficiently.

The OCBC Fintech Accelerator is run by a dedicated team from the dedicated space in Singapore, called the Open Vault at OCBC.

Through a combination of guidance from the OCBC Mentors, NEST expertise and the validation of insights through the OCBC data sandbox, the program grooms eight successful startups every year.

The FinLab

The FinLab is an accelerator program focused on fintech and a joint venture between SGInnovate (SGI) and the United Overseas Bank Ltd (UOB).

Selected fintech startups get feedback and insights from the FinLab’s mentors to help improve or even pivot their business offering, co-working space in BASH, Singapore’s biggest integrated startup space, as well as access business and VC networks to build contacts into the region and scale their businesses faster. They also get commitment from the Finlab to continue providing access to key fintech events under the Finlab banner, both during and after the acceleration program.

The FinLab has wide connections in ASEAN, Greater China, Europe and the US, providing selected startups with an unparalleled access to the global market for growth and expansion.

DBS Accelerator

DBS is partnering with Nest in Hong Kong for the third time for the DBS Accelerator program, which aims to push the financial services industry in Hong Kong forward and spark change.

DBS Accelerator is targeted at fintech-focused startups at the seed through Series B stages, which can address one of the areas of focus: digital channel experience, compliance monitoring, credit digitalization, customer engagement and cybersecurity.

Startups receive mentorship from carefully selected business leaders working in various business units to help them develop their solution and guide them towards a potential pilot.

They also get to be introduced to quality global investors with proven track records and a chance to pitch at Demo Day.

Yes Fintech Accelerator

The Yes Fintech Accelerator program is one of the most recent programs to be launched in Asia, introduced last year by Indian bank Yes Bank.

The program is targeted at tech-focused startups from India and globally with a minimum viable product along with a growing customer base currently innovating in the areas of payments, lending, trade finance and forex solutions, wealth management, regtech, and fin-education, among others.

Selected startups get access to digital banking infrastructure including 200+ APIs, the opportunity to expand to 18 global markets through the bank’s global ecosystem players, mentorship and scale up support, access to 2 million+ customers, and funding of up to US$1 million.

The Wells Fargo Startup Accelerator

Launched in 2014, the Wells Fargo Startup Accelerator is a hands-on, virtual program which lasts approximately six months. It is designed to advance startups that create solutions for enterprise customers – inside and outside the financial industry.

The program offers coaching and access to mentors, advocates, executives, and investors, and provides direct equity investments of up to US$500,000 for selected companies.

Each successful applicant is paired with a Wells Fargo advocate who provides guidance through the program.

Mastercard Start Path Global

Mastercard Start Path Global is a six-month virtual program designed to help startups from around the world scale their businesses.

The program enables companies to gain access to Mastercard’s global ecosystem and to break new markets through relationships with MasterCard and the firm’s customers. It includes two immersion weeks which take place at the launch and three-month point and which are held at different Mastercard and startup hubs around the world.

The program is designed as a hybrid model to help solve key operational challenges for companies, providing immediate access to experts and resources from across the organization.