Australian-based Regtech firm GCS Agile has signed its first international agreement in Singapore for the use of FACS, their FATCA (Foreign Account Tax Compliance Act) And CRS (Common Reporting Standard) Service.

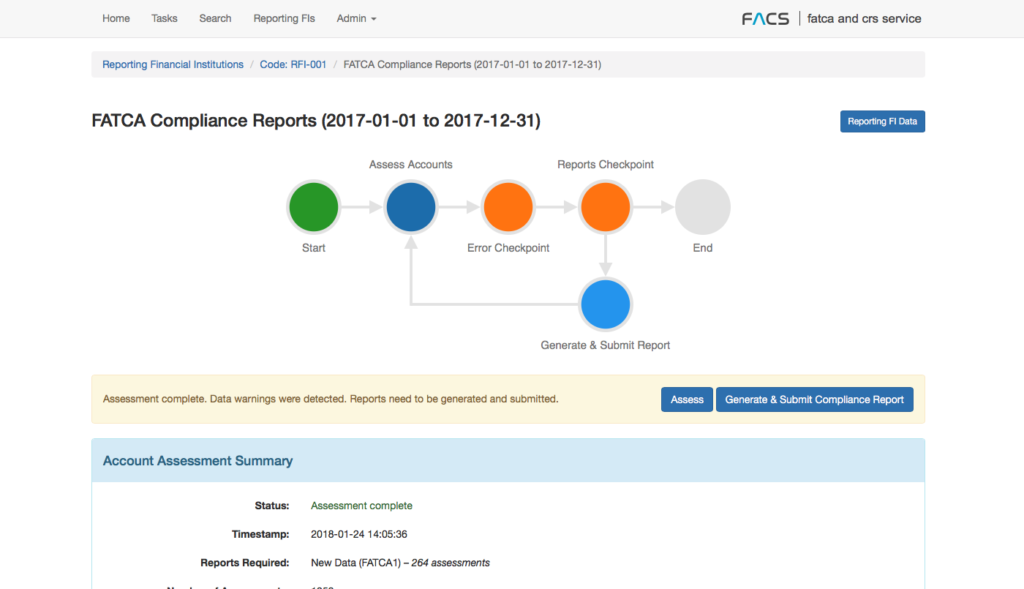

FACTA Compliance Reports via crs-fatca-reporting.com.au

FACS is a world leading software program built specifically to manage the complex requirements for the Common Reporting Standard (CRS), for which reports in Singapore and Australia are due for the first time this year. The partnership is with Trusted Source Pte Ltd, a wholly-owned subsidiary of Temasek Management Services Pte Ltd.

Ong Whee Teck

“We are thrilled to partner with GCS Agile on this important initiative aimed at reducing tax evasion globally. Singapore is a perfect launch pad for such technology given its strong commitment to the rule of law and international tax conventions,”

said Ong Whee Teck, CEO of Trusted Source.

Gerry Carcour,CEO, GCS Agile

“We are proud to have this opportunity to partner with, and be related to the Temasek Group, a respected Singapore icon. We believe that Trusted Source is the best positioned organisation to deliver FATCA and CRS compliance in Singapore using our FACS platform.

Additionally, Trusted Source has the capability to deliver our vision of a “utility service” for the Financial Services Industry required to both enforce and significantly reduce the cost and burden of compliance,”

said Gerry Carcour, CEO of GCS Agile.

CRS is an inter-governmental agreement between the world’s Tax Authorities designed to detect tax evasion. Millions of businesses in more than 100 jurisdictions globally that manage the financial accounts of foreign tax residents must report to their local Tax Authority which in turn shares this financial information with the relevant home Tax Authority.

Rollout first in Singapore, then Hong Kong, New Zealand and South Africa

After Singapore, the technology roll-out is expected to continue in Hong Kong, New Zealand and South Africa. Australia’s financial services companies are required to file CRS reports with the Australian Taxation Office on July 31. Each territory has differing compliance deadlines – reporting to the Inland Revenue Authority of Singapore, for example, is due on May 31.

The highly publicised Panama Papers brought attention to global and systematic tax evasion using offshore accounts, from which 145 governments worldwide are estimated to lose more than 5.1% of global GDP annually according to a report published by the Tax Justice Network in 2011. With Global GDP reported to be US$75.4 trillion in 2016, global tax evasion is estimated to be US$3.85 trillion in that year.

“With CRS, there’s nowhere to hide,”

says GCS Agile CEO Gerry Carcour.

“Many expats the world over who have spent their lives creating a network of overseas accounts will be laid bare extremely quickly.”

Mr Carcour says each country has their own objectives for instilling CRS compliance into their financial systems.

“Singapore and Hong Kong are characterized by hubs of expats that attract the interest of the world’s tax authorities, whereas South Africa is about combating corruption and wealth inequality as large amounts of revenue flow out of the country and are held overseas in various forms of value. FACS will be a significant tool to aid transparency,”

says Mr Carcour.

“New Zealand is not dissimilar from Australia, in that many financial institutions are not yet fully cognisant of the CRS requirements and their implications for the running of their businesses. The biggest impact of this system will be to identify those individuals who have previously slipped through the tax revenue net.”

Featured image via Pixabay