CredoLab, a fintech provider of highly predictive, mobile-based alternative credit scoring solutions for banks, consumer finance companies, and retailers, announced it has closed a US$1 million investment from established global venture capital firm Walden International.

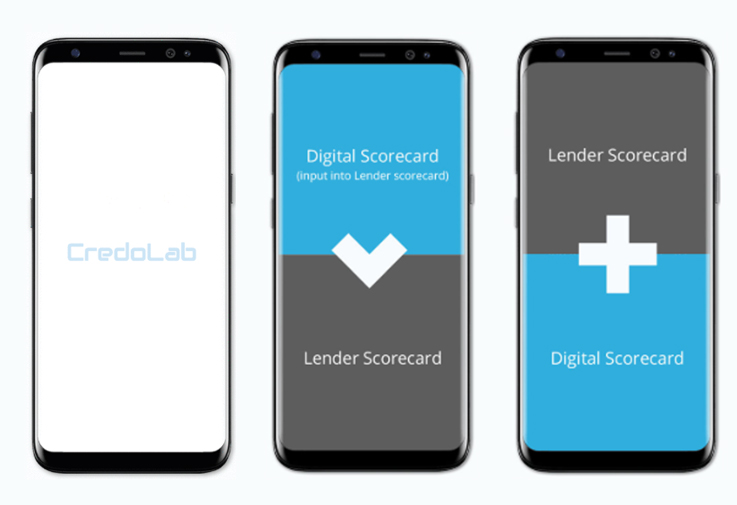

CredoLab utilizes its proprietary mobile application, CredoApp, to extract a unique digital footprint from a consumer’s mobile phone. The company uses proprietary data science algorithms to extract and analyze close to 50,000 data points and turns these completely anonymized digital footprints into highly predictive digital credit scorecards.

The use of non-traditional data and predictive data analytics enables consumers with little to no traditional credit history to access financial services. For lenders, the use of non-traditional data for credit scoring enables them to expand their pool of borrowers while keeping risks in check.

Kris Leong

“There is a big pool of unbanked consumers in Asia with no formal credit histories. In just a short period of time, CredoLab has partnered with almost 30 consumer lending institutions to generate digital credit scorecards for thin-file consumers,”

said Kris Leong, vice president of Walden International.

“With CredoLab’s plug-and-play data science solution, banks and retail lenders can profitably serve the unbanked, and individuals and businesses can access useful and affordable financial products and services that meet their needs. We are excited to join the CredoLab team to serve this huge market opportunity and scale the business globally.”

CredoLab has grown rapidly in the last 12 months, generating millions of data sets and credit scores for clients across Southeast Asia, China, Latin America, Africa, and the Commonwealth of Independent States. With CredoLab’s scoring solution, clients have seen improved delinquency rates and a higher percentage of consumer loans approved.

Peter Barcak, CredoLab co-founder and chief executive officer, said,

Peter Barcak

“I am extremely pleased to count a firm with the technical expertise and global reach of Walden International among our investors.

Our next stage of growth will focus on expanding globally and actively seeking partnerships with alternative data providers to generate high quality leads for banks and consumer finance companies.”

With this new investment, CredoLab will focus on underserved regions, including Asia, where more than half of the world’s underserved lives, and Africa, where less than 20 percent of the population has access to formal financial services[1] and where smartphone penetration growth is among the highest in the world.

Established in 2016, CredoLab is headquartered in Singapore with customers in 15 countries across South East Asia, China, Latin America, Africa, and the Commonwealth of Independent States. The company was previously backed by regional fintech venture capital firm Fintonia Group, and FORUM, the largest fintech venture builder in Emerging Asia.

Featured image via Pexels