Blockchain technology is becoming an important catalyst of digital innovation in Asia Pacific (APAC) as enterprises in the region face critical challenges and are required to accelerate their digital transformation across the board, according to a report by Forrester.

Blockchain has been all the rage in the past years, with companies in the field raising over US$1.3 billion in venture capital in 2018 so far. In APAC, companies and governments are ramping up blockchain research and development to benefit from the many advantages the technology brings, including cost saving opportunities and improved efficiency.

In a paper called Vendor Landscape: Blockchain Technology Providers In Asia Pacific, Forrester explains that blockchain is creating innovation business opportunities under three dimensions: traceability of assets within a value ecosystem; security of asset ownership; business resiliency via consensus. This combination of features provides a reliable, shared view of transactions in the complex digital ecosystem.

APAC enterprises and banks embrace blockchain

Enterprises in APAC are quickly realizing that the shift of trust from centralized to decentralized consensus can spur a new wave of innovation for collaborating and transacting in areas such as trusted value exchange, digital asset management, and smart contract execution in unknown environments.

Commonwealth Bank of Australia (CommBank), for instance, has built a blockchain solution for the issuance of semi-government bonds, helping debt capital markets eliminate settlement risk. Meanwhile, SP Group in Singapore has developed a blockchain platform to simplify the integration of renewable energy sources and reduce customer cost.

But beyond the private sector, governments themselves have realized the potential of blockchain to provide improved services in areas that include national identity management, land registration, voting and healthcare.

Governments driving blockchain innovation

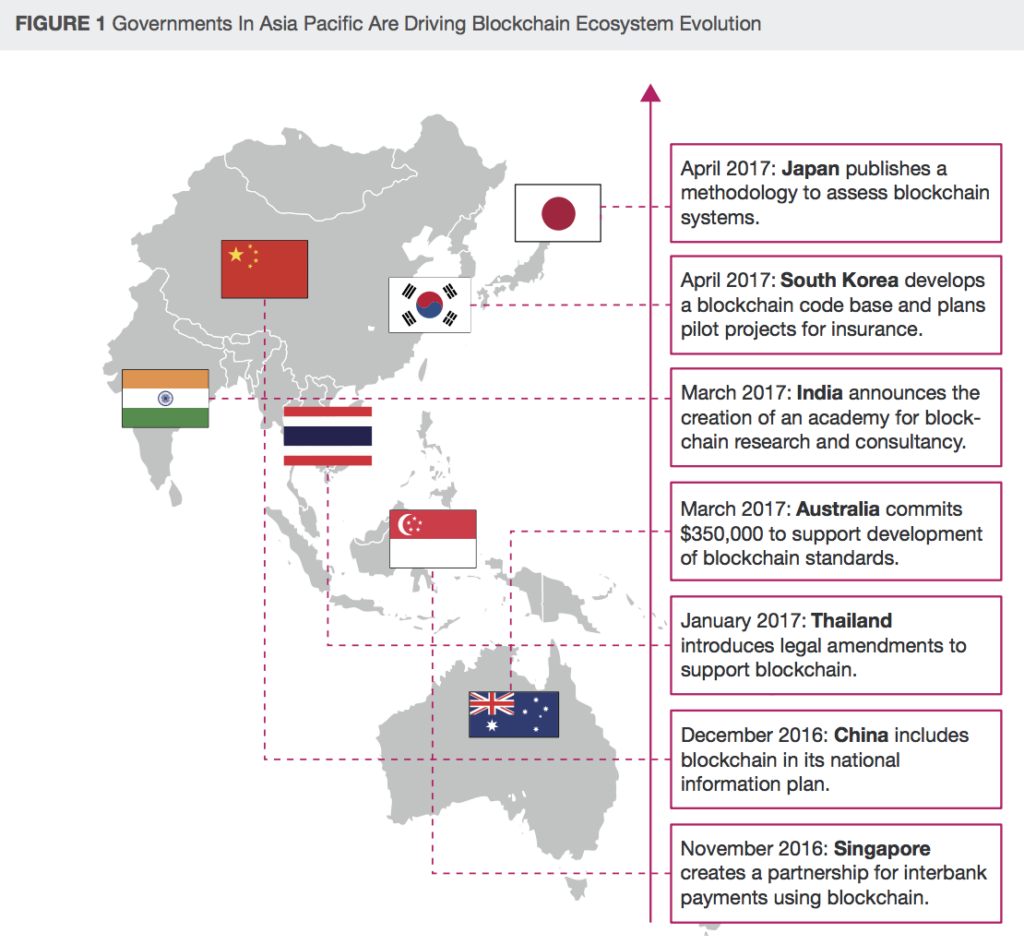

Governments in APAC have begun facilitating blockchain evolution as a key factor to accelerate digital innovation. These have taken different approaches to establishing a blockchain ecosystem and driving digital innovation.

China has included blockchain in the national information planning of its 13th five-year plan and Australia has committed US$521,000 in public funds to its Digital Transformation Agency to explore blockchain applications within government services.

Singapore announced a partnership in 2016 to conduct interbank payments using blockchain in partnership with several financial institutions and US-based blockchain technology developer R3. India established a blockchain academy for research and consultancy, and Japan, South Korea, and Thailand have made substantial progress on assessment methodology, code development, and legal amendments, respectively.

Blockchain providers are driving blockchain adoption in APAC

The blockchain industry has been thriving in the past years as demand for the technology has been rising around the world. APAC has seen numerous homegrown startups emerge, but foreign players have also started tapping into the market, too.

IBM, for instance, has established a digital ecosystem around Hyperledger. Microsoft and KPMG are powering cloud-based blockchain innovation with Azure. Ripple and Factom are expanding strategically via local partnerships with the likes of CommBank, National Australia Bank, Westpac, the Bank of Tokyo-Mitsubishi and iSoftStone,. And Accenture is nurturing an innovation ecosystem via its regional fintech accelerator program the Fintech Innovation Lab Asia Pacific in Hong Kong.

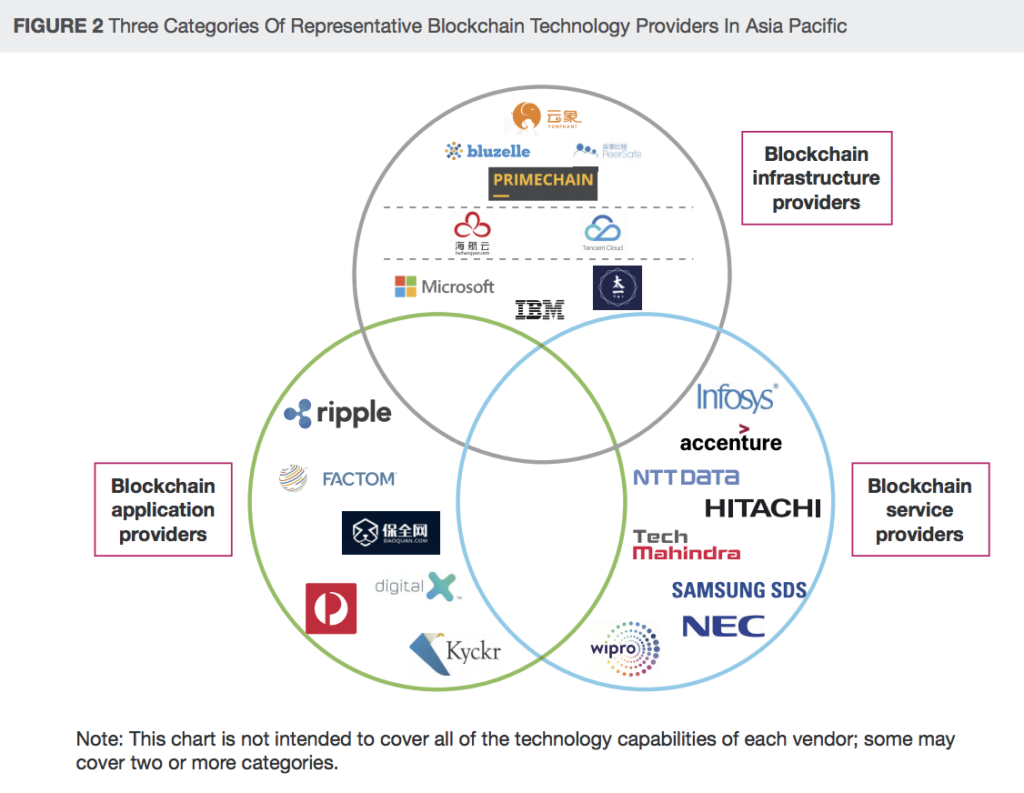

Blockchain technology providers are working with organizations in a variety of verticals, including banking, insurance, logistics, energy, and government. The report classify these providers in three categories:

Blockchain infrastructure providers such as China’s PeerSafe, India’s Primechain and Singapore’s Bluzelle, which offer general-purpose blockchain platforms;

Blockchain application providers such as Baoquan in China and DigitalX in Australia, which deliver direct business value to customers; and

Blockchain service providers like Accenture, Infosys and NTT Data, which engage customers with services on various levels.

On June 20 and 21, the Blockchain For Finance Conference APAC 2018 will bring together some of the industry’s most existing startups and brightest minds to discuss the future of blockchain in the financial services industry. The conference will cover the latest use cases of blockchain in the space, as well as the regulatory landscape, and the world of initial coin offerings (ICOs).

Use our special promo code “FSG200” to get US$200 off the conference ticket price.

Featured image: Blockchain, Wikipedia.