The Evolution of eKYC and Digital Identity in The Age of Blockchain

by Fintech News Singapore June 30, 2018Imagine an ecosystem where you control your data privacy, imagine ease of submitting your data via a click instead of multiple documents for verification, imagine the time and cost savings in commuting to regulatory bodies for proof of identification.

In a utopian world, KYC should be as simple as that, but much of our experience with financial institution can sometimes prove to be quite the opposite. To explore how this scenario could potentially become a reality in the near future, Fintech News Singapore team reached out to XenChain.

Xenchain is a digital identity company that utilizes blockchain, their vision is to create a platform where personal data or asset identification data are accessed, managed and stored in a secure, immutable and irrefutable distributed blockchain.

To fulfill that vision, Xenchain has entered into cooperation with multiple trusted corporate data validators to accurately acquire, validate and store identity data into a decentralised blockchain ledger. In doing so, Xenchain aims empower end users to have full control over their data and enable permission based access to companies, as a result eliminating time consuming processes.

To fulfill that vision, Xenchain has entered into cooperation with multiple trusted corporate data validators to accurately acquire, validate and store identity data into a decentralised blockchain ledger. In doing so, Xenchain aims empower end users to have full control over their data and enable permission based access to companies, as a result eliminating time consuming processes.

Below is an excerpt from the interview we did with Steve Rao, CEO and Co-Founder of Xenchain.

Why does the industry need to rethink KYC (Know-Your-Customer) ?

Here are a few reasons why:

#1. Onboarding Costs

Since the regulators have laid down the guidelines for KYC, financial institutions had been rushing to onboard their corporate clients and end users. As a matter of fact, as the regulators are requesting for more data points, the onboarding costs increased as well. According to Thomas Reuters, financial institutions spend an average of $150 million on client onboarding each year, and that cost is expected to increase by 13% in 2018.

#2. Onboarding Time

The average onboarding time was 28 days in 2016, and it has grown to 32 days in 2017. One of the longest recorded to onboard a corporation was 65 days. To manage this issue, additional headcounts were added to improve the speed, but that is not a long-term solution because it is not scalable. Furthermore, there is a limited supply of skilled staff in this area.

#3. Costs of Data Refresh

If the onboarding time and cost are not bad enough, financial institutions are required to intermittently update their data, which further increases the costs. In the same research by Thomas Reuters, it was discovered at only 11% of the financial institutions has dynamic monitoring, and only 25% of them are intermittently checking for risk and any underlying changes.

#4. Negative Customer Experience

Due to the stringent process and requirements, financial institutions are reporting that 84% of their clients have a negative experience with KYC, causing 12% of their clients to look for alternative banking relationship.

#5. Investment in Technologies

Over a quarter of the annual client onboarding costs are dedicated to the improvement of technology, in an effort to speed up the process and enhance the overall customer experience. This cost is expected to rise linearly as the onboarding cost as well.

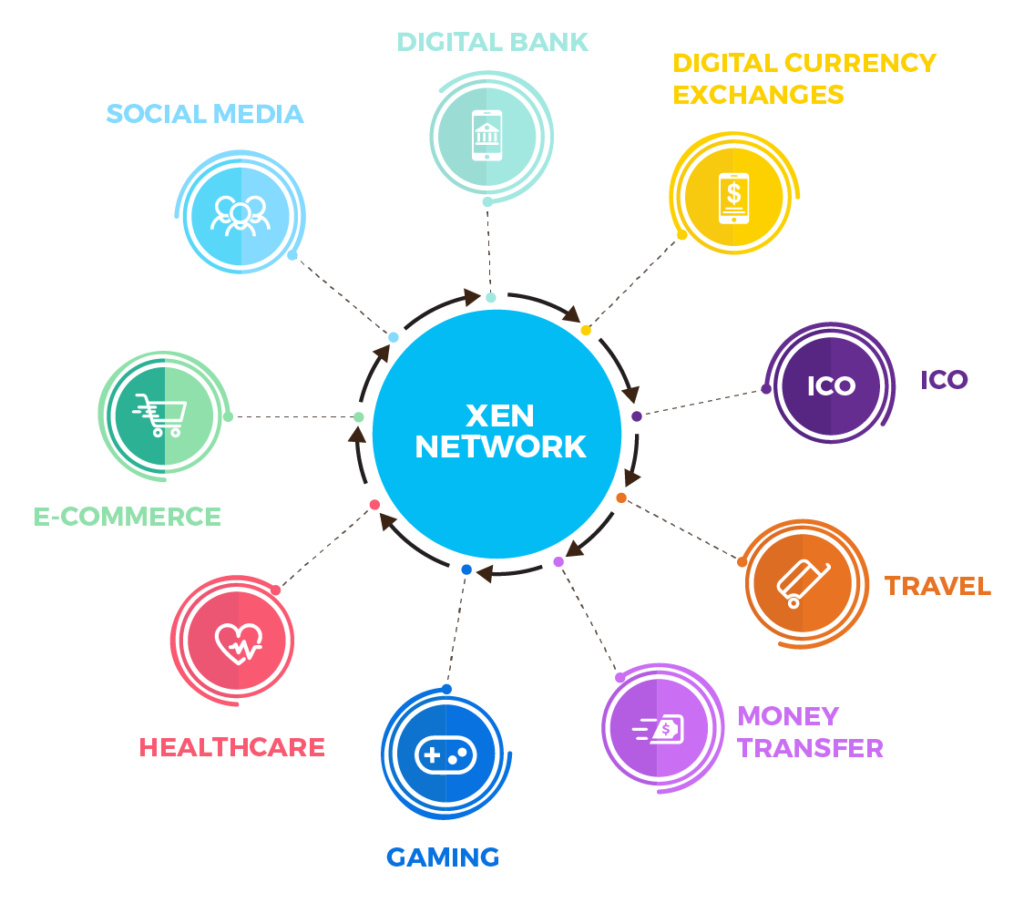

One of the clear solutions for financial institutions to combat this pressing problem, is to outsource their KYC process to trusted, external parties, or extract the data from trusted sources. Xenchain is one of the companies with the necessary experience in this vertical, to solve this issue for the financial institutions. Xenchain’s eKYC app can be used across different industries, from ICOs to digital exchanges, and e-commerce to healthcare.

Because it is built and powered by the blockchain technology, Xenchain can encrypt and store users’ personal data on a decentralized public ledger, making it safer compared to traditional storage practice. Xenchain combines super intelligent text identifiers, facial recognition and digital ID scanners with social validation, to create a simple and seamless customer onboarding and ID verification process.

There much hype around blockchain, we’ve observed projects adopting blockchain for the sake of blockchain – Why is Xenchain deploying blockchain and what do you hope to achieve out it?

In a nutshell, blockchain platforms are decentralized ledgers designed with security and immutability in mind. Traditional databases offer the same, but cost of setting up distributed ledgers with these security features multiplies. Blockchain technology is a cost effective immutable and decentralized ledger if applied in the right industries and use cases.

A few points about blockchain:

#1. The blockchain puts the responsibility back into your hands

Without a third party, you are fully responsible for what you store on the blockchain, and the transactions you administer. There is also no reset of passwords, because no one central party is controlling your information, which meant the only leakage of data that can happen, only happen because you allow it.

#2. The blockchain trains you to have self-governance

Because everything is stored on the blockchain, and the information is available publicly, you will be more cautious on the digital footprints that you leave behind. You will double, or even triple, check before committing to something, which trains us to be accountable too.

#3. Data stored cannot be changed

We cannot change anything on the blockchain, and that, perhaps is one of the key reasons why the technology is so trustworthy. Because instead of taking someone’s word on it, or have a contract around it, you can simply refer to the blockchain address, and the trail of info it follows. Due to the security and transparency features of the blockchain, many new companies are leveraging on it to provide solutions that take trust to a whole new level.

All these factors combined make it a very compelling use case for Xenchain to deploy blockchain

In the context of today’s digital economy, what is the role of digital identity?

Let’s take Malaysia as an example, it is the first country in the world to introduce chip-based national identity cards which stores biometric information, basic details and photo of an individual. These biometric chips are readable using a biometric reader, and can be counter verified on the spot with the individual. This invention became a mass use-case throughout the world, as it closed gaps between borders and made identity access and management easier.

Now begins the new era of facial recognition as a biometric marker, to either replace or complement fingerprint as a biometric indicator.

Xenchain scans Government approved secure documents such as National IDs, Passports, Driving permits/licence, Voter IDs etc, or legal identification documents provided by regulatory bodies. Most of these secure documents come with basic information, Identification number and a photo of the document owner. Xenchain then scans the face of the owner (via selfie on the mobile app, or webcam) to match the photo stored on the document. Hence a Digital Identity is created, and a blockchain identity is created on the blockchain ledger. This eliminates a few steps in KYC methods, hence making it easier with less paper trail.

Despite having fingerprint biometric as indicators, most financial institutions still have difficulty in performing KYC, and even if done so, with paperwork involved and multiple signatures and stamps required for authorization. A digital identity, such as created by Xenchain, is able to make identity management and data accessibility done in a much secure way.

These digital identities can be used for authentication if tagged unto other documents, or validation from verified databases for AML/CFT.

Tell us more about Xenchain’s platform, what are the potential use cases within the financial sector and beyond?

#1 Digital Banks

We are looking into the future. Most banks have started embarking on various mobile and digital banking initiatives. These projects are meant to make the lives of customers and banks easier; by delivering services faster, cheaper, and better. There are 25 known digital banks so far, and the rest of the world is catching up.

Mobile money services run by telcos, especially in the African continent are moving towards a “digital bank” way of life, where users can send money to each other using their sim cards in their phones. No bank branches, just small shops with QR codes to retrieve physical money. All these transactions and processes needs to be regulated, and Xenchain’s eKYC solution checks for AML/CFT and allows digital banks to subscribe to Xenchain’s platform to access data with the permission of the users. Banking without borders, or physical branches.

#2 Digital Currency Exchanges

In cryptocurrency world, volatility of the tokens are off the charts and prices pegged to bitcoins. Peer to Peer exchanges are the flavour of the season, and crypto exchanges are mushrooming globally due to demand and much needed liquidity. Most pundits bet on cryptocurrencies as the future, and they may not be wrong.

The biggest issue faced by exchange customers are the KYC requirements and multiple documents that fail to upload on the first try. These KYC processes are done manually by the exchanges, or sometimes sent to 3rd parties. But the problem persists: it’s not done instantaneously. Xenchain’s quick scanning of documents and facial recognition will match the users and their ID documents, and the easy on-boarding of data unto the platform makes it a seamless and secure data storage for future use on exchanges, or to verify transactions via a click.

#3 Initial Coin Offerings ( ICO )

Fundraising via crowdfunding or VCs took a new twist since 2016, when ICOs were introduced to the world. Blockchain as the underlying technology for products and solutions, startups started raising funds via cryptocurrencies for their projects and list them on crypto exchanges.

These coins varies between blockchain, but dominated by Ethereum’s ERC20 native token. But for users to participate in the presale or ICO, they have to whitelist themselves for KYC. Xenchain’s Digital ID enables quick whitelisting and eKYC for users on the platform, and can be verified using Peer-to-Peer validation on Xenchain’s platform itself.

#4 Travel

While border control is the bigger picture, travelling can be much simpler if validation of identities can be seamless during purchase of flight tickets online till the airport gates via Xenchain’s platform using blockchain. The unique hash addresses are not duplicable and immutable, and accessible globally on the platform.

Submitting information multiple times to multiple partners/agencies will be reduced significantly when the requested data is stored safely with the permission of its users on Xenchain’s platform. Travellers just need to take a selfie at the border gates or at their destination to verify themselves, in a matter of seconds!

#5 Money Transfer

Global remittance market is huge, and important. Whether its cross border money transfers or internal transfers, source of funds is a key issue for banks and remittance companies. KYC requirements are laid out by Central Banks in many cases to control in-flow or out-flow of funds. Xenchain’s eKYC makes this process easier for remittance, and to ensure he or she is who they say they are.

#6 Gaming

Gaming is a billion dollar market, and more gaming companies are creating addictive games for its loyal fans. But gaming has changed since the 80s and 90s. The gaming industry has been booming over the past decade, and has taken over the world by storm with the inclusion of Esports allowing passionate gamers to make a living out of playing their favourite games competitively.

Gaming has expanded to such a large scale that it now has other elements making it more worthwhile for the casual gamer. Among them are in-game cosmetics and betting on official matches on games such as Dota2, Counter Strike Global Offensive and Overwatch. Most of these “trading” is done on their Steam accounts or other gaming platforms, with a web wallet for transactions.

Vulnerabilities in these wallets with multiple game accounts has made hacking possible lately. Xenchain’s Digital Identity can provide a safe way to access personal data safely to access these accounts, and for transactions. Once registered on Xenchai’s platform, only KYC-ed users are allowed to transact between themselves. Data breached can be prevented with Xenchain.

#7 Healthcare

Medical records are always private and confidential. Ask any patient who had to shift across different healthcare providers, and they will be the first to tell you how they wished they had a centralized platform where their doctors could access their medical records, without them having to repeat them again and again.

This age-old problem is common for them, sometimes resulting in loss of medical data and causing them having to retake tests, which is time-consuming. Medical records can be tagged with Xenchain’s Digital Identity on the blockchain to verify patients, and for doctors or healthcare providers to access patient data. Prescription history must also be immutable to prevent malpractice cases from going unnoticed.

#8 E-Commerce

We all love online shopping, for its ease of use and their good deals, but the primary reason for those who have never tried online shopping has always centred on 1 key reason; trust. Questions like whether the product is genuine or if it will arrive at all have always been a challenge for E-commerce sites

A new study has shown that E-commerce fraud resulted in $57.8 Billion in losses in 2017 which is an increase of total fraud of 5.5% from 2016 to 2017 marking a trend of escalating scam incidents in the industry. E-commerce sites started improving reliability of sellers with ratings whereby any transaction dealt are rated by the buyers in terms of product condition and delivery time but nonetheless, this approach is not effective as buyers can intentionally lay a bad rating. Xenchain’s Digital ID and eKYC can help the ecosystem to verify credible sellers and buyers. Peer-to-Peer validation and social scoring is vital in this ecosystem, which are some of the features on Xenchain’s platform.

#9 Social Media

Fake News! This is the current buzzword on social media due to abundance in fake news, not forgetting leaders of countries popularizing this too. All jokes aside, there is a real need for identity verification of users on social media platforms globally. Prior to mid of 2012, Facebook did not require mobile phone numbers of users to sign up on their platform. Users can simply name themselves anything or impersonate anyone with similar digital photos. While it did not seem important before 2012, it is now a vital component of identity verification and authentication via mobile phone numbers. Most countries globally require mobile phone users to register their identities with telco providers as a means of KYC (Know Your Customer) as financial institutions do.

Xenchain’s seamless unboarding of personal data unto its platform using instant facial recognition via its mobile app or web app is a game changer. This 3 minute process ensures the valid ID or passport holder is matched using a liveness or motion test (movement of the eyes and mouth) via selfie photo. Once this data is onboarded unto Xenchain’s platform, the Xen Network is able to create peer-to-peer verification among connections on social media. This means your real friends on Facebook or Twitter are able to verify you and vice versa to prove your identities to prevent fraud, scam and fake accounts.

For more information on how Xenchain works here a few helpful videos

Image Credit: Freepik & Pixabay